But 2010 brought no such luck as increments were true to their name and mid-caps too took a hit on reports of stock price manipulation in some companies.

A review from December 31, 2009 to December 16, 2010 suggests that the mid-cap index and small cap index witnessed a growth of 12.65 per cent and 9.88 per cent, respectively, while the Bombay Stock Exchange barometer Sensex outperformed with a gain of 13.74 per cent during the period.

...

Scams spoil midcap, small cap party in 2010

Image: Investors disappointed.Photographs: Reuters.

The mid-cap and small cap indices track the performance of companies with market capitalisation that are a fifth or tenth of that of blue chip firms.

Scams spoil midcap, small cap party in 2010

Image: Next year to be crucial.Photographs: Reuters.

"Until November, the small cap and mid-cap stocks were giving fairly good returns to the investors. But, a string of scams and stocks rigging issues hit the sector badly which saw wary investors booking profit in order to thwart losses.

"....next year will be crucial for these sectors. To bring back the jolted confidence of investors in the small and medium firms it is important that the scams and negativity get over from the market," Geojit BNP Paribas Research Head Alex Matthews said.

Scams spoil midcap, small cap party in 2010

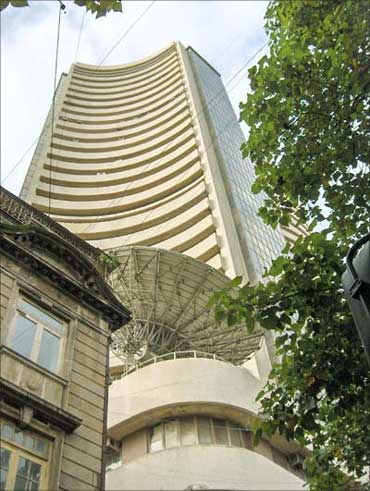

Image: Valuation of mid-cap firms grew.Photographs: Reuters.

Similarly, the valuation of mid-cap firms grew by 1.19 lakh crore to 10.57 lakh crore as on December 16, 2010 from 9.39 lakh crore as on 31 st December last year, while the Sensex saw its market worth swelling by 3.64 lakh crore from 26.47 lakh crore (last year) to 30.11 lakh crore as on December 16.

Scams spoil midcap, small cap party in 2010

Image: Stock price manipulation reports hit small caps.Photographs: Reuters.

"Share prices of many small and mid-cap companies had crashed in the last few days in anticipation of a crackdown by regulators on stock market operators named in the purported IB report, which had a serious dent on the entire sector," Unicon Financial Services CEO Gajendra Nagpal said.

Scams spoil midcap, small cap party in 2010

Image: Negativity surrounded the market.Photographs: Reuters.

To name a few, companies like LIC Housing Finance, Indian Bank, Money Matters Financial Services received severe drubbing from the bribery-to-loan scam.

article