Ranju Sarkar

Kingfisher's departure from the Low Cost Carrier (LCC) segment shows that running an LCC is no cakewalk, requiring a whole new management philosophy.

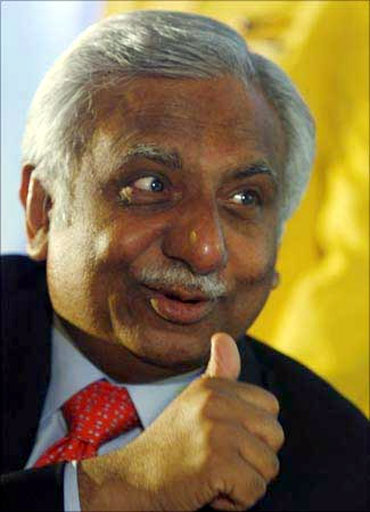

When budget carrier Air Deccan was launched in 2003 and slowly began making inroads into the market, Jet Airways' Chairman Naresh Goyal was among the first to say that low-cost carriers (LCCs) wouldn't work in India.

Today, Goyal is being forced to publicly recant his words.

"With growth mostly coming from the low-fare segments in India, we are undertaking an in-depth review of the business model, including multiplicity of brands being offered in the marketplace," Goyal said after a shareholders meeting in Mumbai in August.

...

Naresh Goyal's next plan: Operate a low cost carrier!

Image: Air Deccan logo.Photographs: Reuters.

"The primary objective of this exercise is to evolve a model which is in sync with market realities," he remarked. In other words, Goyal is stating that he will do what he once said was impossible: Operate an LCC.

What true LCC?

In many ways, Goyal was partially right when he first observed that an LCC in India was a pipe dream.

LCCs try to achieve lower costs by flying more every day, packing in 20% more seats in a plane, by turning them around faster at airports, using a single type of aircraft, flying to secondary airports, charging consumers for meals, and by selling tickets directly online or though call centres.

...

Naresh Goyal's next plan: Operate a low cost carrier!

Image: Air Asia.LCCs also fly point to point as against a hub-and-spoke model by the full-service airlines and don't believe in any codesharing or interline arrangements.

No surprise that India doesn't have a true LCC in the mould of an Air Asia or a Ryan Air - no secondary airports and up to a crippling 40 per cent fuel surcharge in some states strangle the possibility.

For instance, a fare search on September 20th for a one-way ticket from Kuala Lumpur to Singapore for October 12th offered fares of 14 Malaysian Ringgit ($4.38 ) on budget carrier Air Asia (with restrictions) while full service Malaysian Airlines quoted a price of 183 Ringgit ($57.36) - a large price difference.

...

Naresh Goyal's next plan: Operate a low cost carrier!

Image: SpiceJet.Instead, a fare search on September 20th for a one-way ticket from Delhi to Mumbai for October 12th on budget airline Spicejet for Rs 3,885 and full service Kingfisher for Rs 4,034 was insignificant, and the tickets themselves were much higher than what a comparable true LCC in another country would charge for a comparable distance.

Still, an airline like Kingfisher has opted to go the other way, ditching its LCC wing in order to remain full service. Goyal, however, has chosen a divergent route. Will it work?

...

Naresh Goyal's next plan: Operate a low cost carrier!

Image: Jet Airways.The problem with a metamorphosis

''It is always difficult to have a full service airline with a full service culture morph into a LCC. LCC is a state of mind, therefore, it is easier to create a new airline than change an old one,'' said Steve Forte, a former CEO of Jet Airways.

Jet currently operates multiple brands - Jet Airways, JetKonnect and JetLite and under the new plan, Jet may drop Jet Lite and retain JetKonnect and Jet Airways (for international routes).

...

Naresh Goyal's next plan: Operate a low cost carrier!

Image: IndiGo airlines.Easier said than done, say industry experts.

''Any airline can offer low fares, the issue is having the low costs and efficiencies to back it up. It's not just about taking away the meals or few frills, it's about rethinking the airline from scratch, from the office to the airport to the cockpit,'' said David Huttner, senior Vice President, Nyras Ltd, a London-based investment and business advisory.

Sounds daunting, but it isn't enough to prevent Jet from giving it a go, which it says was inevitable.

...

Naresh Goyal's next plan: Operate a low cost carrier!

Image: Jet Airways.Photographs: Reuters.

''One of the last bastions of the full-service airline market, Japan is also now turning to the low-fare space," said Jet Chief Commercial Officer, Sudheer Raghavan, in August. "Low-fare airlines are growing in size. We have no way but to adapt to market dynamics,'' he said.

From 73 per cent today, Raghavan expects the low-fare segment to account for 85-90 per cent of the market in five years.

Jet officials say a shift to a low-fare model will hurt profits, but will enable the airline to price itself better when volumes grow. To offset that, the airline has embarked on a cost-cutting programme.

...

Naresh Goyal's next plan: Operate a low cost carrier!

Image: Jet Airways.Photographs: Reuters.

Shedding excess baggage

This should cause it some pain as Jet has already tried very hard to reduce cost over the last five years.

Problem is, it's difficult to alter legacy cost structures. In the June quarter, Jet's domestic operations had a cost per available seat kilometre (cost/ASKM) of Rs 4.50 vs Rs 3.15 for budget carrier Spicejet.

If one excludes fuel, Jet's domestic operations had a cost/ASKM of Rs 2.57 versus Rs 1.54 for Spicejet during the quarter ended June 2010.

Sure, Jet's revenue/ASKM of Rs 5.56 is almost double of Spicejet's revenue/ASKM of Rs 2.92, yet the difference in cost structure explains Jet's inability to bring down its fares and compete more effectively with budget carriers.

...

Naresh Goyal's next plan: Operate a low cost carrier!

Image: Air Asia.Jet's average fare during the quarter ended June was Rs 5,044 compared to Spicejet's Rs 3,663.

Then there are staff costs, which stand at 13 per cent compared to Spicejet's far lower 7.59 per cent but similar to Air Asia's 12.52 per cent.

This is high compared to the LCCs in India, like Spicejet (which is at 7.59 per cent), but compares favourably with Air Asia's 12.52 per cent. It's pilots also need to fly over 75 hours a month to ensure optimal utilisation.

This is not as easy as one might think because the crew pairings and flight schedules have to be well coordinated and designed to favour optimum performance. ''It is like a giant orchestra where everything has to be just right in order to get the best results,'' says Forte.

...

Naresh Goyal's next plan: Operate a low cost carrier!

Image: Employees of Jet Airways.Photographs: Punit Paranjpe/Reuters.

The human factor

There are a few big conversion success stories like Vueling (with Iberia) in Spain and Jetstar (Qantas Group) in Australasia but most big full service airlines who try to morph into an LCC fail miserably.

They often depend on their existing management to reshape the airline. ''They need to bring in externals who do not have preconceived notions about things like staff practices or their relationship with the travel trade,'' says Huttner.

If Jet can implement an aggressive cost reduction programme, with employee reduction as a part of it, its plans for a metamorphosis stands a chance, say experts.

...

Naresh Goyal's next plan: Operate a low cost carrier!

Image: Retrenched employees protest in 2008.Photographs: Punit Paranjpe/Reuters.

''Jet is much more efficient today than it was in prior years. This needs to improve further and warrants employee reductions in some cases,'' adds Steve Forte, who has been tracking the airline for over a decade now.

However, cutting personnel costs is not always a cinch. Very often, the unions have negotiated contracts and are unwilling to cut back.

''This is particularly true for pilots who are a very difficult bunch of people to deal with as they know very well that they can stop the airline anytime with a walkout or slowdown,'' says an aviation expert.

And Goyal has some experience with layoffs. In 2008, Jet tried to layoff 1,900 people but was forced to take them back after stridently public protests from staff.

...

Naresh Goyal's next plan: Operate a low cost carrier!

Image: JetLite.Given the experience and sensitivity of the issue in the Indian context, experts doubt if Goyal will have the nerve to allow management to pursue such reduction in personnel.

''The moral of the story is that airline founders never learn from history. They go all out in the beginning and then try to correct their mistakes later on," says Forte.

This kind of attitude bears a striking resemblance to Goyal's history with reinvention.

Four years after Air Deccan's launch, Goyal acquired Air Sahara, converted it into an LCC and renamed it JetLite to compete with LCC rivals.

...

Naresh Goyal's next plan: Operate a low cost carrier!

Image: Jet Airways plane at the Mumbai international airport.Photographs: Reuters.

Two years later, as LCCs kept growing at the cost of full-service carriers like Jet and Kingfisher, Goyal introduced Jet Konnect, a no-frills, all-economy service to take on LCCs. This, experts say, is the worst kind of strategy to adopt.

"You almost invariably end up with employee discontent and moral problems which affects the level of service you are trying to achieve and maintain. It would have been easier to be a little smarter at the beginning and construct the right foundations,'' says Forte.

Still, Jet Airways is the country's best run airline and Goyal is a shrewd operator who had to walk for miles to school as his parents couldn't afford a bicycle.

...

Naresh Goyal's next plan: Operate a low cost carrier!

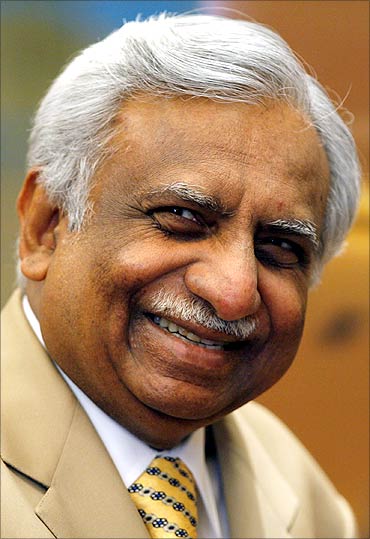

Image: Naresh Goyal.Photographs: Reuters.

He then worked as a cashier at his maternal uncle's company at a starting salary of Rs 300 a month before he entered the airlines business.

Remembering his humble beginnings and his approach in problem solving while building an enduring franchise will be crucial if he is to have any success in giving wings to his daunting, new venture.

Goyal's cost cutting checklist

- Flight profitability takes a hard look at routes that do and don't make money

- Fuel management programme looks at seasonality, weight load and routes to prune costs

- Renegotiating aircraft leases and financing is possible when a good plan backed by credible numbers can revise old contract terms

- Airport service by own crew or another outfit needs to be analysed

- Cabin crew rules require one crew member for each emergency exit. Jet always had at least two or more. Not any more

- On board service means few services and passengers forking out cash for food

- Ticket sales should be done online and not through travel agents

article