Photographs: Kamal Kishore/Reuters. Rediff Business Desk

Corporate India's merger and acquisition activity in February 2010 stood at $2.3 billion, taking the total M&A kitty so far this year to over $5 billion.

Here's a look at India Inc's ten biggest deals.

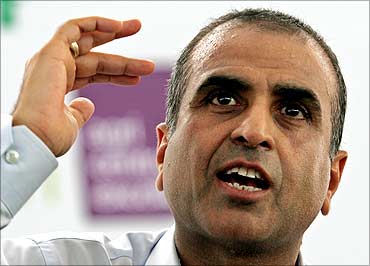

Bharti-Zain: $10.7 billionBharti Airtel is set to seal the $10.7 billion deal with Zain in a few days.

Bharti, which is keen on tapping the African market, had earlier made two failed attempts to acquire the South Africa-based MTN. Though the MTN deal would have been better buyout for Bharti, Zain does offer the company unique advantages. Zain is a market leader in most of its operations, with 50-75 per cent market share in seven countries.

"The (Zain) board is pleased to report that the due diligence process has been completed and that the parties are finalising definitive agreements, which are expected to be signed in the coming days," Zain said in a statement.

The sale of the African operations does not include Zain's operation in Sudan or its investment in Morocco, the company said.

The value of the deal includes $1.7 billion of debt that the Indian telecom giant will assume.

Bharti is due to pay $8.3 billion on signature of the deal, while the remaining $700 million will be paid a year later.

Tata Steel-Corus: $12.2 billion

On January 30, 2007, Tata Steel purchased a 100% stake in the Corus Group at 608 pence per share in an all cash deal, cumulatively valued at $12.2 billion. The deal is the largest Indian takeover of a foreign company till date and made Tata Steel the world's fifth-largest steel group.

...

India Inc's 10 biggest deals

Image: Vodafone bagged a big deal.Vodafone-Hutchison Essar: $11.1 billion

On February 11, 2007, Vodafone agreed to buy out the controlling interest of 67 per cent held by Li Ka Shing Holdings in Hutch-Essar for $11.1 billion.

This is the second-largest M&A deal ever involving an Indian company.

Vodafone Essar is owned by Vodafone 52 per cent, Essar Group 33 per cent and other Indian nationals 15 per cent.

...

India Inc's 10 biggest deals

Image: Kumar Mangalam Birla.Photographs: Rediff Archives.

Hindalco-Novelis: $6 billion

Aluminium and copper major Hindalco Industries, the Kumar Mangalam Birla-led Aditya Birla Group flagship, acquired Canadian company Novelis Inc in a $6-billion, all-cash deal in February 2007.

The acquisition would make Hindalco the global leader in aluminium rolled products and one of the largest aluminium producers in Asia.

With post-acquisition combined revenues in excess of $10 billion, Hindalco would enter the Fortune-500 listing of world's largest companies by sales revenues.

...

India Inc's 10 biggest deals

Image: Malvinder Singh speaks during a news conference in New Delhi.Photographs: Vijay Mathur/Reuters.

Ranbaxy-Daiichi Sankyo: $4.5 billion

Marking the largest-ever deal in the Indian pharma industry, Japanese drug firm Daiichi Sankyo in June 2008 acquired the majority stake of more than 50 per cent in domestic major Ranbaxy for over Rs 15,000 crore ($4.5 billion).

The deal created the 15th biggest drugmaker globally.

...

India Inc's 10 biggest deals

Image: An ONGC engineer works inside the Kalol oil field in Gujarat.Photographs: Amit Dave/Reuters

ONGC-Imperial Energy: $2.8 billion

The Oil and Natural Gas Corp took control of Imperial Energy Plc for $2.8 billion, in January 2009, after an overwhelming 96.8 per cent of London-listed firm's total shareholders accepted its takeover offer.

OVL in the past seven years increase its number of projects to 39 in 17 countries, from just a single project in Vietnam.

...

India Inc's 10 biggest deals

Image: A woman looks at Japan's top mobile phone operator NTT DoCoMo handsets in Tokyo.Photographs: Yuriko Nakao/Reuters.

Japanese telecom giant NTT DoCoMo picked up a 26 per cent equity stake in Tata Teleservices for about Rs 13,070 crore ($2.7 billion) in November 2008.

With a subscriber base of 25 million in 20 circles DoCoMo paid Rs 20,107 per subscriber to acquire the stake. DoCoMo picked up the equity through a combination of fresh issuance of equity and acquisition of shares from the existing promoters.

...

India Inc's 10 biggest deals

Image: Rana Talwar (R), chairman of Centurion Bank of Punjab, Aditya Puri, MD, HDFC Bank.Photographs: Arko Datta/Reuters

HDFC Bank approved the acquisition of Centurion Bank of Punjab for Rs 9,510 crore ($2.4 billion) in one of the largest mergers in the financial sector in India in February, 2008.

CBoP shareholders got one share of HDFC Bank for every 29 shares held by them. Post-acquisition, HDFC Bank became the second-largest private sector bank in India.

...

India Inc's 10 biggest deals

Image: An emblem outside the Jaguar assembly plant in Castle Bromwich, Birmingham.Photographs: Eddie Keogh/Reuters.

Tata Motors-Jaguar Land Rover: $2.3 billion

Creating history, one of India's top corporate entities, Tata Motors, in March 2008 acquired luxury auto brands -- Jaguar and Land Rover -- from Ford Motor for $2.3 billion, stamping their authority as a takeover tycoon.

Beating compatriot Mahindra and Mahindra for the prestigious brands, just a year after acquiring steel giant Corus for $12.1 billion, the Tatas signed the deal with Ford, which on its part chipped in with $600 million towards JLR's pension plan.

...

India Inc's 10 biggest deals

Image: Power-generating windmill turbines in Suzlon wind farm near Ahmedabad.Photographs: Amit Dave/Reuters.

Suzlon-RePower: $1.7 billion

Wind power major Suzlon Energy in May 2007 acquired the German wind turbine manufacturer REpower for $1.7 billion. The deal now ranks as the country's 10th largest corporate takeover.

REpower is one of Germany's leading manufacturers of wind turbines, with a 10 per cent share of the overall market.

Suzlon is now the largest wind turbine maker in Asia and the fifth largest in the world.

article