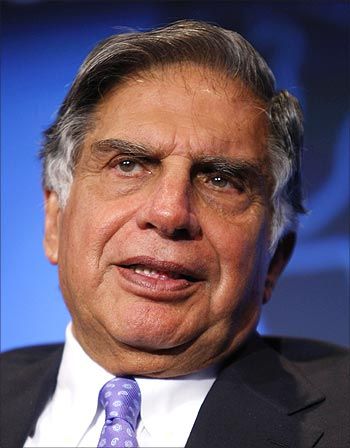

The family office category was up 38 per cent, led by names such as Ratan Tata, Ronnie Screwvala and various Infosys co-founders.

Hedge funds and India-dedicated funds had diminished the pace of their investments into the country in the second half of 2015-16 compared to the first half.

Hedge funds and India-dedicated funds had diminished the pace of their investments into the country in the second half of 2015-16 compared to the first half.

However, family offices were more active in the second half, according to a report from research firm Venture Intelligence.

The family office category was up 38 per cent, led by names such as Ratan Tata, Ronnie Screwvala and various Infosys co-founders, who were also active in the first half but accelerated in the second.

According to the data, Ratan Tata’s own office invested in 12 companies in the second half of the year - Nestaway, Moglix, Invictus, Bollant Industries, SnapBizz, Dogspot, Tracxn, CashKaro, FirstCry, TeaBox, UrbanClap and LetsVenture. In the first half, it had seven investments, in Zivame, Yourstory, Ola, Ampere Vehicles, Lybrate, Kaaryah and Holachef.

N R Narayana Murthy's private investment entity, Catamaran Ventures, invested in three companies in the second half and three during the first half.

Nandan Nilekani invested in five companies during the second half and two in the first part.

A third Infosys co-founder, S Gopalakrishnan, invested in one company in the first half and three in the second half.

Unilazer, promoted by Screwvala, invested in two companies during the first half and another six in the second half.

“Interestingly, among traditional venture capital funds, the India - dedicated ones - which have raised money to be deployed only in India, like Sequoia Capital India (16 deals in the second half vs 31 in the first half) and Accel India (17 vs 27) - slowed (down 36 per cent) as compared to foreign VCs (down 22 per cent). Among foreign funds (which have a choice to deploy their capital in geographies other than India, Japanese early-stage VCs like Beenos Partners (seven deals vs five later) and M&A Partners (five vs four) stepped up their pace,” it said.

In the first half of the financial year (April to September 2015), things were rosy all round and all kinds of international investors, from hedge funds to European & Russian billionaires, were putting capital into Indian start-ups. The next six months saw a relative cooling in such investment activity.

“Investment activity of hedge funds and related investors, including key Flipkart backer Tiger Global (which made five investments in the latest six months vs 18 in the previous six months)was down the most, as much as 67 per cent,” it added.

Strategic investors and corporate VCs’ activities were down by 46 per cent. Angel networks and the like saw activities down by two per cent, it said.

Hedge funds which followed Tiger into India, such as Steadview Capital and Falcon Edge Capital were missing after October 2015.

Corporate VCs – like Qualcomm Ventures which had four investments in the latest six months against nine in the previous six and Nokia Growth Partner —slowed by 44 per cent.

“Angel investment networks and 'super angels', as well as the impact investors/social VC segments, maintained about the same pace across both periods. In fact, the recent six months witnessed the entry of several more independent angels, making their first set of investments as professional investors, into the Indian start-up eco-system. The period has also witnessed impact investors leading rounds at online services and e-commerce companies. For example, Aspada Investments led a $5-million round for entry jobs marketplace Aasaanjobs, with existing financial VCs in the company (IDG Ventures India and Inventus Capital) co-investing,” said the research entity.