Photographs: Michael Caronna/Reuters Jitendra Kumar Gupta in Mumbai

The prices of non-ferrous metals have risen by 70-130 per cent from their lows about a year back. At current levels, there is less room for further appreciation. And, in fact, prices of some of the non-ferrous metals might even decline. Analysts believe that investors have bought these metals in anticipation of a quick global economic recovery. However, in case of any set back in the form of a slower than expected recovery, the same could derail the rally.

Notably, there has been a huge built up of metal inventory at the London Metal Exchange (LME), which is again a result of inflow of investor money as well as restocking of stocks (by actual users) at lower prices. "About two-third of the inventory build-up is on account of the long term buyer and investors' money coming in," says Gopal Agrawal, head equity, Mirae Asset Global Investments.

As capacity utilisation at metal producers is averaging around 70 per cent, higher metal prices would attract new supplies and put pressure on prices. Additionally, since the current rally is also due to the weakening dollar, a rebound in the dollar as a result of further recovery in the US economy, could pose additional concerns for metal prices.

This is also a reason that an eminent global investor like Jim Rogers says, "I would not buy base metal at this point in time because they have run up a lot in the recent past."

Rakesh Arora, who tracks the metals sector at Macquarie Securities, is also bearish on the sector. "Already most of the non-ferrous metal prices are trading at higher levels and have crossed the price assumptions we set for 2009-10. And, if we look at the fundamentals, I don't think they have changed drastically. I think the prices should come down from these levels."

To know about the developments in each of the three non-ferrous segments and prospects of India's largest producers, read on.

.

Base metal stocks: Should you invest?

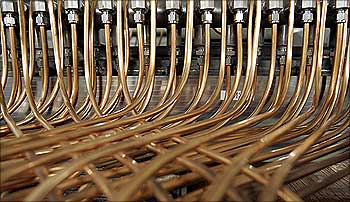

Image: A view of the sulphuric acid installation at Europe's largest copper producer Norddeutche Affinerie in Pirdop.Photographs: Oleg Popov/Reuters

Aluminium

Although aluminium prices have recovered to $2,200 per tonne levels from their February 2009 lows of $1250 per tonne, estimates suggest that global aluminium consumption will decline by 6-7 per cent each in CY09 and CY10. This is in contrast with the 4.4 growth expected in global aluminium production in CY10, which along the doubling of inventory at LME in last one year to about 46,00,000 tonnes should increase the surplus further. Such a situation would keep aluminium prices under pressure in the near-term.

Analysts are expecting the prices to remain at current levels or even decline in 2010. In the domestic market, the demand is expected to grow by about 5-6 per cent led by consumption from power, automobile and construction sectors. However, India too would experience surplus production. According to Crisil, domestic aluminium capacity is likely to increase from 1.3 million tonnes in 2008-09 to around 4.0 million tonnes in 2013-14. Since domestic prices move in tandem with global, prices would remain under check.

Copper

While the global copper demand-supply equation for CY09 is expected to remain balanced, it is expected to be favourable in CY10. In 2010, global copper consumption is expected to grow by about 3.3 per cent and outpace the growth in production, which is expected to be 2 per cent. However, for now, the improving fundamentals are already reflecting in the copper prices, which have recovered from a low of $2,800 per tonne in December 2008, to $6,854 per tonne currently.

Also, inventory levels have almost doubled in last six months. Hence, analysts expect copper prices to remain in the range of $7,000 per tonne in 2010. The domestic demand for copper is expected to remain higher and could grow at about 6 per cent in CY10. The demand will be driven by the increasing consumption from the power sector. However, copper prices are still expected to remain in check in line with the global trend.

Zinc

Over 50 per cent of global zinc produced is consumed for making galvanised steel. The sluggish pick up in global steel demand has also slowed down the demand for zinc. As steel demand and prices are yet to stabilise globally, analysts believe that demand for zinc may not improve drastically. In 2010, the global zinc consumption is expected to go up by 6 per cent to 10.98 million tonnes, which will still be lower compared to the estimated production of 11.17 million tonnes.

Zinc prices, too, have risen and more than doubled since February this year primarily on account of Chinese demand, which is due to higher steel production in the country. At current levels of $2,298 per tonne, the price is already ahead of analysts' estimated price of $2,200 for CY10 indicating that there is not much upside here on.

Base metal stocks: Should you invest?

Image: A worker walks past stacks of high purity aluminium ingots at the Khakas aluminium smelter in the Siberian city of Sayanogorsk.Photographs: Sergei Karpukhin/Reuters

Hindalco

The company's major concern with regards to the performance of its overseas subsidiary, Novelis, which accounts for about 70 per cent of the company's consolidated revenues, are easing. Novelis reported improved volume growth and operating profits on a sequential basis. But, since aluminium prices are expected to remain subdued and raw material prices are rising, concerns still exist.

Hindalco is a major player in the domestic aluminium industry. While aluminium accounts for 75 per cent of its total revenues, the company also has presence in copper. The company recently completed a QIP issue and raised Rs 2,900 crore (Rs 29 billion). While part of the proceeds will be will used for Hindalco's expansion plans over the next 2-3 years, the QIP issue will lead to an equity dilution of 12 per cent.

Overall, the stock has run up significantly taking cue from higher international metal prices and improving fundamentals of Novelis. At Rs 143, it trades at a PE of 12 times estimated FY11 earnings, and is expensive.

Hindustan Zinc

On the back of an increase in the international zinc and lead prices, and expectations of Sterlite Industries buying the government's minority stake in the company, the share price of Hindustan Zinc has gone up by four-fold since its 52-week low of Rs 303.2 made in February 2009. Considering that global zinc prices might correct marginally and that stock valuations are high, analysts expect the stock to correct in the short-term.

However, since fundamentals remain healthy, investors can use any correction to invest with a long-term perspective. The stock is trading at 12.5 times its 2010-11 and 6.9 times its 2011-12 estimated earnings. The company also has liquid investments worth Rs 10,000 crore (Rs 100 billion) in its books, which is about to Rs 237 per share.

The company's integrated zinc and lead operations make it one of the low-cost producers globally. Hindustan Zinc, which generates about 70 per cent of its revenue from zinc and 9 per cent from lead, is expanding its cumulative capacity for zinc and lead by 41 per cent to 1.06 million tonnes by 2010-11, which will make it the world's largest producer of zinc and lead.

Base metal stocks: Should you invest?

Image: Bolivian indigenous woman Felipa holds a piece of silver ore in Potosi.Photographs: David Mercado/Reuters

Nalco

In the domestic market, Nalco is the second largest producer of aluminium and largest manufacturer of alumina, which is the raw material for making aluminium. Given its integrated operations, the company is one of the low-cost producers of aluminium globally; its cost of production is about $1,300 per tonne. The company is ramping up its aluminium capacity from 3.45 lakh tonnes to 4.60 lakh tonnes, which is expected to be commissioned in the current month. Nalco is also expanding its alumina capacity from 1.6 million tonne to 2.1 million tonne.

However, analysts believe that the expected delay in expansion of alumina capacity remains a concern. Although 2009-10 financials will be subdued due to relatively lower prices, higher volumes and improved realisation in 2010-11 should help the company post revenue growth of about 24 per cent. Further, margins are expected improve by about 500 basis points, which should push up net profits by 38 per cent year-on-year in 2010-11. However, at Rs 382, considering that the stock trades at 21 times its 2010-11 estimated earnings, valuations are not cheap.

Sterlite Industries

The likely correction in base metal prices would also impact Sterlite given its presence in all key metals such as aluminium, copper and zinc. However, its low production cost, aggressive expansion plans and revenue contribution from the power division are some positives. The company is doubling its copper capacities to almost 8 lakh tonne by June 2011, and expanding Balco's (its aluminium arm) capacity from 2.4 lakh tonne to 5.7 lakh tonne by September 2010. Sterlite is also setting up 2,400 mw of coal-based power generation capacity, wherein the first unit of 600 mw will be operational by March 2010. Analysts estimate the power business to contribute about 30 per cent to the consolidated operating profits in 2010-11.

While Sterlite's profitability would be subdued in 2009-10 due to the impact of lower base metal prices year-on-year, its revenues are seen rising by about 30 per cent and net profits by 55 per cent in 2010-11. The growth in 2010-11 net profits is seen higher on the back of cost reduction, higher sales realisations, and contribution from the power business. Analysts value the stock between Rs 950-1,050 on sum-of-the-part basis indicating 15-30 per cent upside from current levels. With the company having filed the draft prospectus with the Sebi with an aim to list its power arm, there is scope for unlocking value.

article