|

|

| Help | |

|

You are here: Rediff Home

» India » Business » Columnists » Guest Column » Kunal Kumar Kundu |

|

| ||||||||||||||||||||||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||||||||||||||||

Europe is not far behind

While the world is busy criticizing the US for its subprime misadventure, the European Central Bank and the Federal Reserve have recently found that Europe's non-financial companies are currently burdened with Euro 5.3 trillion or $7.5 trillion of debt, equal to about 57 per cent of the Euro-zone economy.

This figure is up 48 per cent since 2001 and comparable with 46 per cent in the US. A decade of investing more than they have earned has loaded companies in the 15-nation Euro area with debt, leaving them thinner cushions of cash to fall back on than their US and Japanese counterparts.

Companies in this region are now under pressure to curtail hiring and capital spending to meet rising interest payments, as lower growth has already impacted their profitability.

Even as the US and Japanese companies were already taking measures in terms of getting rid of idle factories and excess workers and repaying their debt since the early part of this decade, European companies, on the other hand, took advantage of easy credit to increase borrowing, allowing them to make acquisitions and bolster investment for 20 straight quarters.

Companies across sectors in Europe have reportedly accelerated their borrowing in the period 2005-2007, adding Euro 1.8 trillion to their debt.

What is also important to note is that the euro zone retail sales report for July were weaker than originally anticipated, falling 0.4 per cent m-o-m with a q-o-q rate of -0.8 per cent.

Car registrations are down almost 6 per cent q-o-q, the largest decline since 2001. Moreover, consumer confidence and households perceptions of inflation, has deteriorated further in Q3 relative to Q2.

Even the United Kingdom is probably already in recession and the Bank of England is forecasting a flat (0 per cent growth) GDP next year.

Clearly Europe is facing strong headwinds going forward and it is very unlikely that it can act as global growth engine in the current situation where US is also slowing down.

And what about India?

This brings us to India, China and other Asian economies. Are these economies truly decoupled from US or for that matter rest of the world? Not really.

Most of these economies have become strong because of liberalization that allowed the flourishing of the conspicuously consuming middle class. These economies are actually more coupled with the rest of the world than they earlier were and this made them stronger.

And now, following the sub-prime crisis, credit crunch did not remain contained within US leading to a global risk aversion.

For the Indian and Chinese economies for example, domestic demand has been an important growth factor, more so for India than China. The common driving factor for domestic demand in both the countries, however, has been benign interest rate and inflation scenario and of course huge flow of global liquidity on the back of ultra easy monetary policy (especially by Fed).

With inflation rising and liquidity easing off globally, domestic demand is under pressure. In case of China, the problem is compounded because of their dependence on exports. With their major trading partners experiencing slowdown, Chinese exports are on the wane. Large stock build up due to falling exports have resulted in their inflation easing off recently.

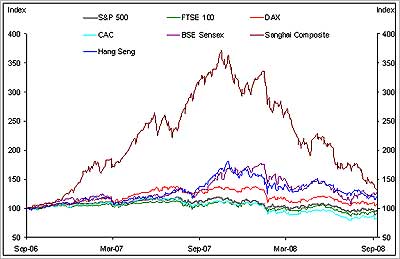

Even their stock markets are showing clear indications of coupling.

Source: Yahoo Finance

As can be seen from the above chart, when the sub-prime crisis first emerged, the stock markets in Asian economies namely China, India, Hong Kong etc continued to ignore the likely implication of the systemic problem, fully believing in the decoupling theory and hoping that the problem will be contained within the US only.

However, as the crisis imploded and got transmitted across the globe, the markets reacted viciously. This is because, in a highly globalized world, the transmission mechanism gains pace and as the markets realized the likely implication on the domestic economies, they tanked.

Even the central bankers everywhere are faced with a similar and serious dilemma. Do they raise rates to fight inflation, cut rates to stimulate their economies, or sit tight and hope that prices moderate as the world economy slows?

In short, the world has not decoupled, but is more closely intertwined because of the global financial community. Housing problems and excesses in California (and the rest of the US, the United Kingdom, Spain, etc.) affect banks in Europe and Asia and the US simultaneously.

One cannot have a worldwide recovery until the financial crisis in the major lending institutions is dealt with. A functioning banking system is the lubricant for a world economy, and the banking industry is cutting back on loans and tightening the standards by which they do make loans.

This is not only hurting domestic demand, but also impacting otherwise sound companies what with the pains from the crisis yet to be fully realized. This means that the banks and the financial institutions, over time, are going to have to increase their loan loss provisions, hitting both earnings and capital.

And that means they will have to raise more investment capital and equity at a time when their stock prices are low. A vicious cycle. Banks have less capital, so they are able to lend less to the very businesses that need the money; and without the said money the businesses will be less capable of paying their current loans, which means that banks have less capital.

That will prolong the recession, which will hurt consumers and corporate profits, which in turn puts more pressure on banks. Ultimately it means that banks are going to have to raise a lot more capital than anyone who is buying financial stocks today imagines.

And it is largely going to be expensive capital. Clearly the world has caught a cold as US sneezes. And, make no mistake, the sneeze can become severe cough going forward.

The author is COH, Global Market Research, at Infosys BPO, Bangalore. The views expressed are his own. He can be contacted at kunalkumar_kundu@infosys.com

More Guest Columns

|

|

|

|

| © 2008 Rediff.com India Limited. All Rights Reserved. Disclaimer | Feedback |