At least 200 shell firms and “benami” assets have come under the scanner of the investigative agencies that are probing the Rs 11,400-crore alleged fraud at the Punjab National Bank, involving diamond czar Nirav Modi, his relative and business partner Mehul Choksi and others.

The Enforcement Directorate, which continued its searches against Modi, Choksi and their companies for the fourth day on Sunday , is also moving to attach at least two dozen immovable properties under the Prevention of Money Laundering Act.

The ED on Sunday raided at least 45 premises, including jewellery showrooms and workshops, across the country.

“As many as 29 properties -- of Modi, his family members and companies -- that have been provisionally attached by the Income Tax department, are being assessed by the ED under the PMLA. A few more assets will be attached soon under the anti-money laundering law,” a senior ED official said.

He added that the ED and the I-T department had zeroed in on about 200 dummy or shell companies in the country and abroad that were being used to route or receive funds as part of the alleged fraud.

It is suspected that the shell firms were being used by the accused to launder money and create “benami” assets in the form of land, gold and precious stones, which is now being probed by the tax department.

Both the ED and the IT department had formed special teams to investigate the case, sources said.

The ED has seized diamonds, gold jewellery and other precious stones worth Rs 5,674 crore till now in the case.

The I-T department on Saturday attached nine bank accounts of Gitanjali Gems, its promoter Mehul Choksi and others in connection with a tax evasion probe against them.

It had also attached 29 properties and 105 bank accounts of Modi, his family members and firms owned by them.

Modi, Choksi and others are being investigated by multiple probe agencies after it recently came to light, following a complaint by the PNB, that they allegedly cheated the nationalised bank to the tune of Rs 11,400 crore, with the purported involvement of a few employees of the bank.

The Central Bureau of Investigation is also looking into the matter.

Officials of other banks also being probed

Officials at overseas branches of other banks, where the fraudulently issued Letter of Undertakings were encashed, are under scanner, sources said.

Officials of Hong Kong branches of Indian lenders including Allahabad Bank, State Bank of India, Union Bank, UCO Bank and Axis Bank are part of the entire fraud which continued for 7 years.

As per the guidelines, the tenure for the encashment of LoUs for the jems and jewellery sector is usually of 90 days and not 365 days -- the maturity period of most of the LoUs linked with the PNB fraud, sources said, adding that the deviation from the usual practice should have raised alarm in the minds of officials working at the Hong Kong branch of other lenders.

But surprisingly this did not happen till last month when PNB refused to honour LoU fraudulently issued by some of the staff at its Brady House branch in Mumbai, sources said.

Had someone raised the alarm earlier, the quantum of fraud could have been lower, sources said, adding that it is like alert citizen informing police about some nefarious activity to authorities for the further action.

As many as 11 Indian banks have operations in Hong Kong. Branches of Allahabad Bank, UCO Bank, Union Bank of India, Axis Bank, SBI, Bank of India, Bank of Baroda, Canara Bank, HDFC Bank, ICICI Bank, and Indian Overseas Bank are present in the city state.

Among the lenders having a branch in Hong Kong, country’s largest lender SBI has already announced an exposure of $212 million to the PNB fraud involving Nirav Modi-promoted companies.

At the same time, another public sector lender Union Bank of India’s exposure stood at $300 million, while UCO Bank has to realise $ 411.82 million.

Allahabad Bank suspects it exposure of around Rs 2,000 crore.

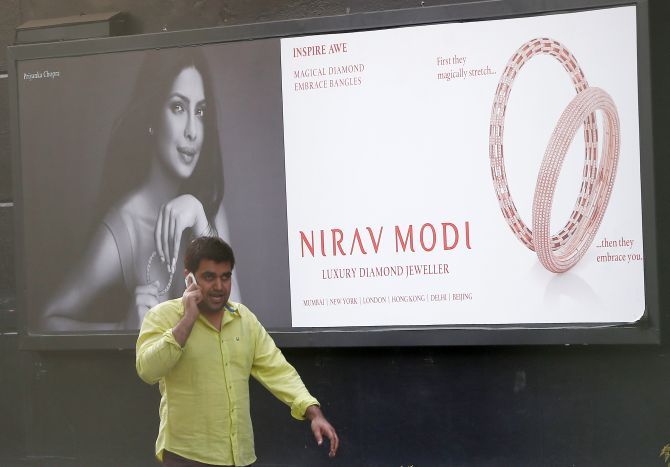

Image: A man talks on a phone as he walks past a Nirav Modi showroom during a raid by the Enforcement Directorate in New Delhi. Photograph: Adnan Abidi/Reuters