September 6, 2002

|

|

|

|

|

|

||

|

Home >

Money > Interviews September 6, 2002 |

Feedback

|

|

|

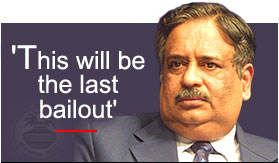

The Rediff Interview/ UTI Chairman M Damodaran

M Damodaran, chairman, Unit Trust of India, admits the country's largest and oldest mutual fund made a grave mistake. He understands the agony this once-reliable fund has brought to its 28.96 million investors and accepts that the anger is completely justified. Even though UTI may have made it clear in all of its offer documents right since 1964 that the fund does not give any assurance of a return or even a protection to capital invested, Damodaran confesses that nowhere along the way this element of risk was appropriately communicated to the investor. But what he doesn't understand is why only the UTI has been the recipient of all the bashing and mud slinging it has received in the past one year. "Many other funds and investors made similar calls and suffered," he insists in this exclusive interview with Senior Correspondent Kanchana Suggu. A day before the bailout package was to be finalized, Damodaran asserted that UTI would require an assistance of not more than Rs 6,000 crores (Rs 60 billion). A day later, in what came as a surprise to many, the government declared the total deficit in UTI at Rs 14,561 crores (Rs 145.61 billion). With that also came the news of a bifurcation of the mutual fund into UTI-I and UTI-II and the decision to manage the former by a government-appointed administrator and the latter by a professional chairman. "For all you know, you could get a new administrator and I may be asked to pack my bags and leave," Damodaran told rediff two days after the government's bailout package was announced when asked who the professional chairman to manage UTI-II would be. What do you think of the government's bailout package? I am very happy with whatever the government wants. There are some pluses and some minuses. The announcement is a clear and unequivocal statement by the government that it will meet its obligation. This definitely means that the investor will get far more confidence. And what about the minuses that you just mentioned? Well, I can't think of any. How, according to you, will the government's decision to bifurcate help UTI? I think there were a lot of NAV-based schemes that were somehow being associated with the not so well performing schemes. Such schemes will now be free from any such association and therefore will not suffer. Kanchana Suggu also spoke to Damodaran a day before the bailout package was announced. This is what he had to say then: Considering the fact that according to unaudited results, all of UTI's MIP schemes show negative reserves in the January-June 2002 period, what is the amount of bailout UTI is looking at this time around? Firstly, I don't think we should think of this package in terms of a bailout. I don't know whether the government is referring to it as a bailout package but accurately, it is a kind of a hand holding exercise at a period of time when there are certain payouts, which are more than what the schemes can pay out at the time of maturity. It is not as if some kind of a permanent grant is being given to the trust. What has happened as far as the assured return schemes are concerned is that there is a tendency to add up shortfalls as on today of schemes that are maturing on different dates, whereas on the dates of maturity you might be looking at totally different numbers. It might be possible that schemes that are maturing two to three years down the line might not be facing any shortfall at all. I say this because one of the major reasons why these shortfalls arise is that we've made very huge provisions for non-performing assets; provisions in excess of 90 percent. There is a very active recovery drive that is going on. Every rupee that comes in as a result of the recovery drive is going to push up the NAVs (net asset value) and reduce the shortfall. The recovery effect has already started. We are seeing some inflows and we expect to see a lot of inflows in terms of recovered amounts. What we've classified as NPAs are almost fully provided for. So all of this will directly impact positively on the NAVs and will reduce the shortfalls. I have always urged that we should not take a snapshot kind of a thing and say that as on today there are x number of schemes where the shortfall adds up to y crores and therefore y crores is the amount that needs to be given. I think that the way it should be addressed is that as and when we reach a situation when one or more schemes is likely to mature, you look at what the possible shortfall is in relation to those dates and then see how to address it rather than look at this very large number as on today and put in place today an assistance package that might not be needed. As far as the fully assured return schemes are concerned where you have the same rate of return as well as an assurance of protection of capital, the shortfall as on today is in the region of Rs 4,000 crores (Rs 40 billion). Then we have four schemes where we have protection of capital that is assured on maturity, but where the trust has the right to reset the rate of return at the commencement of each year, which we have been doing in terms of what we expect the market will offer for the next 12 months. Then you have four long-term assured return schemes maturing somewhere around 2018 or 2020, where the shortfalls will keep on increasing if the present conditions continue, because we got locked in there at a very high rate of return which is not sustainable. There if you look at the shortfall today, you are looking at another Rs 3,000 crores (Rs 30 billion) plus. But as I mentioned, it is extremely important to recognize that it's not as if we need all that money today. There will be changes as we go forward. The stock markets are going up even as I talk to you today. One of the problems with these schemes was everybody said that you are more heavily into equity than income schemes. But equity has under performed. As we go forward, we expect that the equity is not going to remain the way it is. If you look at today's shortfall and how they have arisen, we had the situation of a very sudden and a very drastic change in the provisioning norms of mutual funds, which is far tighter than it is for banks and financial institutions, where for 18 months of default you have to make 100 percent provisions. That is why we have provided to the extent of 92 percent of our non-performing assets. I don't see any major bailout package necessary at this point of time as far as the assured return schemes are concerned. For US-64, there's already a package in place. So what are you expecting? As far as US-64 is concerned, you might see a refinement in the package that is already been implemented. The refinement might be so that US-64 is strengthened a little more than what it is at this point in time. Instead of doing this business of giving us this assistance in bits and pieces by way of a reimbursement, we first pay out whatever the investor has to be paid out now and then we send a bill to the government and the government pays us. To meet the repurchase requirements, we have to sell equity in the market, right? Now that is depressing the market. It's giving us no value whether in US-64 or in other schemes. That aspect will get addressed possibly if there is an upfront assistance coming. We have some expectation of how the investors are expected to behave on May 31 if there is a huge gap between the NAV and say Rs 10 or whatever. So factoring in the rational investor behavior that every investor would like to cash out on a higher assured price, if we see a situation in which we get that assistance upfront (what we need in the month of May), and we are not obliged to sell as much as we might now, there is a positive for the market. That itself would bring down the difference; not only in this scheme, but other schemes. Number two is I think the market is not worried about what we've sold so far, but what the market expects we might sell. Everyone knows what our holding is. They know our scrips; they know where we're overweight because it's all now disclosed. With that knowledge in the market and with the knowledge that we are to become SEBI compliant, this overhang, which exists in the market has to be addressed and that will be addressed if the money comes in upfront. So you would prefer that the government give all the money at one time instead of spreading it over a period of time. Yes. One time. Upfront. If the government were to give it at one time, how much would that be? According to our expectation, it is in the region of Rs 6,000 crores (Rs 60 billion). According to analysts and rumors what UTI needs is between Rs 15,000 crores and Rs 17,000 crores (Rs 170 billion). Do you think this is the right amount? I am glad you said analysts and rumors. I don't know if analysts are the authors of rumors or rumors influence analysts. Luckily for me, I don't understand analysis. That figure is very wide off the mark. I don't think these frightening figures that people put and add up from out of nowhere is helping the investor cause. Don't you think the government's regular bailout package rewards inefficiency? But where is the regular bailout package? I have also heard that periodically UTI gets bailed out. I want to know where this periodic bailout is taking place. 1998, you had a crisis in UTI. In 1999, you had a special unit scheme. This scheme only meant that Rs 3,300 crores (Rs 33 billion) worth of PSU stocks was made available by the government in terms of 5-year bonds. The market value of those stocks at that point of time was Rs 1,547 crores (Rs 15.47 billion). Someone said UTI got Rs 3,300 crores, which is not true. On that date, what UTI got was Rs 3,300 crores minus Rs 1,547 crores. Today that Rs 1,547 crores is Rs 2,500 crores (Rs 25 billion). So it is in a sense a floating assistance where the number is reduced over time. With some divestment taking place of those PSU stocks which we hold in large numbers, Rs 3,300 crores might become 3,300 crores and there might be no bailout at all. I don't see any other bailout package that has been offered by the government except the Rs 300 crores (Rs 3 billion) that you saw after 31st March and the 500 crores (Rs 5 billion), which we should receive any time now, which we haven't received. The point is, what does that represent? It is a commitment given by the government through UTI, that because from 1964 onwards, you had a perception that this was a particular type of fund, which it wasn't and there was a risk which you did not factor in your thought process when you invested and we did nothing to convince you to the contrary, the government is assuring a certain price. UTI, as an organization is not getting a huge corpus for some failing on its part. The nature of the US-64 assistance truly construed is the government meeting its own commitment to the investor community for a perception problem through the UTI. To talk in terms of repeat bailout packages and that we are at the finance ministry's doorstep with a begging bowl is really a wrong way. How many more bailouts do you see for UTI? There's none at all that is required, other than the one that is being put into place. Because you see, US-64 is NAV-based. There is no question of a shortfall any longer, perceived or real. There might be problems getting addressed. All other schemes are NAV-based. So there is no shortfall, there is no need for bailout by whatever name called. This will be the last bailout. The Joint Parliamentary Committee wants UTI Bank to conduct an independent inquiry into its failed merger with Global Trust Bank as it reckons that UTI and UTI Bank officials stood to gain personally from this merger? Can you tell us what the progress on this inquiry is? Let us get to what we've seen in the papers. I think it has been stated on behalf of the JPC. What has been published in the papers is not the draft report of the JPC. So the JPC has not asked you to conduct an independent inquiry. What I am saying is this conclusion of who gained and who did not gain is something that you've only read about in the papers. Its not as if there is some interim report of the JPC that's available with us that obliges us or the UTI bank board to undertake these exercises. It is a fact that the UTI bank board went into this question because of the newspaper reports and I want to clarify this. It has nothing to do with what is attributable to the JPC, but newspaper reports alleging that the JPC's draft report contains such and such thing. Responding to that, the chairman of UTI Bank went on leave and said since the issue is being written about in the papers I want the board to look at this and decide what should be done. So the UTI Bank board considered this. Having considered all relevant matters, I think on the 31st July, it came to two conclusions. One that there was nothing done that was wrong. Two that Mr Nayak, chairman, UTI Bank, should be requested to resume his duties, which he has since done. It has been authoritatively stated by the JPC that what has been written in the newspapers is not the draft report of the JPC. PART II: 'It's not as if we knew nothing about the market' PART III: 'US-64 will be smaller than it is now'

ALSO READ:

|

ADVERTISEMENT |

||||||||||||