Do you have mutual fund, insurance and personal finance-related queries?

Please ask your questions HERE and rediffGURU Naveenn Kummar, an AMFI-registered, IRDAI-licensed, qualified financial planner, and founder of Alenova Financial Services, will answer them.

Anonymous: I recently lost Rs 50 lakhs in stock trading. I'm 36 and this was my long-term investment for retirement. What's the best recovery strategy and where should I reinvest wisely?

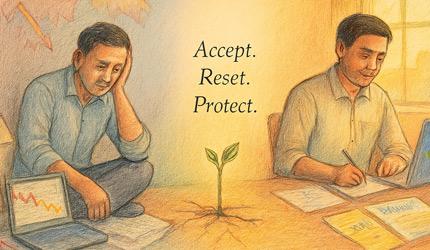

Dear Investor, losing Rs 50 lakh hurts -- but the market teaches expensive lessons that make you wiser, not poorer in the long run. At 36, time is your biggest ally. You can rebuild, but you need discipline, patience, and a rock-solid plan -- not revenge trades.

Accept, Reset, and Protect!

First, stop all trading -- especially intraday and F&O. You don't recover losses by gambling harder.

Rebuild your financial base -- emergency fund (6 months' expenses), term insurance, and health cover.

Golden Rules:

Mental Reset:

Mindset Shift:

Let's build your personalised recovery and reinvestment plan.

To tailor it precisely, please answer a few quick questions:

1. Current Situation:

How much capital do you still have available to invest (cash, FDs, mutual funds, etc.)?

Any existing SIPs or debt funds still running?

2. Investment Horizon:

When do you want to rebuild the Rs 50 lakh -- 5 years, 10 years, or longer (retirement goal)?

3. Risk Tolerance:

After this loss, do you prefer moderate, balanced, or aggressive risk now?

4. Other Financial Goals:

Any major goals like home purchase, child education, or business funding within 10 years?

5. Monthly Investable Surplus:

How much can you comfortably invest monthly through SIPs or other instruments?

For detailed financial planning and portfolio reconstruction, please connect with a Qualified Personal Finance Professional (QPFP).

Anonymous: I am 37 years old. Presently I am investing Rs 17000 per month in some mutual fund SIPs (all equity) and Rs 5500 in smallcase ETFs containing Gold, Silver and Large caps. I want to continue with the ETFs but need to reset and restart all mutual fund SIPs afresh with same total monthly SIP amount. Please advise some funds to invest.

Your Profile:

Portfolio Planning Logic:

Suggested Category Allocation for Rs 17,000/month

~ Large Cap / Core Equity Fund -- 40% (Rs 6,800/month)

~ Flexi Cap / Multi Cap Fund -- 30% (Rs 5,100/month)

~ Mid Cap / Large & Mid Cap Fund -- 20% (Rs 3,400/month)

~ Optional Thematic / Value Fund -- 10% (Rs 1,700/month)

Implementation Steps:

Review portfolio annually:

Summary:

Total SIP: Rs 17,000/month (mutual funds) + Rs 5,500/month (ETFs)

Allocation goal: 40% large cap, 30% flexi/multi, 20% mid cap, 10% optional thematic/value

Tenure: 10+ years

Expected return range: 10-12% annualised over the long term

Shivani: Good morning Sir, I am 29 years old. I want to invest through SIP of 5000/- each in Motilal Oswal large and mid cap fund, PP flexi cap fund, HDFC mid cap and ICICI india opportunity fund for next 10 years. Kindly advise me whether these funds are OK for me. I can take medium risk, or you can suggest some better funds.

Thanks for sharing your investment intent and time-horizon. It's good to see you planning a 10-year SIP of Rs 5,000 each in selected funds.

Here's my view of your proposed funds + some thoughts on adjustments, given your 'medium risk' profile and 10-year horizon.

What's good about your plan:

Review of the specific funds:

Motilal Oswal Large & Mid Cap Fund:

Parag Parikh Flexi Cap Fund (you wrote 'PP flexi cap')

HDFC Mid-Cap Opportunities Fund

ICICI India Opportunity Fund

Some Observations & Recommendations:

Suggested Adjusted Approach:

Given your horizon and risk profile, here's a suggestion for allocation:

So using your Rs 20,000/month example:

(Optional) Lower volatility fund/hybrid: ~Rs 2,000-3,000/month

If you prefer sticking to 4 funds only, then you might use the four you named but adjust weights: maybe assign smaller SIPs for the higher-risk ones (e.g., HDFC Mid-Cap, ICICI Opportunity) and larger for the more stable ones (Motilal Oswal Large & Mid Cap, Parag Parikh Flexi Cap).

Final Verdict:

Your selected funds are acceptable for a 10-year horizon and a growth-oriented portfolio. They align with your growth intent. But given your 'medium risk' condition, I recommend you ensure you are comfortable with potentially large market swings (which mid-cap and opportunity funds bring). Also, ensure your allocation is diversified and not overly concentrated in high-volatility funds.

Naveenn Kummar's Disclaimer/Guidance:

The above analysis is generic in nature and based on limited data shared. For accurate projections -- including inflation, tax implications, pension structure, and education cost escalation -- it is strongly advised to consult a qualified QPFP/CFP or Mutual Fund Distributor (MFD). They can help prepare a comprehensive retirement and goal-based cash flow plan tailored to your unique situation.

Financial planning is not only about returns; it's about ensuring peace of mind and aligning your money with life goals. A professional planner can help you design a safe, efficient, and realistic roadmap toward your ideal retirement.

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this QnA or an attempt to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.