Dipta Joshi in Mumbai

Two recent court verdicts on land acquisition should ring as warning bells for buyers of under-construction property.

A fortnight before, the Supreme Court quashed the acquisition of 156 hectares in Noida Extension.

On Wednesday, the Allahabad High Court cancelled the acquisition of 589.13 hectares in Greater Noida.

Property buyers would find themselves in deep trouble because of these two judgments.

Many would have taken loans from banks to fund their houses and paid the builders - most likely, only the first installment.

Loans for under-construction properties are disbursed in three to four tranches. That implies, with a loan-to-value ratio of 80:20, the buyer would have paid his part of the money completely.

The bank's exposure, especially in the first tranche, would be 5-15 per cent.

...

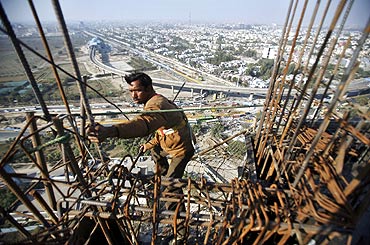

Plan to buy under-construction property? Think again!

Image: Most buyers prefer to pay the pre-EMI.According to an official in a housing finance company, most buyers prefer to pay the pre-EMI, where a simple rate of interest is charged. Only some buyers start paying the entire EMI.

The SC has come to the rescue of buyers in the case of Noida Extension by asking the builders to pay the buyers back with interest.

However, after the court judgements, builders cannot continue construction anymore, implying there will be no ownership of a flat in the next few years.

On the other hand, the EMIs have already started.

If one does get into such situations, the onus is completely on the buyer to pay back the bank.

...

Plan to buy under-construction property? Think again!

Image: A buyer who has taken a loan has little option.A senior SBI official says since the contract is with the borrower and not the builder, there is nothing much they can do.

While lenders also do the due-diligence of properties and look at the record of the past 13 years to ensure it has a clear title, there is little they can do when such situations arise.

A buyer who has taken a loan has little option. If the builder pays back the money, things could be settled amicably.

However, if they do not, there could be a long haul. In such situations, if a builder is offering a 'suitable' property in any of his other projects, one could use the option.

However, 'suitable' is the key word here.

...

Plan to buy under-construction property? Think again!

Image: Customer is liable for compensation for any delay from developers' side."Developers can create third-party rights or sell the units to customers only once they have the commencement certificate.

"Buyers who have bought the flat without asking for a copy of this certificate are at fault and cannot be protected in the court of law," says Pranay Vakil, chairman, Knight Frank, a real estate consultancy.

In Maharashtra, under the Maharashtra Ownership Flats Act, the developer needs to hand over a conveyance deed to the buyer.

This will include the stamp duty paid for the flat, besides the terms of agreement between the builder and the buyer. The customer is liable for compensation for any delay from developers' side.

However, most developers may, instead, hand over an allotment letter on the builder's letterhead.

Such letters are not considered legal evidence and can put the buyer in a spot, if he is trying for a refund on cancellation.

article