| « Back to article | Print this article |

SBI was the top gainer after it reported lower-than-expected rise in bad loans

Benchmark share indices rose for the second straight day with state-owned banks gaining the most led by State Bank of India after it reported lower-than-expected rise in bad loans.

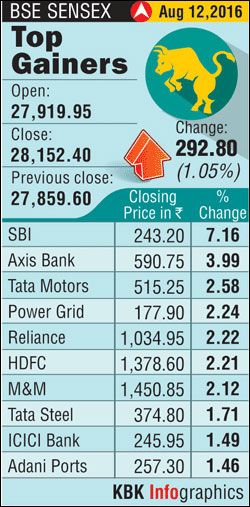

The S&P BSE Sensex ended up 293 points at 28,152 and the Nifty50 settled 80 points higher at 8,672. In the broader market, the BSE Midcap and Smallcap indices ended up 0.2%-0.8% each. Market breadth ended weak with 1406 losers and 1251 gainers on the BSE.

"Today’s movement was a combination good global cues supported by short covering. Additionally, better-than-expected results from SBI added to the buoyant market mood. Markets will consolidate and then move up over the next several weeks and the bias is clearly positive. Therefore any dips should be considered as opportunities to buy in to the market," Jayant Manglik, President, Retail Distribution, Religare Securities.

Foreign institutional investors were net buyers in equities worth Rs 608 crore on Thursday, as per provisional stock exchange data.

Foreign institutional investors were net buyers in equities worth Rs 608 crore on Thursday, as per provisional stock exchange data.

The merger news between Grasim and Aditya Birla Nuvo was the highlight of today's trade along with earnings from state-owned banks such as State Bank of India and Bank of India.

SBI zoomed 7% after the gross bad loans as a percentage of total loans rose to 6.94% as of end-June, from 6.50% in March. Standalone net profit dropped 32% to Rs 2,521 crore for the three months to June 30, against Rs 3,692 crore reported a year earlier.

Grasim ended flat while Aditya Birla Nuvo slumped 18%. Kumar Mangalam Birla, chairman of Aditya Birla Group, on Thursday announced the merger of Aditya Birla Nuvo (ABNL) with Grasim Industries. The first step involves merging the two companies and the second would be a spin-off of the financial division.

For every 10 shares held, the shareholders of AB Nuvo will receive 3 shares of Grasim. Post-merger when the financial services business is spun off, the shareholders of the merged Grasim will receive seven shares of Aditya Birla Financial Services – the arm which holds the insurance and asset management companies.

Yes Bank ended 3% higher amid reports that the private lender's weightage on the MSCI Global Standard Indices will be raised to 1.7% from 0.46%.

Energy shares rallied tracking gains in global crude oil prices. Reliance Industries ended up 2% while ONGC gained nearly 1%.

Hindalco ended 2.5% higher after the metal major reported a higher-than-expected net profit at Rs 294 crore in the June quarter even as net sales declined on year-on-year basis mainly because of sharp fall in expenses.

Among other shares, shares of Mafatlal Group companies such as Mafatlal Industries, Navin Fluorine International and Nocil have rallied up to 13% on the BSE on the back of heavy volumes.

Rane Engine Valve surged 9% after the company announced the sale of part of its land in Alandur, Chennai at a market value of Rs 94.82 crore.

Bank of India surged over 10% after the bank also reported lower-than-expected rise in gross NPAs compared to the previous quarter. Gross NPAs for the June quarter were marginally higher at 13.38% compared with 13.07% in the previous quarter while Net NPAs declined to 7.78% from 7.79% in the previous quarter.