| « Back to article | Print this article |

Gains were led by IT exporters amid a weakening rupee while bank shares reversed early losses.

Markets ended higher on Monday after opinon polls in Britain over the weekend, ahead of the referendum on Thursday, increased the possibility that Britain would continue to remain in the European Union.

Earlier, markets witnessed a knee-jerk reaction after RBI Governor Raghuram Rajan's decision to move back to academia after finishing his term at the Reserve Bank of India in September too everyone by surprise.

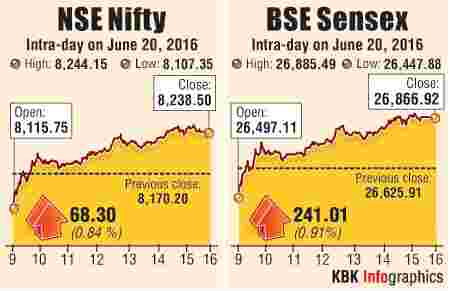

The S&P BSE Sensex was up 241 points at 26,867 and the Nifty50 gained 68 points at 8,239.

In the broader markets, the BSE Midcap and Smallcap indices are up 0.4% each.

Market breadth is strong with 1384 gainers and 1201 losers on the BSE.

Earlier, markets witnessed a knee-jerk reaction after RBI Governor Raghuram Rajan's decision not to continue after September 3 took everyone by surprise.

"Markets have taken the exit of RBI governor Raghuram Rajan's in its stride expecting more policy measures from the new governor for growth rather than inflation in addition to more flexible policies for banks in terms of asset quality norms.

Further, global markets have been supportive after fears of Britain exiting the European Union are receding," said G Chokkalingam, Founder & MD, Equinomics Research and Advisory.

The Indian rupee which had fallen sharply in early trades after Reserve Bank of India Governor Raghuram Rajan's decided not to seek a second term has trimmed losses and is trading 29 paise lower at 67.37.

Foreign institutional investors were net buyers in equities worth Rs 32 crore on Friday, as per provisional stock exchange data.

"As long as the government chooses someone who has credibility in the eyes of domestic & foreign institutional investors to conduct an independent monetary policy; frayed nerves among a section of investors & commentators will be calmed.

"It is neither Rexit or Brexit but RainExit that should be worrying investors more as nearly 60% of Indians still depend on agriculture & allied activities and with two successive monsoon failures the need for a normal monsoon to kick-start rural demand cannot be under underestimated," says Ajay Bodke, CEO & Chief Portfolio Manager - PMS, Prabhudas Lilladher.

GLOBAL MARKETS

Asian shares were also trading higher with Japanese stocks gaining the most.

The benchmark Nikkei ended up 2.3% while China's Shanghai Composite ended flat with positive bias.

Among others, Straits Times and Hang Seng ended up 1.3%-1.7% each.

European shares were trading higher after worries over Britain exiting the European Union eased slightly with bank shares leading the gains. The FTSE-100, DAX and CAC-40 were up 2.6%-3.2% each.

STOCKS

IT exporters firmed up on the back of a weakening rupee. Infosys ended up 2.9% while TCS gained nearly 2%.

Wipro ended up nearly 1%. The company has tweaked the incentive structure for its top executives, wherein 50% of the weightage will be given to the performance of the company and the other 50% of the weightage would be given to Individual performance and performance of the team.

HCL Technologies ended up 2% after the company announced that it has signed a strategic IT partnership contract with LeasePlan, a global fleet management and driver mobility company of Dutch origin.

Banking stocks have recouped early losses and have turned positive. SBI ended up 1% while HDFC Bank and ICICI Bank ended with marginal gains.

Larsen & Toubro ended up nearly 1.9% after the company said its subsidiary L&T Hydrocarbon Engineering has won orders valued at Rs. 1170 crore.

Bharti Airtel extended gains to end 2.3% higher on upgrades by brokerages, given its robust spectrum holdings, gains on revenue market share and potential improvement in Africa operations.<?P>

Bharti Airtel extended gains to end 2.3% higher on upgrades by brokerages, given its robust spectrum holdings, gains on revenue market share and potential improvement in Africa operations.<?P>

Auto stocks were also among the top gainers with Tata Motors up 4.2%.

The auto major's arm JLR India, on Monday launched the 2 litre petrol derivative of Land Rover Discovery Sport at a starting price of Rs 56.50 lakh (ex-showroom, Delhi).

Among others, Maruti Suzuki, Bajaj Auto and Hero MotoCorp also ended higher.

Oil stocks were also among the top gainers with Reliance Industries and ONGC gaining 1.6% each.

Among other shares, Eros International Media ended up 2.5% after the company said it has entered into a television syndication deal for their new and catalogue films with Zee Network.

Max Financial Services ended higher by 6% after the company and Max Life on Friday entered into an agreement for a merger with HDFC Life.

Shares of tyre manufacturers are trading weak on worries over pressure on margins. Ceat, MRF, JK Tyre, Balkrishna Industries, TVS Srichakra and Apollo Tyres ended down nearly 2% each.

Shares of real estate companies extended gains for the second straight day on the bourses after the Securities and Exchange Board of India (Sebi) proposed further relaxations to the real estate investment trusts (Reits) regulations, to attract real estate developers towards launching these instruments. Unitech, DLF, Phoenix, Housing Development & Infrastructure (HDIL) ended upto 7% higher.