Photographs: Reuters. Vivek Kaul

The heat had finally reached Mumbai. She was fidgeting and he was snoring. Finally she woke him up.

"Did you happen to read what Warren Buffett has written in his latest letter to his shareholders?" she asked.

"What? Warren Buffett?" he replied. "It's four in the morning!"

"Hmmm. So?"

"Let me sleep."

"Come on," she said, trying to wake him up.

"I haven't read it," he replied, trying to go back to sleep.

"Don't lie," she said. "If you haven't, what are these print outs doing next to your bed."

"Yeah, printouts. I guess you won't let me sleep."

"No, I won't" she said with a winner's smile on her face.

...

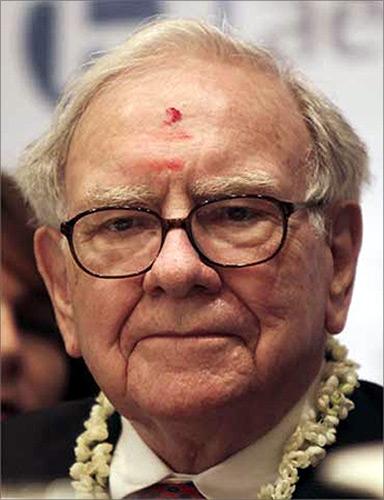

Why Warren Buffett is wrong about gold

Image: Warren Buffett.Photographs: Reuters.

"Well every year Warren Buffett writes a letter to the shareholders of Berkshire Hathaway, explaining the investment decisions he has made during the course of the last year and how he sees things panning out in the days to come."

"Arre! Itna to I know!" she interrupted. "What are the main points he has made in this year's letter?"

"This year he has talked about gold."

"Gold?"

"Yeah gold. And why investing in stocks is going to be a much better bet than gold in the days to come."

"And what's the logic there?" she asked.

"As Buffett puts it "Gold has some industrial and decorative utility, but the demand for these purposes is both limited and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end."

...

Why Warren Buffett is wrong about gold

Image: A goldsmith displays gold bangles in his jewellery shop in Istanbul.Photographs: Murad Sezer/Reuters.

"Seems like a fair point. So why do people buy gold then?"

"In the words of Buffett "what motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the past decade that belief has proved correct. Beyond that, the rising price has on its own generated additional buying enthusiasm.""

"Hmmm. And what do you have to say regarding this?"

"Well, gold has very few industrial uses, given the fact that it is very expensive. And yes, people beyond a point buy it because everyone else is. But then that is true about any other investment as well. Let us take the case of America. In the late nineties everyone wanted to buy dotcom stocks. Once they were done buying dotcom stocks, all of them wanted to buy houses. This pushed up the price of first dotcom stocks and then houses. Of course beyond a point the bubble burst, investors lost money, and landed the whole world into a big financial mess," he explained.

...

Why Warren Buffett is wrong about gold

Image: George Soros."So? One shouldn't buy when everyone else is buying?" she interrupted.

" I never said that. Some of the investors who got their timing right did make pot-loads of money as well.

As George Soros, the biggest speculator of them all once wrote "Nothing is quite as profitable as investing in an early stage bubble."

"As usual, there are two sides to everything," she said, rather philosophically.

" But let's stay on track. We were talking about gold."

"Yes gold."

"I don't agree with what Buffett has to say."

"Why?"

"Because what he says goes against basic human nature over the years and I do feel that gold is going to give good returns in the days to come."

"What makes you say that so confidently?"

"Let me get into some history before I get back to gold."

"History?"

...

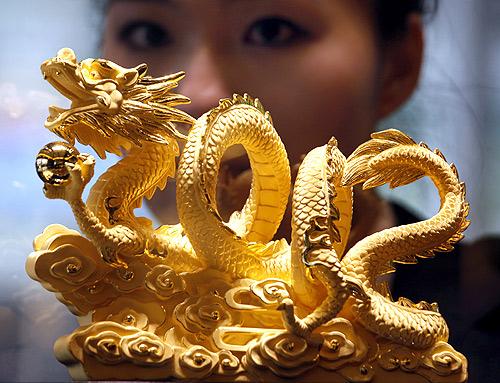

Why Warren Buffett is wrong about gold

Image: A sales representative poses behind a nine-tael 24K gold in the shape of a dragon forming the numerals 2012.Photographs: Bobby Yip/Reuters.

"Yes history. Sir Thomas Gresham was a financial advisor to Queen Elizabeth I, in the sixteenth century. Gresham helped Elizabeth clean up the monetary mess created by her father Henry VIII and her brother Edward VI, who ruled before her. Those days the primary form of money was gold or silver coins. And the quality of a coin was known by the amount of gold or silver it contained. But Henry VIII and Edward VI had managed to completely debase the pound by ensuring that it had very little silver left in it."

"But what was debasement?" she asked.

"Kings and governments throughout history have been debasing coins. Nero, who watched while Rome was burning, was one of the first kings to debase money. Debasement was a practice where the ruler lowered the precious metal content of the coin while keeping its value unchanged. So let us say one coin weighed five grams. The king decides that from now on the coin will weigh only four grams. Earlier 20 coins could be made out of 100 grams of metal. Now 25 coins can be made from the same amount of metal."

"Oh!"

...

Why Warren Buffett is wrong about gold

Image: Gold earrings are seen on display at a store in New York.Photographs: Shannon Stapleton/Reuters.

"There is another other way to explain this. Let us say a particular coin has a face value of 100 cents (or paisa or pence for that matter). The face value of a coin is also referred to as its tale. Initially the metal content in the coin is also worth 100 cents. The value of metal content in the coin is referred to as species," he said.

"In this example, the tale value of the coin is equal to the specie value. Now the ruler decides to debase the coin and reduce its metal content by 10%. So the specie value of the coin will now be 90 cents even though the face value of the coin continues to be 100 cents. As explained above by doing this the ruler could mint more coins out of the same amount of metal," he explained.

"Very interesting," she commented.

...

Why Warren Buffett is wrong about gold

Image: Second hand gold jewellery items are displayed at Ginza Tanaka store in Tokyo.Photographs: Yuriko Nakao/Reuters.

"And that is how things were in Britain at that point of time. The economy was full of debased coins launched by the earlier rulers. Elizabeth wanted to launch new coins where the face value of the coin was equal to the amount of metal in it i.e. tale was equal to the specie."

"Yes that made sense, given that the coins hardly had any silver left in them."

"But there was a slight problem."

"Problem? What problem?" she asked, getting into the discussion totally.

"In such a situation Gresham felt that bad money will drive out the good money. This meant that the citizens of the country will hoard onto the new coins whereas they would continue using the existing debased coins in the market for making payments. The new coins because they had a greater amount of silver in it would be melted and sold for their precious metal content. Hence the bad money would drive out the good. This in later years came to be known as the Gresham's Law."

...

Why Warren Buffett is wrong about gold

Image: Figurines in 24K gold.Photographs: Bobby Yip/Reuters.

"Yeah. That would be the logical way to react. Melt the coins and sell them for their silver value and get more money in the process," she said.

"So what did they do to get rid of this problem?"

"To get rid of this problem Gresham decided that all the old coins would be exchanged for new coins. So there were no old coins in the market, and the market moved onto using the new coins as the currency."

"Hmmm. But what has all this got to do with gold?"

"I was just coming to that. This phenomenon of bad money driving out good has been observed time and again through the centuries, even before Gresham's name became attached to it.

As John Mauldin, a hedge fund manager explains it, "'Under the Greeks and Romans, when gold coins were debased, few people were dumb enough to want to exchange their old coins that had high gold content for newer ones that had low gold content, so older good coins disappeared as people hid them."

"Hmmm. But how is it relevant today?"

...

Why Warren Buffett is wrong about gold

Image: A shopkeeper poses with gold rings inside a jewellery shop in Taipei.Photographs: Nicky Loh/Reuters.

"Bad money is driving out good money even today, though in a slightly different form. Governments across the world have been printing more and more paper money to tide over the various financial crises that they are facing. When a government resorts to printing more of its currency, it leads to a situation where there is much more currency in the market than before and hence like the coins which lost their precious metal content, paper money is also getting debased," he explained.

"Hmmm. Sounds convincing."

"To protect themselves from this debasement people buy another asset i.e. gold in this case, something which cannot be debased. During earlier days paper money was backed by gold or silver and it could be exchanged for gold or silver as and when needed," he said.

"When governments printed more paper money than they had precious metal backing it, people simply turned up with their paper at the central bank or the government mint and demanded it be converted into gold or silver. This option hasn't been available to people since the first world war started in 1914. Now whenever people see more and more of paper money, the smarter ones simply go out there and buy that gold," he said.

"So?"

...

Why Warren Buffett is wrong about gold

Image: An art nouveau Spanish brooch from the 1910's, made from 18-carat gold.Photographs: Suzanne Plunkett/Reuters.

"So gold keeps disappearing from the market and hence its price keeps going up. And as was the case earlier bad money i.e. paper money, drives out the good money i.e. gold, away from the market."

"Ah, what a comparison!"

"And that is why Warren Buffett will be wrong when it comes to gold. As long as governments around the world keep printing money to fight the financial crisis, gold as an investment class will keep doing well."

"But why is Buffett anti gold then?"

"A major reason for it is the fact that Buffett is a follower of the school of value investing established by Benjamin Graham."

...

Why Warren Buffett is wrong about gold

Image: A model presents a creation by jewellery designer Mukhi during a show at Joaillerie Liban Exhibition 09 in Beirut.Photographs: Jamal Saidi/Reuters.

"For most of the period that Graham was an active investor, private ownership of gold in the United States remained banned. Franklin D Roosevelt outlawed it in 1933 and it remained so till 1974. Graham passed away in 1976," he said.

"Hence during the price years of his life as an investor, gold was never an investment class. To him investments were limited to stocks or bonds. Hence the theory of value investing never got around to talking about gold," he said.

"Very interesting," she said.

"So can I sleep now?" he asked.

"Na," she replied.

"Why?"

"Its six thirty now. Time to get ready for office!"

article