. . .

Budget: A tightrope walk for the FM

Image: Inflation, biggest problem for govt.Photographs: Reuters.

The biggest problem for the government against the backdrop of high WPI and food inflation continues to be rising crude oil prices, which have recently crossed $108 (Brent) per barrel, the highest in the last two years.

Not only will these add to the already spiralling inflation, but will also lead to an increase in subsidies to the oil and fertiliser sectors, and hurt the government's fiscal position. On this front, analysts believe the government is likely to tackle the issue by lowering duty and increase subsidies.

. . .

Budget: A tightrope walk for the FM

Image: Higher social spending.Given the higher growth trajectory of the economy, analysts believe that there needs to be a push for fiscal consolidation.

An Edelweiss report says that in order to carry out meaningful fiscal consolidation, the government will have to boost its revenues by expanding tax base (like introducing GST, cutting on tax evasion) and propelling economic growth and, at the same time, reducing revenue expenditures (like ill-targeted subsidies). However, given the government's commitment to programmes like NREGS, as well as maintaining subsidies due to political compulsions (Assembly election in four States), there is little room to rein expenditure in. Analysts say, with elections round the corner, higher social spending will take precedence over reform.. . .

Budget: A tightrope walk for the FM

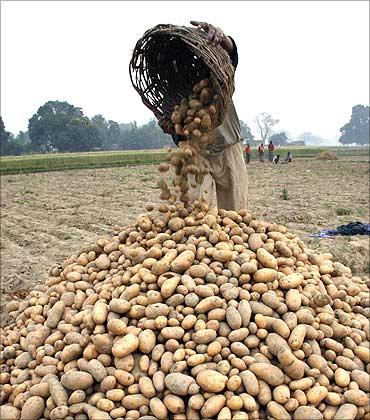

Image: Government might look at agricultural reforms.Photographs: Reuters.

However, given that part of the inflation was due to supply constraints, the government might look at agricultural reforms to improve productivity, enhance cold storage infrastructure, and reduce mandi tax.

Coupled with this, the Street will keep an eye out for any reform and policy measure to encourage FDI and further opening up of sectors like insurance and multi-brand retail. However, if the lax fiscal policy measures continue, given the current growth rate and capacity constraints, it will lead to higher cost of capital for companies and likely slowdown in corporate investments, which is negative for India Inc, and markets.. . .

Budget: A tightrope walk for the FM

Image: High hopes for markets.While the market may be disappointed if some of the measures on fiscal consolidation, tax and policy reforms are not undertaken, a large part of the same is already in the price, feel analysts at ICICI Securities.

They say significant challenges for the government in increasing revenues on the back of absence of one-off income (3G auctions), uncertainty on the timing of the divestments, and lower tax receipts if earnings fall, are already discounted by the market and expectation from the Budget are low among investors.. . .

Budget: A tightrope walk for the FM

Image: Budget is likely to bring more services under the tax ambit.As far as impact on specific sectors is concerned, the Budget is likely to bring more services under the tax ambit, remove tax exemptions and increase excise duties, albeit moderately.

The largest impact of discontinuing exemptions according to Edelweiss Research analysts would be the information technology sector, wherein the extension of sunset clause on tax exemptions for STP is unlikely. A rollback of excise tax sops and additional excise on diesel cars is likely to affect most auto companies. Higher allocation to infrastructure and spending on social sectors should boost the fortunes of construction and consumption sectors. And, any move toward increasing disposable income should help sustain growth.For detailed sector-wise impact, see the table

article