Photographs: Reuters Puneet Wadhwa in New Delhi

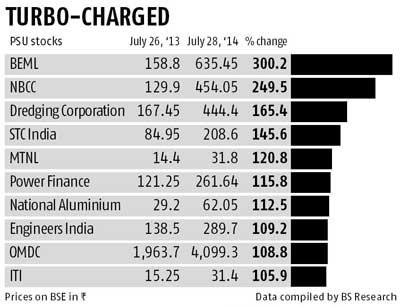

Stocks of government probables for divestment or stake sale such as Steel Authority of India (SAIL), Mahanagar Telephone Nigam (MTNL), National Aluminium Company (Nalco) and Container Corporation (Concor) have outperformed the markets in the past one year.

Most of the stocks from the public sector undertaking (PSU) basket that are either classified as sick units that can be sold or where the government can divest some of its shareholding have gained up to 300 per cent in the past one year.

In contrast, the S&P BSE Sensex and CNX Nifty, the benchmark indices on the two main exchanges, have moved up about 31 per cent each in the past year. The S&P BSE PSU Index has gained 39 per cent in this period.

…

Should you bet big on these PSU stocks?

Photographs: Reuters

According to reports, the government plans to sell five per cent stake in SAIL around Diwali, followed by Coal India.

“The government is trying to drive efficiencies in a lot of public sector companies. This has been a clear agenda for the government, that they’ll try and create more autonomy for PSUs, to try and get them at par with private counterparts. One needs to evaluate companies on a case-to-case basis, as each has a different set of factors working for and against it,” said Mayuresh Joshi, vice-president (institutional), Angel Broking.

…

Should you bet big on these PSU stocks?

Photographs: Uttam Ghosh/Rediff.com

There are a dozen other companies in which the government could offload shares this financial year, reports suggest. Power Finance Corporation (PFC), Rural Electrification Corporation (REC), Tehri Hydro Development Corp, SJVN, NHPC, Concor, MMTC, Neyveli Lignite and MOIL are examples, where the government could cut its stake via the offer-for-sale route.

Says Amar Ambani, head of research, India Infoline Group: “I do believe that there will be some interest in the divestment process, as investors who are now warming up to the market or who think that they missed the bus would like to jump in. Having said that, I don’t think the government will be in such a hurry to divest immediately. They might wait for the second half of the year or closer to the last four months of the current financial year to go into a divestment overdrive, in a hope that till then there will be a further appreciation in stock prices.”

…

Should you bet big on these PSU stocks?

Photographs: Uttam Ghosh/Rediff.com

Stock strategy

Analysts say the recent run-up in these stocks could prove an overhang in some of these. One also needs to assess the price at which the government does offer the shares. Usually, when the government does dilute its stake, it is at a discount to the prevalent market price.

Analysts say the recent run-up in these stocks could prove an overhang in some of these. One also needs to assess the price at which the government does offer the shares. Usually, when the government does dilute its stake, it is at a discount to the prevalent market price.

“Unless we see a substantial improvement in fundamentals, I don’t think one should buy such stocks, given the run-up and play in any divestment story. There are ample opportunities for investors in the large-caps and mid-caps. There is no point getting into a stock where absolute comfort is missing. However, in the case of Oil and Natural Gas Corporation and Coal India, there are other triggers besides the divestment that can play out, such as deregulation of diesel prices, gas price hike, etc,” says Ambani of IIFL.

…

Should you bet big on these PSU stocks?

Photographs: Uttam Ghosh/Rediff.com

“At a fundamental level, I believe,” says Joshi of Angel Broking, “Cash flows are an important aspect to consider, besides giving these companies autonomy. I suggest investors wait for these efficiencies to come about before making an investment decision, even when the government looks to divest its stake. I don’t expect fundamentals to change overnight. Power financing stocks like PFC and REC are qualitative stories and investors need to have an investment horizon of three– four years if they invest in these stocks via the government’s divestment programme.”

Adding: “We feel there is a lot of value in Coal India but it is not getting exhibited properly due to several factors. Investors should not rush in to buy every stock whenever the divestment is announced. It is advisable to look at the fundamentals of each company and then take an investment call, from a long–term horizon.”

article