|

|

| Help | |

| You are here: Rediff Home » India » Business » Special » Features |

|

| ||||||||||||||||||||||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||||||||||||||||

The volatility in the equity markets last quarter would have made most investors anxious about their equity fund investments. After four years of superlative returns, they are suddenly facing uncertainty. Many NFOs of last year are giving negative returns. Under these circumstances, should you cash out or wait and watch?

That will depend on the type of investor you are. If you are looking for a quick buck, there can be no strategy. But those who have invested with an objective in mind, need not worry as long as their plan stands on the pillars of long-term investment horizon, asset allocation and portfolio rebalancing, systematic investment and monitoring.

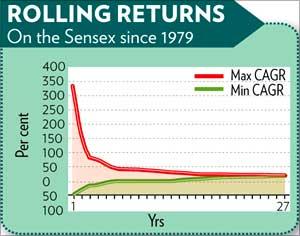

Equity investments should be earmarked for long-term goals only. In such cases, short-term volatility in the markets will smoothen out over time and have no final effect. Paras Adanwala, CIO (equity), ING Mutual Fund, says that this correction in the bull market should be seen as an opportunity to buy and not the onset of a bear phase.

The exceptional returns from equity funds in the last few years would have driven a lot of investors to divert a large portion of their investments to equity. If these investments have been made in line with an asset allocation that suits their risk profile and goals, then unless there is a change in either of these, there is no need to alter the way resources have been allocated to equity.

If, however, the portfolio is too heavily tilted towards equity, then this exposure must be reduced. Look for chances to exit schemes that add no value to the portfolio. If the portfolio is too light on equity to meet your long-term goals, then you must increase your equity holdings.

But the buying should be systematic. Mahesh Patil, fund manager, Birla Sun Life Mutual Fund, believes that this is a good time for investors to shore up their equity investments. "Catching bottoms may not be possible; it would be a better strategy to spread your investments over a couple of months," he says. Systematic investment plans (SIP) are the way ahead then for investors to invest in such markets.

Schemes should be selected on the basis of how they fit to a portfolio's needs. There is no particular benefit in investing in an NFO unless it offers a new proposition. Funds that have invested in international markets are a case in point. They bring geographical diversification to a portfolio, which reduces systematic risks.

Otherwise, go for an existing fund that has done well over time. Adanwala, however, believes that investments made in good NFOs should be given time to perform and that any depreciation in NAV is temporary.

Otherwise, go for an existing fund that has done well over time. Adanwala, however, believes that investments made in good NFOs should be given time to perform and that any depreciation in NAV is temporary.

Track NFO investments closely. Evaluate its performance both against the fund's stated investment objective, as well as peers, and exit only if it persistently underperforms on the parameters of managing returns as well as risk.

The message is clear. Investors working with a plan should not allow these temporary blips to derail it.

Instead, they should look at them as opportunities to put their portfolio in order.

Monitor investments closely and make purchase and redemption decisions solely on the basis of the relative performance of the funds and the demands of the portfolio.

With reports from Kumar Gautam

More Specials

Powered by

|

|

| © 2008 Rediff.com India Limited. All Rights Reserved. Disclaimer | Feedback |