As the curtains drew over 2010, you must have made promises to yourself: Vowed to exercise regularly, be more organised in life, refrain from being impulsive etc.,

Strangely though, resolutions hardly ever revolve around your finances. Maybe this year, it is time to undergo that much needed change; investors should resolve to get in good financial shape in the New Year. Here are few resolutions that should get you started:

Streamline your investments with your financial goals

One is often making haphazard investments. Under the pretext of conducting tax savings in the nick of the moment; you end up investing in the most accessible investment avenue. You may also invest in post office schemes or insurance schemes under the pretext of helping a relative / friend / neighbour achieve their targets. Often, during such investments, it never occurs to you that it is pertinent to align these investments with your financial goals.

This year, as a first step towards investment planning, we suggest you to chalk your long-term financial goals and ensure to invest inline with your financial dreams.

You have been investing, but have predominantly stuck your guns with the avenues which you are familiar with. This a common mistake that people commit while investing, diversifying your portfolio is pertinent to ensure that your returns are optimised at adjudged risk levels.

It may be a good idea to experiment with your investments; however, you need to understand where you are putting your money.

Watch where you spend, stick to a budget

Budget may not be the most fashionable thing to adapt to, but this is what will enable you to keep tab on your expenses effectively.

'A small leak can sink a ship', similarly, ad hoc expenses can also create a dent in your household expenses, it becomes pertinent to understand spending pattern and plug the ones that are unnecessary.

It has also become a fad to swipe the plastic card at the drop of your hat; but using your card prudently would help you avoid any impulsive spending. You can also conduct small exercises such as, answering questions: 'Is this a need or want?' If it is a need, go ahead with the intended expenditure, for a want take a 24 hour waiting period post which you can spend with clarity in your mind.

Start with a realistic number (percentage of net earnings). You can slowly increase it in a phased manner. For example, you start off with Rs 2,000 in January, increase this by Rs 200 every month, by December you would end up saving Rs 4,200 if this is done on a consistent basis.

Commit to raising your savings rate by a meaningful but reasonable level. If the goal is too easy, then it isn't much of a resolution.

While it is important to save, it is in fact of equal pertinence to invest it prudently in avenues that will provide good returns.

Create an emergency fund

One of the learning from last year was the importance of creating an emergency fund. When cashless mediclaims went into trouble, one truly understood the need to have some funds stacked up for such emergencies.

This was a revelation when there were job losses across the counter; individuals were stuck with huge EMIs which became unmanageable. With these learnings, it is only prudent to set out to create multiple layers of liquidity for:

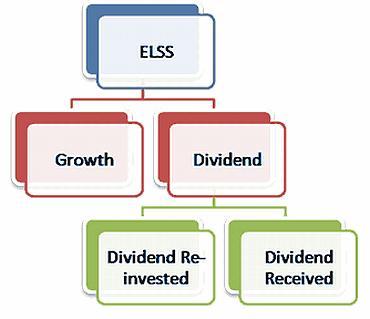

Tax planning, is often a ritual that you conduct during the fag end of the financial year, this year round, spend quality time, right at the start. Utilise all the tax-breaks efficiently this time round; don't leave this important part of your finances for last minute rush.

Resolve this year to understand and invest. Evaluate investment avenues which will provide tax-free returns, categorically invest in only such avenues where the returns are tax-free.

Stick to your financial resolutions, it will go a long way in putting that extra money in your pocket; this will also help you organise your finances better.

We wish all the readers a happy and a prosperous New Year! May this New Year bring in many opportunities to create wealth for you!