|

|

| Help | |

|

You are here: Rediff Home

» India » Business » Columnists » Guest Column » Kunal Kumar Kundu |

|

| ||||||||||||||||||||||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||||||||||||||||

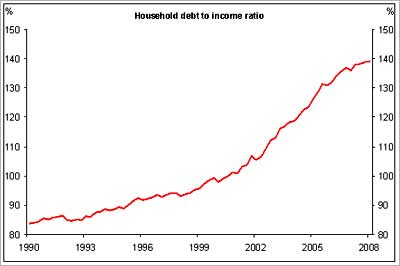

So much so, that their savings rate were almost in the negative territory. Debt ratios for the household sector are high and rising: the debt to disposable income ratio for average US households has increased from 100 per cent in the year 2000 to almost 140 per cent today.

Time, however, is now for a reversal in this trend and the process has already started what with the positive effects on consumption of the tax rebates already fading away. That rebate boost was supposed to stimulate consumption until August of this year.

However, after a recovery of retail sales, real personal spending and consumption in April and May, real retail sales and real personal consumption spending have fallen already in June and July. So consumers stopped consuming in spite of the tax rebates instead of spending such rebates (so far only 30 per cent of them have been spent). And, this is not surprising.

Employment generation is on a clear wane what with August payrolls down 84k -- the eighth month in a row -- and there were 58k in downward revisions to the previous two months. Private payrolls were even weaker, down 101k and down on average 92k over the past 3 months. The unemployment rate at 6.1% is the lowest since October 2003.

Source: Federal Reserve Board (FRB)

Rising unemployment and inflation have been forcing the consumer confidence to much lower levels. The University of Michigan Consumer Sentiment Index has been falling consistently since the middle of last year. The August index (though recovered marginally) recorded 63, a level that was not seen over decades. Home prices have plummeted and more is likely to come.

Home equity withdrawal (HEW) that peaked at $700 billion in 2005 is now down to about $24 billion (practically zero). And financial institutions are sharply cutting back on outstanding home equity loan obligations.

Thus, borrowing against housing wealth is now collapsing. Lower availability of liquidity and rising energy prices are displacing normal consumption.

The economy is in such a shape currently that the Fed, despite the rising inflation, has shifted its focus to growth stability (rather than price stability) and is trying its best not to raise interest rates so that the economy does not go on a tailspin.

They are hoping that the slowdown in the economy will take care of inflationary concerns going forward. In fact, economists are expecting near zero GDP growth rate in Q3 and slight improvement in the next quarter. If things turn out to be even worse, we are in for contraction as well.

A long dark period awaits US

While technically, the US has been able to avoid recession so far, the economy is in for a long bout of anemic growth. In fact, former Fed chairman Paul Volker predicts, "Growth in the economy in this decade will be the slowest of any decade since the Great Depression.” These are ominous words from the man who sailed the US through one of the country's worst economic times in the 1980s, when inflation touched 15 per cent forcing him to raise interest rates to as high as 20 per cent.

Clearly, not much good news is in store for the economy. Even if the US itself creeps along and avoids sharp economic slowdown, the rest of the world is beginning to feel the discomfort of slow growth and inflationary pressures.

Unfortunately, Europe is unlikely to come to the rescue. We are now seeing the major European economies go into simultaneous recessions while inflation continues to remain a concern. Indeed, the GDP growth is easing in a number of European economies as highlighted by national accounts figures announced recently.

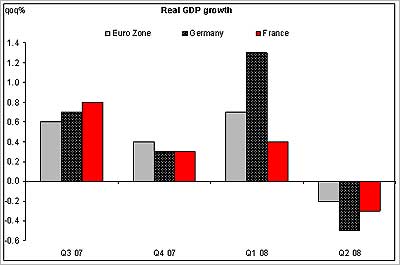

The flash second quarter GDP data for the euro zone noted a 0.2 per cent q-o-q (quarter on quarter) contraction, following a 0.7 per cent expansion in the first three months of the year. This was primarily the result of a 0.5 per cent downturn in the region's largest economy, Germany, and a 0.3 per cent contraction in second biggest, France. This is shown in the table below:

GDP growth (%age change quarter ago)

Source: National sources

And it's not just Germany and France. Preliminary data suggest the Italian economy also contracted 0.3 per cent during the quarter, the Netherlands reported no growth, and Spain grew at its slowest pace since the 1993 recession, with a minimal 0.1 per cent expansion. The Spanish government fears recession in the second half of the year and called for emergency discussions on Thursday to deal with the situation.

Latvia and Estonia also contracted in the second quarter, with Estonia reporting a technical recession after also shrinking in the first three months of the year. While no flash estimate is available for Ireland, the economy is on the brink of recession.

A look at composition of Euro Zone Q2 GDP figure shows weaker private consumption (-0.2 per cent) and investment (-1.2 per cent). In fact, total investment contracted the most since 2002.

Seemingly we are entering a weaker capex cycle that can slowdown the economies going forward. This is more likely to happen because the European non-financial companies are currently highly leveraged. Click here for Part III.

More Guest Columns

|

|

|

|

| © 2008 Rediff.com India Limited. All Rights Reserved. Disclaimer | Feedback |