Photographs: Courtesy, Supertech Mansi Taneja in New Delhi

Even as demand in the real estate market remains sluggish, Delhi and Mumbai have recorded property price appreciation of 33.3 per cent and 22.65 per cent, respectively, through the last two and a half years, data show.

In terms of price rise during this period, Jaipur topped the list of cities (a rise of 64 per cent).

In spite of declining sales, realty prices across 12 major cities have been rising since April 2011, data from National Housing Bank (NHB) show.

…

Cities that saw the highest rise and fall in realty prices

Image: A labourer works at the construction site of a residential complex in Kolkata.Photographs: Rupak De Chowdhuri/Reuters

Of the 15 cities covered between April 2011 and December 2013, only three - Kochi, Bhopal and Faridabad - have recorded drop in property prices.

At 1.03 per cent, Kolkata recorded the least appreciation in prices, showed the NHB Residex (the index is based on actual lending towards residential property by banks/financial institutions).

…

Cities that saw the highest rise and fall in realty prices

Image: Mumbai's skyline.Photographs: Punit Paranjpe/Reuters

Experts say price appreciation is a combination of many factors such as cost of construction, inflation and land costs.

The appreciation would have been much higher had a slowdown not hit the economy, they added.

…

Cities that saw the highest rise and fall in realty prices

Image: Labourers work at a construction site of a commercial complex in Mumbai.Photographs: Vivek Prakash/Reuters

NHB Chairman R V Verma says excluding the Delhi National Capital Region (NCR) and Mumbai, the market is functioning efficiently.

“Demand is pulling up prices in most cities. Also, there is an inflationary cost attached to it. Credit is easily available in small cities — tier-I and tier-II. Housing loans are going up; there is growth of about 20 per cent.”

…

Cities that saw the highest rise and fall in realty prices

Image: Labourers work at the construction site of a commercial complex in New Delhi.Photographs: Anindito Mukherjee/Reuters

“In the coming period, people expect interest rates and prices to rise, which is why this is the right time to buy property,” Verma said.

Samir Jasuja, founder and chief executive of real estate research company PropEquity, says, “Despite the slowdown, there are green shots in many micro markets, which continue to give significantly high returns. Markets in various cities have seen price appreciation of 50-150 per cent since 2008-09.”

…

Cities that saw the highest rise and fall in realty prices

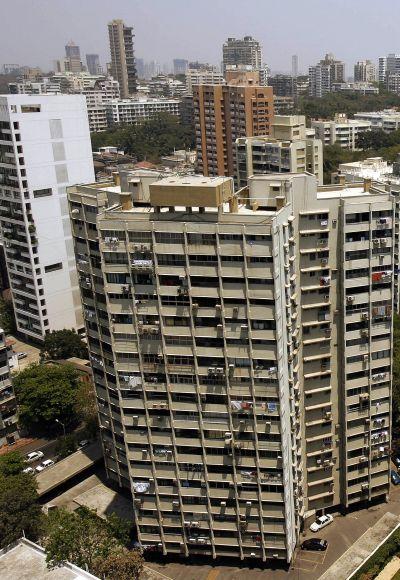

Image: Residential buildings in Mumbai.Photographs: Punit Paranjpe/Reuters

High prices in markets such as Delhi-NCR and Mumbai are mainly because in these regions, investors hold on to properties. That results in end users not being able to buy.

“This also creates barriers for new launches/construction at lower prices in these areas,” said a real estate analyst.

According to consulting firm Liases Foras, for the December 20123 quarter, the inventory (months required to clear the stock at the existing pace of absorption) across India stood at 30 months.

...

Cities that saw the highest rise and fall in realty prices

Image: Mumbai SkylinePhotographs: Punit Paranjpe/Reuters

The Mumbai Metropolitan Region had the highest inventory of 46 months. Inventory of eight months shows a healthy real estate market.

Shveta Jain, executive director (residential services), Cushman & Wakefield, says, “Though activity has come down, we are now seeing more healthy transactions. Speculative investments/activities have also slowed, which is a very good sign. The market is more mature now.”

In the high- and mid-end segments, price appreciation across India stood at an average 22-23 per cent through the past year, Jain said.

article