Photographs: Press Information Bureau.

What to expect from the Budget

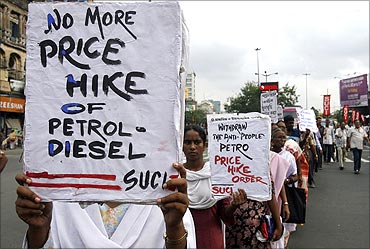

Image: People protest against inflation.Photographs: Reuters.

What to expect from the Budget

Image: Labourers sort onions at a wholesale vegetable market in Siliguri.Photographs: Reuters.

What to expect from the Budget

Image: Reserve Bank of India.Do we have to live with such high rates of inflation?

As I mentioned, it is basically driven by food inflation. Apart from administrative and other steps, which have been taken, it is not possible to suddenly increase the supply-side response. The other is that both the government and the Reserve Bank of India have to strike an optimal balance between achieving growth and controlling inflation. You can use very aggressive monetary policy but then you strive for growth and employment. In that sense, the policy space to tackle this kind of inflation is certainly somewhat limited. On the current account deficit, foreign direct investment seems to be an added concern.

What to expect from the Budget

Image: FDI falls.

What to expect from the Budget

Image: FII flows are really a matter of concern.Barring a few projects, which one can count on fingertips, I do not think that is really the cause. The other issue is whether FII flows are really a matter of concern.

Should we be worried that it's predominantly the FII flows, which are funding the current account deficit? Conceptually, one might say that this is money which has a tendency to come in and go out at a short notice.

But from 1992 onwards, only for the period in 2008, which was not a normal situation, FIIs needed to take money out to settle their books of accounts at their primary locations.

The bottom line is that as long as we are doing well in terms of growth we will get money, which will fund the current account deficit. It will be a combination of FII, FDI, FCB and so on. The proportions might vary and change from time to time.

What to expect from the Budget

Image: Activists from Socialist Unity Centre of India (SUCI) hold placards during a protest.Photographs: Parth Sanyal/Reuters.

What to expect from the Budget

Image: A woman carries a cooking gas cylinder as men pull a string tied to a motorbike during a protest.Photographs: Amit Dave/Reuters.

On what percentage the government will share at this point in time, the decision is one third. I can't say whether there is any further consideration of this issue, though the petroleum ministry would want that.

On duties, at this point in time there is no proposal. But when the Budget is formulated, the finance minister in the normal course looks at various sectors in relation to duties and taxes.

So, if there is a rationale or justification, I suppose an appropriate decision will be taken.

What to expect from the Budget

Image: A jeweller displays silver plates in the form of Indian rupee notes in Chandigarh.Photographs: Ajay Verma/Reuters.

It would like to spend money to give legal entitlements, which has been the philosophy of this government.

But clearly the idea and the message is that the expenditure right down to the lowest level should be effective and actually go for the purpose it is intended, so far as the policy framework is concerned.

That is a part of the monitoring, which takes places through the Planning Commission and the line ministries.

On tax reforms also, the year has been very bleak, as most of your proposals were postponed.

The Direct Taxes Code did not get really postponed. It was not possible to put in place an entirely new architecture over a short period of time and bring into effect from April 2011. It is in Parliament now and they (Standing Committee) are having a look at it. So, that is on track. But on the Goods and Services Tax, there has to be some kind of consensus first and then legislative changes. It will take some time.

What to expect from the Budget

Image: 3G auction, a money spinner.With the current scenario in place, do you think the government can meet its fiscal deficit target this year?

This year, we are definitely meeting the fiscal deficit target, partly because we got a good amount of non-tax revenue.This year, you got 3G money. But how do you plan to achieve the target next year?

The fiscal deficit this year will come down to 5.5 per cent from 6.7 per cent last year. It could be even lower than 5.5 per cent.

So, there is a significant drop. But for a fiscal deficit target of 4.8 per cent next year, the drop would be only 0.7 per cent.

We realised you cannot have reductions of the magnitude which you had in the beginning. So whether we get windfall gains or not, it is not germane to the fall in fiscal deficit.

Second, we are seeing a good amount of buoyancy in revenue collections, which we are confident would continue in the next year.

What to expect from the Budget

Image: A worker at an Indian Oil petrol pump.Photographs: Mukesh Gupta/Reuters.

They should not because there is no projection that oil will go to some unrealistic level. Though $90-100 per barrel is not a comfortable zone, but we will see as we go along.

Disinvestment has not done really well. Do you expect the target would be met?

Disinvestment is also on track. One or two companies are due to come out with their offerings in the next two months. So, they should be in a position to do that.Oil sector companies are in a bind. If oil prices don't get raised, then their ability to raise money from the market gets undermined. Perhaps this is linked to the oil sector reforms.

This year they are talking of ONGC. IOC is not intended for this year.

What to expect from the Budget

Image: State Bank of India.

What to expect from the Budget

Image: Chinese currency.If one were to expect something in next year's Budget, what would that be?

I really have no idea because very little of the next year's Budget is in position at this stage. Second, even if it were I would not be in a position to talk about it today.What you have to read is the thrust and the direction the finance minister has given in his last two budgets.

These are how to unshackle and achieve more growth, how to strengthen the real sectors and address their concerns, how to strengthen the financial sector and the regulatory architecture, how to conceive new activities which make India a strong economy and make it earn its rightful place in the global system. There is focus on agriculture and some aspects of manufacturing. Presumably, we need to build on those policies of the government.

What to expect from the Budget

Image: Rise in frauds.Photographs: Reuters.

article