Ashish Pai

Avoid buying stocks based on cost alone. Highly priced stocks may be expensive but provide better returns.

Whenever we buy a product or service, we look at its cost. Cheaper products seem more affordable and hence attractive to buy. The same applies to stocks.

Low-priced ones attract more buying interest. However, do they give good returns? One must know how to compare stocks, the pricing and how to find value for money.

...

How to get high returns from stocks

Image: Earn more from stocks.Then, the P/E ratio is 10. Another stock B, has a price of Rs 200 and its EPS is Rs 8. Then, the P/E ratio is 25. Stock B is said to be costlier than stock A.

Another method is to compare the price-to-book value (P/BV). Taking the case mentioned above, if the book value of A is Rs 500 and book value of B is Rs 40, the ratios are two and five, respectively. Again, stock B is costlier than stock A.

These two are the most common and universally utilised methods for evaluating the prices of stocks.

...

How to get high returns from stocks

Image: State Bank of India.Let us see why some stocks are highly priced:

Growth in earnings: The stock of most top-rated companies such as HDFC, HDFC Bank, State Bank of India, Cipla, Infosys Technologies, TCS, ITC, BHEL, L&T, Tata Power and so on have been among the most expensive in the market and in their industries.

But inspite of their high prices they have been able to give better returns. This is because their earnings growth is superior. They also have grown at a faster pace.In contrast, many of their cheaper peers have been at low valuations for years, but this hasn't helped in increasing their market returns.

What can explain this contradictory situation? One, the better rate of earnings growth. Two, the market always appreciates companies which deliver better than the industry returns.

...

How to get high returns from stocks

Image: Blue-chip stocks highly priced.Better resource raising: Most blue-chip stocks with high prices are of companies self-sufficient in capital and able to fund growth entirely through internal accruals.

Either because of enormous generation of cash flows or because the business doesn't have much capital requirement.

Their shareholders don't have to suffer equity dilution, nor would they have to raise high-cost funds which dampen equity earnings.

...

How to get high returns from stocks

Image: Know about corporate governance when investing in a company.Good corporate governance: The companies with good corporate governance have a better valuation in the market.

The prices of these stocks are always at a premium, as the investing community have a lot of respect for the management and believe in their business philosophy and decisions.

Examples are Infosys, Wipro, Tata Group companies, HDFC. It is important to know about corporate governance when investing in a company.

...

How to get high returns from stocks

Image: Stocks with better liquidity usually get higher valuation.For example, Asian Paints and Kansai Nerolac, are both fundamentally good companies operating in the paints industry.

However, the valuation for Asian Paints is higher as compared to Kansai Nerolac, as the latter's shares are less liquid.

Market perception: Market perception also helps in determining the stock valuation. Companies in sunrise industries like education, healthcare and telecom usually get a better valuation.

...

How to get high returns from stocks

Image: Richly valued stocks have beaten their low-cost peers.Photographs: Reuters.

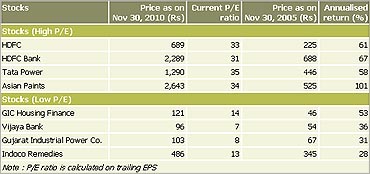

In the table given, we have taken some of the highly priced stocks not only in absolute terms but also in relative terms.

And, compared their five-year returns with those of their low-cost peers. As can be seen in the table, the richly valued stocks have beaten their low-cost peers substantially.

...

How to get high returns from stocks

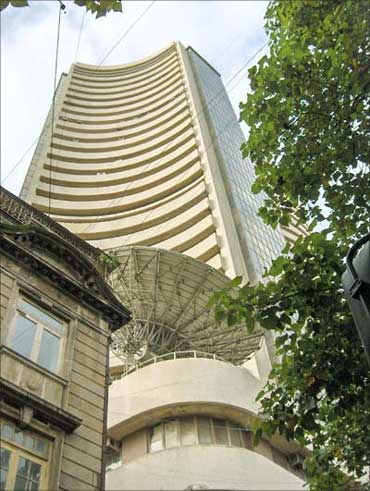

Image: Bombay Stock Exchange.Remember that if stock price was the only indication of whether a stock was cheap or not, nobody would have been buying stocks like Infosys, SBI, HDFC and so on.

But these high-priced stocks have always delivered better returns than the market.

Conclusion:Retail investors should not be worrying only about the cost price. If any stock is providing value for money they should go for it, irrespective of the price. If investing in small-and mid-cap stocks, look before you leap.

The writer is a freelancer.

article