With nine chairpersons and managing directors of public sector banks (PSBs) due for retirement in 2013-14, the government is doing what it has been doing for many years to fill the vacancies: Relaxing the eligibility criteria.

This time, 17 executive directors have been called for the interview, which will happen in January. But, the government could manage that number only because one of the requirements for the job, a minimum service of two years as executive director, was eased and made six months!

And, this is not the last time that such concessions have been made. Banks are going through an unusual manpower crunch. In the next 10 years, they will have to hire around one million people to keep their branches running and account for retirement and natural attrition. Finding the right candidate for a leadership position will be even tougher.

The Khandelwal committee, which was set up to address the human resource challenges of state-owned banks, while acknowledging the manpower shortage banks are facing, said: "The leadership gaps in public sector banks are palpable. In the next five years, 80 per cent of general managers, 65 per cent of deputy general managers, 58 per cent of assistant general managers and 44 per cent of chief managers would be retiring."

So many people leaving at the same time has prompted the Reserve Bank of India to call the 10 years from 2010 to 2020 as the 'decade of retirement'.

This peculiar situation facing state banks is as much an outcome of the slowdown in recruitment in the 1990s as of lack of retirement planning.

A large number of people joined the banking sector in 1972-73 following the nationalisation of banks. The next wave of recruitment came in 1983-84, and then there was a lull in activity.

...

"For two decades additional manpower in banking sector was not commensurate with the growth. Finally, in 2011-12, about 20,000 people joined public sector banks (excluding State Bank of India), both as clerks and officers," says a veteran banker.

Bankers say the entire decade of the 1990s saw virtually no recruitment. To add to trouble, in 2000, after computers were introduced at branches, a voluntary retirement scheme was launched to shed excess staff.

The scheme was prepared by the Indian Banks' Association (IBA) and approved by the government.

Later, in the second half of 2000-10 when the country returned to the high-growth path, recruitment failed to keep pace with business growth.

At the same time, the per-employee expense of PSBs shot up sharply; the employee cost, at present, is 150 per cent more than that of private sector banks.

"One thing is, thus, loud and clear - the competitive advantage in terms of staff costs that we always thought public sector banks had is no longer there," RBI Deputy Governor K C Chakrabarty said recently.

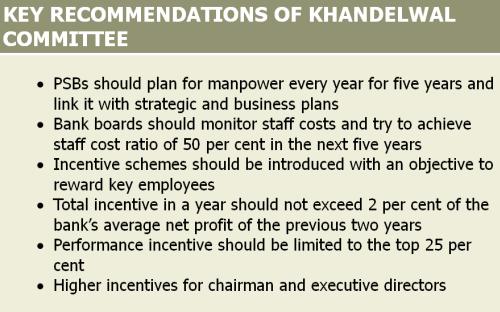

The Khandelwal committee in its report submitted in 2010 had suggested some drastic steps, such as performance-linked pay on the lines of the private sector to attract talent to state-owned banks.

...

It said PSBs were seriously handicapped, as they were lagging behind their private sector counterparts in terms of human capital.

"Their employee compensation package, skill sets, skewed age profile, restrictive deployment, performance management system are the major issues placing PSBs somewhat at a disadvantage," the report said.

According to the central bank, finding the right person for the job would be a huge challenge for PSBs, especially when banks are also required to carry out the task of financial inclusion.

Most banks rely on management schools to supply fresh recruits, but the banking regulator has questioned the rationale of hiring management graduates for financial inclusion, as it believes such students will not be in tune with the problems of banking in far-flung areas.

"Will these people have empathy towards the poorest of the poor? I have often heard bank heads talk about the challenge of finding people keen to work in rural areas," asks Chakrabarty.

While some of the recommendations of the Khandelwal committee were implemented (like a third executive director in large banks exclusively focusing on human resources), the fate of the committee's other suggestions remains uncertain.

The government had appointed another committee under the chairmanship of Alok Nigam - one of the joint secretaries at the North Block - to study the viability of the Khandelwal committee's recommendations.