Is Dangal TV a flash in the pan?

Vanita Kohli-Khandekar reports.

Is it a flash in the pan or the making of a new broadcasting power?

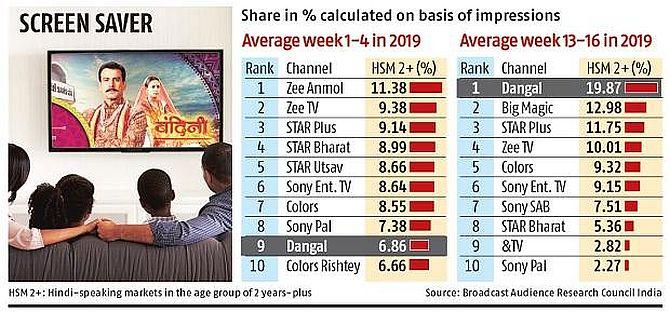

In April this year, Dangal TV became the most popular general entertainment channel in Hindi.

Its top shows, Ramayan and Crime Alert, among others, brought it a one-fifth share of the viewership in the Hindi-speaking market, over the last seven weeks.

At second and third spot are Zee's Big Magic (13%) and Disney's Star Plus (12%) in channel share, going by the Broadcast Audience Research Council India (BARC) numbers.

At Rs 7,000 crore (Rs 70 billion), the Hindi GEC market is the largest slice of the Rs 30,500 crore (Rs 305 billion) television ad pie.

It is also the bellwether genre for the Rs 74,000 crore/Rs 740 billion (ad plus pay) broadcasting industry.

Four of India's five leading broadcasters -- Star India, Zee, Sony, and Jio's Viacom18 -- use their large share in the HSM as a lever to negotiate ad rates, distribution space, and share of pay revenues.

How then did a channel from a little-known Indore-based company, Enterr 10, beat the Rs 13,448 crore (Rs 134.48 billion) Star India and the Rs 7,126 crore (Rs 71.26 billion) Zee to the No 1 slot in a genre they have dominated for decades?

Through 'sheer, dumb luck', as Professor McGonagall puts it in Harry Potter and the Philosopher's Stone

How Dangal TV hit the top spot

In the build-up to the implementation of the Telecom Regulatory Authority of India's tariff order earlier this year, the Big Four decided not to re-bid for slots on DD Freedish, Prasar Bharati's free direct-to-home service.

The idea was to ensure consumers don't shift en masse to free platforms since the tariff order was bound to push prices up.

And they were right.

According to Dinyar Contractor, editor and executive director, Satellite and Cable TV magazine, cable and DTH subscription prices have gone up between 30% and 100%.

But DD Freedish is not easily ignored.

At an estimated reach of 30 million homes -- almost all of them in the Hindi belt -- it is India's largest DTH platform.

More importantly, most of these homes are in rural India, which houses 109 million of the 197 million TV homes we have.

While about 32% of BARC's sample of 40,000 homes is in rural India, the final viewership numbers are weighted to the universe; so, DD Freedish gets a huge weight in the sample.

When the Big Four were on DD Freedish, invariably Zee Anmol, Star Bharat, and Sony Pal, among other channels, dominated Hindi viewership.

Dangal TV was there too, at No. 9, till January this year.

But since April, "People (on DD Freedish) don't have anything else to watch," says Divya Radhakrishnan, managing director, Helios Media.

Helios has worked with Enterr 10 as an ad sales concessionaire earlier.

Of the 110-plus channels on DD Freedish, more than two-thirds are State-run.

The others are nondescript channels which operate on the fringes of the broadcasting ecosystem.

Note that in urban India, the larger ad market, Star Plus remains No 1, while Dangal TV is No 6.

And that brings us to the question asked in the beginning.

Is Dangal TV a flash in the pan or can Enterr 10 build something out of this?

If any of the major broadcasters comes back on DD Freedish, can Dangal TV lose its perch?

"Dangal's programming is appealing to the heartland. Also continuity works in GEC. If other networks decide to come back, it will become competitive," thinks Radhakrishnan.

"Their time spent is higher than the lead erstwhile free-to-air channel -- this is due to less fragmentation and competition in the (DD) Freedish GEC space," says Vanita Keswani, CEO, Madison Media Sigma.

Radhakrishnan adds that it is not just distribution that worked; the Indore-based Enterr10 is building up its content and management capabilities.

Founded in 2004 by Manish Singhal, the company owns and operates four channels -- Enterr10 (Hindi films), Bhojpuri Cinema, Fakt Marathi (Marathi films), and Dangal TV.

Last year it bought the entire library of Imagine TV, the erstwhile Hindi channel from the joint venture between NDTV and Turner.

This included Ramayan, the show that is topping the charts on Dangal TV.

In March this year, Joy Chakraborthy, a media veteran who has been with Zee and Star, among other firms, joined as CEO.

He is busy putting together a team and plans for original content.

So there are attempts to build something out of this.