|

|

| Help | |

|

You are here: Rediff Home

» India » Business » Columnists » Guest Column » Kunal Kumar Kundu |

|

| ||||||||||||||||||||||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||||||||||||||||

As early as even last year, economists and analysts argued that the engine of global growth has shifted. The world has, according to them, decoupled from the American economy.

China, India (which warmed the cockles of our heart) and other emerging market economies were starting to provide a consumer base for the world that can stave off any problems emanating from the economic slowdown in the United States.

Added to these were Europe's new and growing markets and things looked pretty hunky dory.

Not any more.

With the Indian economy exhibiting distinctive signs of slowdown (a real growth rate of even 7.5 per cent for the current financial year seems well nigh impossible), the Chinese growth slated to slip to a single-digit level -- possibly for the first time in six years -- and the European majors flirting with their old nemesis (exhibiting occasional spurt of good growth but only flattering to deceive) of anemic growth, the much avowed decoupling theory is at mortal risk of failing to run its course.

But, first things first.

How credible was the theory in the first place? A look at the data reveals that the proponents of the theory might be missed something obvious.

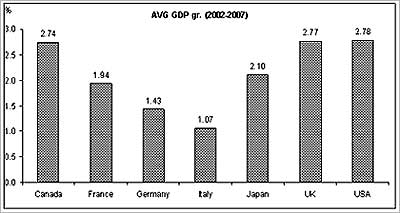

America, the largest economy in the world, has grown faster than the G-7 economies in the last five years and accounts for about 25% of the global output.

Note: CAGR calculated from the Real GDP (in USD terms) data (SA, @ 2000 prices and exchange rates)

Source: National sources and my calculation

Source: World Bank

Also, with the countries being highly integrated both through the real economy as well as the financial economy (maybe more so financially), the necessary pre-condition to decoupling could have been the following:

As things stand as of now, none of these conditions are satisfied.

The US economic slowdown is likely to be anything but mild, especially in the light of sub-prime crisis. With the pain of the sub-prime crisis seemingly only half way through (a write-off so far to the tune of about $500 billion as compared to an estimate of $1,000 billion), its spillover impact on the real economy seems to have just begun and is no where near to have been played out.

About 100 US banks might fold up

First, the likely impact of the sub-prime crisis. According to Institutional Risk Analytics, about 100 banks are likely to fail between now and July of 2009. Most of them will be small, but there will be a few large banks.

The total assets of those banks are estimated to be $850 billion. Those are the assets the FDIC (Federal Deposit Insurance Corporation) is going to have to cover when they take over the banks.

Take Washington Mutual as an example. Their debt now trades at 20 per cent, which is worse than junk. There is no way they could issue preferred stock to recapitalize their business. And they are going to need more capital, as they have write downs in their future due to the slowing of the economy.

Any common issue would have to seriously dilute existing shareholders almost to the point of nothing.

The FDIC has about $50 billion. These reserves have been built up over the years from deposit insurance paid by banks that are part of the programme. They are going to need an estimated $20 billion just to cover the failure of Indy Mac.

The FDIC will have to cover only a small percentage of the $850 billion, as some of those assets will surely be good. But if they have to cover 10 per cent, then the FDIC would need another $50 billion. Not a very encouraging scenario.

And then there’s Freddie Mac and Fannie May. Companies that were leveraged more than 60 times the owners fund and covered half of the $12-trillion mortgage market.

Their effective nationalization, while addressing the short-term concern (especially the likely catastrophic effect of these institutions going bust), however, will not be a solution to the basic problem and will also come at a great economic cost. Insurer American International Group too has received a $85-billion bailout from US Fed. The Fed will extend a 24-month bridge loan of $85 billion to the insurer, in return for an unprecedented acquisition of a 79.9 per cent stake in the firm by the central bank.

How many more write downs and credit losses are expected, both in the US and abroad?

The Federal Reserve Board published a paper recently with the title: Foreign Exposure to Asset-Backed Securities of U.S. Origin (by Beltran/Pounder/Thomas). According to Dr Nouriel Roubini, the Federal Reserve’s Flow of Funds data reveals that foreigners hold about 39 per cent of outstanding ABS (asset-backed securities) backed by US assets. Therefore, foreigners will bear 39 per cent of any mark-to-market markdowns associated with those securities.

US economy faltering

In this backdrop, how is the US economy going to fare?

The perennially consumption-driven US economy is facing a strong headwind of faltering demand and even more likely anemic demand going forward. The traditionally low-saving US consumers went on a consumption binge as positive wealth effect kicked-in following the abnormal rise in home prices. Click here for Part II.

More Guest Columns

|

|

|

|

| © 2008 Rediff.com India Limited. All Rights Reserved. Disclaimer | Feedback |