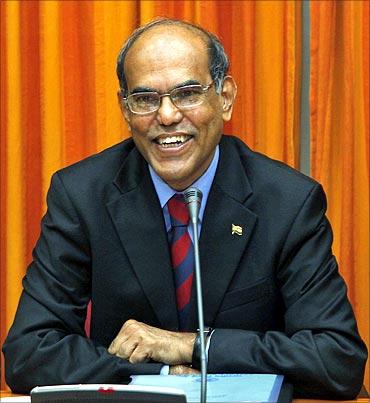

For India to regain its growth momentum and indeed accelerate it further, we need to address several challenges, said Duvvuri Subbarao, Governor, Reserve Bank of India, while delivering the Haksar Memorial Lecture.

India clocked average annual growth of 9 per cent in the five year period 2003-08.

For a nation that once believed that the Hindu rate of growth was its destiny, this remarkable growth performance was cause for celebration.

It was also a trigger for setting off an aspiration for double digit growth.

The India growth story was thrown off track by the global financial crisis which engulfed virtually every country in the world.

We recovered from the crisis sooner than other countries, but the growth rate is yet to reach the pre-crisis level.

There is widespread anxiety that we may have got derailed from the high growth trajectory, and a number of questions are being asked.

Is our growth story faltering?

Has India's potential growth rate declined because of the crisis?

Are the growth drivers that worked our way during 2003-08 still intact?

When will we reach double digit growth, and what indeed should we be doing to achieve that?

. . .

Elephants too dance

My simple and single answer to all of the above questions is that the India growth story is still credible.

If the East Asians are the tigers, and China the dragon, India is commonly 'the elephant' -- a strong animal with enormous potential but given to a lumbering pace.

For a world that once believed that an elephant does not have any animal spirit, our march up the high growth trajectory proved that an elephant too can dance.

But the elephant dance got interrupted by the 'zoo party' of the global financial crisis, and to get it back on course, we need to rejig the dance.

So, for India to regain its growth momentum and indeed accelerate it further, we need to address several challenges.

What I propose to do is to outline what in my view are the ten most important challenges that we need to address to move up the growth ladder.

. . .

First Challenge: Raising Agricultural Production and Productivity

The first challenge is stepping up agriculture production and productivity.

We have, of course, come a long way from the chronic food shortages of the early years of independence; and even as population increased, we have been able to maintain food self-sufficiency, thanks to investment in irrigation, improved farming practices and better technologies.

But in recent years, there has been growing concern about erosion at the margin of food self-sufficiency.

The supply-demand gap in the food sector is, in part, a problem of success -- a consequence of a shift in dietary habits from cereal to protein based foods reflecting rising incomes, especially rural incomes.

Regardless, our quest for inclusive growth will be jeopardized if we are not able to address the root causes of structural food inflation.

Some analysts argue that agriculture cannot be a concern from an overall growth perspective because it accounts for only about 15 per cent of GDP, and that the share will further decline as the economy matures.

This argument is flawed.

Even as its share may be small and declining, agriculture still accommodates 53 per cent of the labour force.

Besides, agriculture has very vital supply demand linkages with other sectors of the economy.

Raising agricultural production and productivity is, therefore, important for containing price pressures, raising rural incomes and making growth more inclusive.

There are several initiatives necessary to launch the second Green Revolution -- larger public investment, greater input efficiency, soil conservation, improved farming practices, developing resilience to rainfall variations and climate change effects, to name just a few.

And to build forward and backward linkages, there is need to invest in rural infrastructure and the supply chain.

We also need to be mindful that land and water costs will only increase over time; and inclusive growth will push up wages thereby putting upward pressure on inflation.

In a context of rising costs, improving productivity becomes imperative to balance the needs of producers for higher prices and the demand of consumers for low prices.

. . .

Second Challenge: Expanding Employment

The second major challenge to making growth inclusive is to expand employment opportunities.

Even as more people than ever before are in work, there is a sense of crisis about jobs.

That is not surprising because unemployment is the most significant cause of economic pain in a poor country.

Unemployment may be one of our biggest problems, but analysing the problem is a challenge not the least because there are no reliable statistics.

There is an enormous amount of unemployment and underemployment in the rural sector but the size and nature of the problem are unclear.

Millions of people are locked in low productivity jobs in the unorganized industry and service sectors. India's high end IT service sector may be dazzling the world but, contrary to popular perception, it employs no more than 3 million.

So, the problem of jobs is that a lot of people are out of work, and where they have work to do, they are performing below their potential.

The recent National Sample Survey Organization data suggest that both unemployment rate and employment growth declined during the period 2004/05 to 2009/10.

This is intriguing, but has been explained as a result of a large number of young people pursuing education resulting in fewer job seekers.

This means only a temporary respite, as once out of school, these people will add to the labour force.

There will be other pressures too.

As agricultural productivity goes up, it will release millions of surplus labour who will have to be found jobs outside the farm sector.

Also, more women will join the labour force and add to the demand for jobs.

Putting all these trends together, various estimates suggest that India's labour force will increase by 250-300 million in the next twenty years.

Finding productive jobs for such huge numbers is a big challenge, and clearly the answer lies in stepping up growth, and importantly, stepping up the employment intensity of growth.

Where are the jobs going to come from?

To examine that, it will be interesting to look at the relative shares of different sectors of the economy in GDP and in jobs.

The following table shows the figures for 2009/10.

| Sectoral Shares of GDP and Employment 2009/10 | ||

|

| Share of GDP | Share of Employment |

|

| (Percentages) | |

| Agriculture | 15 | 53 |

| Industry | 20 | 12 |

| Services | 65 | 35 |

The above numbers clearly underscore the need to move people out of low productivity jobs in agriculture to industry and services.

A portion of the surplus labour in agriculture could be absorbed in non-farm allied activities.

There will be opportunities also in the construction sector which is growing, but a major expansion of job opportunities in the service sector will not be possible without skill improvement.

That will inevitably take time.

So, much of the burden of job creation falls on the manufacturing sector.

For a long time, it was believed that India defied the text book development paradigm by leapfrogging directly from agriculture to services, skipping the manufacturing sector.

Our experience clearly demonstrates that such a 'leap frog' cannot be sustained. We have to heed the text book and look to manufacturing for expanding employment.

The recently unveiled National Manufacturing Policy aims at raising the share of manufacturing in GDP from 16 per cent to 25 per cent and generating additional employment of 100 million by 2022.

To exploit the full job potential of this emphasis on manufacturing, we need to liberalize our labour laws and employment regulations so that perverse incentives to push labour into the unorganised sector are eliminated.

My discussion of the challenge of job creation will be incomplete if I do not address the issue of 'demographic dividend'.

The demographic dividend argument, which has gained increasing currency in recent years, goes as follows.

Demographics are in India's favour because the working age population is growing faster than the overall population.

This expanding working age population will earn, and will save, thereby contributing to higher savings and higher investment, which will lead to higher growth.

Aren't we carrying this 'demography is destiny' argument too far?

There is nothing inevitable about the demographic dividend.

Demographic dividend will flow if, and only if, we are able to find jobs for the growing labour force.

To summarise, the second challenge to sustaining India's growth momentum is to expand employment opportunities and improve labour productivity.

. . .

Third Challenge: Raising Productivity

Job expansion is one side of the challenge to inclusive growth.

The other side is enhancing productivity.

Historical evidence clearly demonstrates a quantum jump in productivity as labour moves from the agriculture to the secondary and tertiary sectors.

Back of the envelope calculations show that at the current stage of our economic development, as a worker moves from agriculture to other sectors, his/her productivity increases by nearly a factor of five.

Productivity improvement entails better managing factors of production as well as factor productivity.

In terms of factors of production, managing surplus labour in the farm sector, raising the rate of domestic savings, attracting stable foreign savings, sustainable use of natural resources and managing the demand on land from key growth sectors will be important.

Improving factor productivity hinges critically on raising the skill endowment of the labour force.

The skills gap is no longer just a handi#8745 it is turning out to be a crisis.

For example, we want to scale up steel production to 120 MT, and that requires millions of skilled people. Yet finding even a crane operator is oftentimes a challenge.

Even as demand for skills increases, the supply side response is lagging far behind. India churns out 350,000 engineers every year, but barely a quarter of them are employable. We have 7000 ITIs, but their curriculums are woefully outdated.

There is an incentive issue in skill training.

Skill development is a quintessentially merit good where the societal cost benefit calculus is higher than the individual cost-benefit calculation.

The private sector will be reluctant to invest in skills since workers can migrate with their skills.

This was the understanding that prompted the government to launch the ambitious National Skill Development Programme as a PPP initiative to train 500 million people by 2022.

Several states are also allowing vocational training institutions to be set up as PPP initiatives as well as not-for-profit societies.

To conclude, we need to focus a lot more on improving productivity across a broad range of areas in order to raise the growth rate as well as the quality of growth.

. . .

Fourth Challenge: Managing Urbanisation

Historically, there has been a strong correlation between urbanisation and economic growth across countries and across time with the causation possibly running both ways.

Empirical studies show that middle income countries reach about 50 per cent urbanisation and high income countries typically have 70-80 per cent urbanisation.

China's rapid growth over the last two decades, for example, ran concurrently with an increase in urbanisation rate from 32 per cent in 1997 to 50 per cent in 2010 consistent with its low middle income status.

In India, we are behind on urbanisation.

In the twenty years since the start of reforms, the proportion of urban population increased from 26 per cent in 1991 to just about 31 per cent in 2011.

Accelerating growth, therefore, presents two tasks from the urbanisation perspective. First, the rate of urbanisation has to pick up pace so as to move people up the productivity ladder, and second, we have to manage the pressures of urbanisation proactively.

The costs of unplanned urbanisation are already very visible in terms of the huge strains on infrastructure and sanitation, pressure on utilities and inadequate and low quality social service provision.

Our cities are clearly unprepared for the influx of migrants on the scale that it is occurring and the result is slums and squatter settlements.

Unplanned urbanisation has also entailed other problems ranging from crime, law and order, pollution, congestion and environmental degradation.

Expanding urban infrastructure demands huge resources. Isher Judge Ahluwalia and others have estimated that investment requirements for urban infrastructure over the twenty year period 2012-2031 would be about Rs 40 trillion which translates to an annual average investment of about $100 per capita.

Mobilising resources of this order is obviously a big challenge and will call for more effective taxation, efficient project planning and implementation, innovative urban governance and much greater sensitivity to embracing the migrants into the urban ecology.

. . .

Fifth Challenge: Bridging the Infrastructure Deficit

It is widely acknowledged that infrastructure deficit is by far one of the most binding constraints to accelerating growth.

Even so, our efforts to bridge the deficit have fallen way short of the task.

The Eleventh Five Year Plan projected investment in infrastructure of $500 billion but the final expenditure is likely to fall well short of that.

The Twelfth Plan doubles the projected investment over the five year period 2012-17 to $1 trillion which means that annual investment in infrastructure has to increase from the current level of 6 per cent of GDP to over 10 per cent.

Given its fiscal compulsions, the government will clearly not be able to mobilize resources of this order.

The Twelfth Plan projections call for 50 per cent of the projected investment to come from the private sector and much of the project implementation to happen in the PPP mode.

Infrastructure investment, therefore, poses three sub-challenges: mobilising the necessary resources, reforming regulations and contractual arrangements and efficient project planning and execution.

Let me make a comment here on the Reserve Bank of India's efforts to support infrastructure financing.

Infrastructure requires long-term finance, and it should ideally be funded by long term sources like insurance and pension funds.

Since these markets in India are still not deep enough, the burden of financing infrastructure is falling on banks.

Banks cannot expand lending for infrastructure beyond a point because of exposure risks. In financing infrastructure, banks also face an asset-liability mismatch problem since their liabilities are largely short-term whereas infrastructure funding is typically long-term.

In order to support infrastructure financing by banks, the Reserve Bank has relaxed regulatory norms to the extent prudential limits would permit.

These include higher exposure norms in respect of single borrowers and borrower groups, permitting banks to invest in Infrastructure Debt Funds and to enter into take out financing arrangements, relaxing regulations governing bank guarantees for infrastructure financing and for financing promoters equity, and creating a separate category of NBFCs specializing in infrastructure finance (infrastructure finance companies).

Development of the corporate bond market will go a long way in augmenting infrastructure financing.

Both the government and the Reserve Bank have taken a number of initiatives to develop the corporate bond market and some further initiatives are in the pipeline.

Even as these measures to ease the supply side of the corporate bond market are important, it is also the case that the corporate bond market remains demand constrained suggesting that we need to address the issue from that perspective as well.

. . .

Sixth Challenge: Improving Social Sector Outcomes

India's human development indicators are distressing.

As per the UNDP's Human Development Index 2011, we rank 134 out of 187 countries, clearly in the bottom third of the league of nations.

Even as education and health outcomes have improved over the years, on many indicators such as life expectancy at birth, educational attainment and nutrition levels, we rank well below average.

Historical evidence shows that economic development and social development are strongly correlated with the causation possibly running both ways.

In recent years, the government has stepped up expenditure on education, health and nutrition, revamped social sector programmes and tried to improve the delivery systems.

Among the many lacunae of our social sector programmes is that we continue to emphasise outputs and not outcomes.

For improving service delivery, we need to spend more on the twin merit goods of primary education and basic health.

But we also need to spend more efficiently, because better education and health are a function not just of the quantum of expenditure but also of the quality of that expenditure.

Let me illustrate this by an example.

The Centre and the states in India today spend a total of 4 per cent of GDP on education. The goal is to raise this ratio to 6 per cent of GDP.

That is necessary but not sufficient. Note that countries in our neighbourhood -- China and Sri Lanka -- spend less than 4 per cent of their respective GDPs on education.

Yet they have literacy levels in the range of 90+ per cent as compared to our 74 per cent. The same goes for the health sector too. So, what matters is not just the quantum of expenditure, but also the quality of expenditure as measured by outcomes.

Just to illustrate, according to a 2010 report by Pratham, an NGO focused on education, only 17 per cent of children in classes 1 to 8 in rural areas have the ability to read a word and only 40 per cent are able to recognise numbers.

. . .

Seventh Challenge: Promoting Financial Inclusion

Why is financial inclusion important?

It is important because it is a necessary condition for sustaining equitable growth.

There are few, if any, instances of an economy transiting from an agrarian system to a post-industrial modern society without broad-based financial inclusion.

As people having comfortable access to financial services, we all know from personal experience that economic opportunity is strongly intertwined with financial access.

Such access is especially powerful for the poor as it provides them opportunities to build savings, make investments and avail credit.

Importantly, access to financial services also helps the poor insure themselves against income shocks and equips them to meet emergencies such as illness, death in the family or loss of employment.

Needless to add, financial inclusion protects the poor from the clutches of the usurious money lenders.

Apart from helping the poor at the micro level, financial inclusion delivers benefits at the macro level too.

By transferring money directly to the bank accounts of the beneficiaries, the government can minimise the leakage in its affirmative action programmes.

Financial inclusion gives access to banks of a large pool of low cost and stable funds which will aid their asset liability management.

Financial inclusion is, therefore, a win-win proposition for the poor, for the banks, for the governments at the Centre and the states and for the national economy.

Yet the extent of financial exclusion is staggering.

Out of the 600,000 habitations in the country, less than 30,000 have a commercial bank branch.

Just about 40 per cent of the population across the country have bank accounts, and this ratio is much lower in the north-east of the country.

The proportion of people having any kind of life insurance cover is as low as 10 per cent and proportion having non-life insurance is an abysmally low 0.6 per cent.

These statistics, distressing as they are, do not convey the true extent of financial exclusion. Even where bank accounts are claimed to have been opened, verification has often shown that these accounts are dormant.

Few conduct any banking transactions and even fewer receive any credit.

Millions of people across the country are thereby denied the opportunity to harness their earning capacity and entrepreneurial talent, and are condemned to marginalization and poverty.

Over the last four years, the Reserve Bank has launched several initiatives to deepen financial inclusion.

Our goal is not just that poor households must have a bank account, but that the account must be effectively used by them for savings, remittances and for credit.

Our most ambitious initiative has been the 'Business Correspondent' model or branchless banking which helps reach banking services to remote villages at a low overhead cost.

By far the biggest factor inhibiting financial inclusion is that banks continue to see it as an obligation and not an opportunity.

If banks take a slightly longer term view, they will, I am sure, change their perception. Remember that illustration they give in business strategy courses.

A business executive of a shoe company was sent to a large developing country to assess the market potential there.

What he saw was millions of people going without shoes.

He came back and reported to the management that there was no business potential there because no one wears shoes.

A few months later, a strategist of a rival company went and saw the same picture.

He came back and reported to his management that there is tremendous business potential in that country because of the number of shoes they can sell.

Ultimately, it is a question of mindset. And such a change in mindset is what is necessary to make financial inclusion meaningful.

. . .

Eighth Challenge: Managing Globalistion

Globalistion, as measured by the movement of ideas, people, goods, services and capital across borders has undoubtedly been one of the defining features of the last twenty-five years.

For countries that believed that geography is destiny, globalization has opened up incredible opportunities, but also exposed them to ruthless challenges.

If the 'Great Moderation in the years before the crisis -- steady growth in advanced economies and accelerating growth in emerging economies, and low and stable inflation all around the world -- was an indication of the positive side of globalisation, the devastating toll of the global financial crisis was its negative side.

India too is integrating with the world, more extensively, more deeply, and faster than we tend to acknowledge.

India's remarkable growth acceleration in the period 2003-08 is a demonstration of the positive side of globalisation.

We benefitted from steady growth and stability around the world. But on the flip side, the fact that we were affected by the crisis, no doubt by less than other countries, is an illustration of the negative side of globalisation.

There was dismay, if not despair, that we were affected by the global financial crisis of 2008.

This is because our expectations were shaped by the Asian crisis a decade ago where we came out relatively unscathed.

The reason we got hit by the 2008 crisis is that between the Asian crisis of the late 1990s and the global financial crisis of 2008, India's integration with the world has deepened as evidenced by the numbers in the table below.

| India's Deepening Global Integration | ||

|

| As percentage of GDP | |

|

| 1998/99 | 2008/09 |

| (Export+Import)/GDP | 20 | 41 |

| Two way (capital+current flows) / GDP | 44 | 112 |

As may be seen, India's two-way trade flows doubled in the ten year period 1998-2008, but the two-way current and capital flows increased by more than two and a half times evidencing that India's trade integration with the world got deeper, but that its financial integration got even deeper.

Globalisation as an economic force is here to stay.

It is too potent a force to be comprehensively reversed, although there may be some short-term blips.

As Nayan Chanda says in his book, "Bound Together: How Traders, Preachers, Adventurers and Warriors Shaped Globalization", globalization was, is, and will always be inevitable. No revolution in human history has been totally benign.

So is it the case with globalisation.

It comes with benefits and costs.

The challenge for us, as indeed for every country in the world, will be to minimize the costs and maximise the benefits of globalisation.

As India further embraces globalisation, there are many things we should be doing to optimize the cost-benefit calculus.

I will cite just two examples to illustrate the point.

From the macro perspective, we need to manage the 'Impossible Trinity'.

According to the 'Impossible Trinity' theory, a country cannot simultaneously have a fixed exchange rate, an open capital account and independent monetary policy.

Most advanced economies give up on the fixed exchange rate to gain policy leverage on the other two parameters.

Emerging economies typically eschew corner solutions in favour of middle solutions.

For example, in India, our capital account is partly open, we let the exchange rate float and intervene only for the purpose of managing excess volatility and disruptions to macroeconomic stability, and operate our monetary policy taking into account the impact of external developments on our domestic situation.

Our challenge will be to continue to manage this impossible trinity even as we gradually open up our economy further.

Another dimension of the globalisation challenge that I want to illustrate is 'innovation'. Innovation has always been, and will always be, the well-spring of growth, but its importance increases in a knowledge economy.

History has shown that as an economy grows, first incomes and then wages rise, and it then loses competitiveness in labour intensive industries forcing it to seek new sources of growth through innovation.

Or else, it gets locked into what has now come to be called the 'middle income trap'.

For example, in India we enjoyed a comparative advantage in the IT industry because of our superior technical manpower and knowledge of English.

But that advantage is now threatened as other countries are fast catching up. In order to continue to benefit from globalisation, we need to move up the value chain and the only way that can happen is through innovation.

To summarise, given that globalisation is inevitable, and India will further embrace globalisation, we need to harness it to our advantage so that it aids both the quantum and quality of our growth.

. . .

Ninth Challenge: Providing a Stable and Predictable Macroeconomic Environment

That a stable and predictable macroeconomic environment is a necessary condition for growth is too obvious to need any reiteration.

It is only in such an environment that both savers and investors can make informed decisions so that savings translate efficiently into productive investment.

Every country that has got into a crisis in the last twenty-five years tells a story of excess -- an excess carried to an unsustainable level and then an implosion.

Fast growth gained through an excess can be an allure because the signs of instability brewing in the underbelly are oftentimes not visible in real time.

But when the implosion inevitably happens, the losses by way of lost growth and welfare can be monumental.

I want to emphasise the importance of a stable macroeconomic environment by referring to two of our big tasks.

The first is reduction of fiscal deficits both at the Centre and in the states to stabilize the debt-GDP ratios at sustainable levels.

The harm that fiscal irresponsibility can cause are evident from both our own experience and that of other countries.

In charting a roadmap for fiscal consolidation, we also need to be mindful of the quality of fiscal adjustment -- which is to weed out unproductive expenditure and protect, if not enhance, growth-promoting expenditure.

The second task is to bring inflation down first to 5 per cent, and then even lower, consistent with India's broader integration into the global economy.

A high inflation scenario makes both savers and investors uncertain.

The current inflation we are experiencing is a consequence of both supply shocks and demand pressures.

The Reserve Bank's monetary tightening has been aimed at restraining demand and anchoring inflation expectations.

This has to be supplemented by supply side responses to raise the potential output of the economy.

. . .

Tenth Challenge: Good Governance

I have so far highlighted nine challenges to accelerating our growth.

Identifying these challenges and drawing up plans to address them is the relatively easy part.

What is infinitely more difficult is the translation of those policies into action.

That brings me to the final item on my list -- the challenge of providing good governance.

That good governance is at the very heart of economic growth and poverty reduction, and even political legitimacy, is one of the undisputed lessons of development experience from around the world over the last 60 years.

In the ultimate analysis, it is the quality of governance that separates success and failure in economic development.

Across countries, application of the same policies in roughly similar contexts has produced dramatically different results.

In our own country, we have seen vast differences across states in development outcomes from out of the same mix of development policies.

These differences across countries as well as across regions within countries, even as they adopt similar policy packages, arise because of differences in governance.

Indeed research shows that per capita incomes and the quality of governance are strongly correlated indicating a virtuous circle in which good governance results in economic development.

. . .

Rejig the Elephant Dance

Let me now conclude. I have highlighted ten challenges that we need to address in order to accelerate output growth with focus on the quality of growth.

I must admit that this list is by no means exhaustive, and individual lists can vary both in content and emphasis.

I hope my list would, at the least, serve as a reference point for thinking through.

As people we are understandably eager for our economy to sprint like a tiger rather than amble like an elephant.

Yet few animals have an elephant's stamina.

And elephants do not always amb#8804 they dance too.

And when elephants start dancing, they can go on for a long long time.

But while dancing, an elephant can go off course occasionally.

That calls for rejigging the dance.

As I conclude, my thoughts are on how late Shri Haksar might have rejigged the elephant dance.