He is the man behind Blackstone’s India strategy

US private equity (PE) major Blackstone’s real estate team in India seems to be following a different strategy compared to its peers. During the boom years of Indian real estate between 2005 and 2008, when billions of dollars of foreign funds were invested in Indian realty, Blackstone invested only Rs 35 crore (Rs 350 million) for a 35 per cent stake in Bangalore-based Synergy Property Development Services (April 2008). Experts say this investment by Blackstone, which manages $80 billion of real estate assets globally, has become its vehicle for studying Indian real estate market.

In the aftermath of the Lehman Brothers crisis in 2008, when many US PE funds in real estate wound up and foreign fund flow slowed in Indian property, Blackstone steadily increased its investments in Indian real estate, investing about $1.5 billion in Indian real estate, making it the biggest owner of office properties in the country.

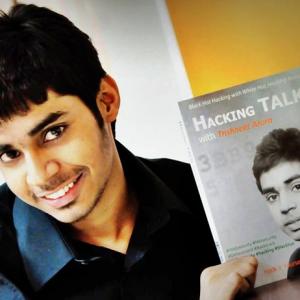

The man behind Blackstone’s India strategy is Tuhin Parikh (left), a low-profile Indian Institute of Management graduate who joined the fund manager in 2007 from The Chatterjee Group’s TCG Urban Infrastructure Holdings Ltd (TCG UIH) where he was CEO. Parikh is senior managing director at Blackstone now.

The man behind Blackstone’s India strategy is Tuhin Parikh (left), a low-profile Indian Institute of Management graduate who joined the fund manager in 2007 from The Chatterjee Group’s TCG Urban Infrastructure Holdings Ltd (TCG UIH) where he was CEO. Parikh is senior managing director at Blackstone now.

An alumnus of Maneckji Cooper School in Mumbai, he introduced bowling to Mumbai when he was director of Galaxy Entertainment.

Two years after Blackstone invested in Synergy, it bought Bank of America Merrill Lynch’s $2-billion Asia real estate portfolio, which included $400 million of Indian properties including some of DLF’s residential projects in south India.

It went on to buy DLF Ackruti IT Park in Pune, Express Towers in Mumbai , and Embassy group's IT park projects in Bengaluru, among others. The latest acquisition of Blackstone is 3C group’s IT SEZ in the national capital region for Rs 625 crore (Rs 6.25 billion).

Although Blackstone has a separate vertical for office investments globally, Tuhin helped it zero in and seal the deals in commercial property space, say realty experts.

Many in the PE sector believe Blackstone will exit its investments eventually through a real estate investment trust (Reit). Although reports have emerged that Blackstone has already started work of bringing all its assets under a Reit, those close to the PE giant say it will do so only after the government gives tax breaks to Reits.

While Parikh did not comment for this story, people talk highly of him.

“Tuhin (Parikh) is a sharp analyst who can read the market correctly. When other people were investing, he was quietly watching. When everybody stopped, he started when the markets were down,” said Atul Chordia, chairman of Pune-based realty firm Panchshil Realty, which tied up with Blackstone to buy Express Towers In Mumbai. According to Chordia, Tuhin’s team takes time to take a decision on investments but once they decide, they act pretty fast.

Cushman & Wakefield’s managing director Sanjay Dutt, who has known Parikh for many years, says he is the only private equity executive who saw opportunity in office properties and invested a lot in that space.

“He was intelligent enough to form joint ventures with developers across the country like Jeetu Virmani of Embassy in South, Panchshil in West and now focusing on North. He surprised everybody by buying Express Towers with Panchshil.” said Dutt.

According to the head of a US-based PE fund, while most PE funds allocated $2-3 billion for global real estate, Blackstone had that kind of money for Asia alone, most of which flew into India.

“Parikh has done so many deals at the right time. Since he had the support of Blackstone’s large balance sheet, they picked up good assets at discounted price,” said a former colleague of Parikh, who did not wish to be named.

Tuhin Parikh: Senior MD, Real Estate, Blackstone

Joined Blackstone: January 2007

Previously with: TCG Urban Infra, ITC

Education: PGDM from IIM -A

Investment strategy: Buying low-risk, income-generating infotech parks and office properties. Experts say the US PE giant wants to pool them under a Reit or real estate investment trust and exit