Photographs: Reuters Dipen Shah in Mumbai

The year 2011 was one of the most challenging years for investors: high inflation, increasing interest rates, depreciating currency, deadlock in government decision making and uncertain global conditions substantially dampened investor sentiment and business confidence.

The Indian equity markets is one of the worst performing markets globally -- down for the calendar year 2011 by about 25 per cent in rupee terms and around 35 per cent in dollar terms.

In sectors like infrastructure and real estate the fall in the value of stocks has been much deeper.

The participation of local and foreign institutions in Indian equity markets has been marginal. Inflation continues to be a challenge.

. . .

The TOP 5 stock picks for the year 2012

Photographs: Reuters

The Reserve Bank of India's Monetary Policy to check inflation rates by continuous increase in interest rates has had its effect by way of slowdown in economic growth.

The toned down GDP growth target from 8.5 per cent to 7.5 per cent looks difficult to achieve. Fiscal deficit is likely to be around 5.5 per cent against the target of 4.7 per cent.

In short things which were looking positive at the beginning of the year seem to have lost steam and the situation looks grim.

Default by corporate borrowers and restructuring of loans looks more likely especially in the infrastructure and capital goods sector.

. . .

The TOP 5 stock picks for the year 2012

Photographs: Reuters

The sudden steep fall in rupee vis a vis dollar has taken many exporters and importers by surprise resulting in large losses in the open dollar positions.

The global scenario looks very uncertain. What will happen to the Euro is anybody's guess. Whatever the solution be, we are going to see a lot of pain and slowdown of the Euro region for some time.

While the United States seem to show some signs of recovery one is still not confident whether it will last or slip back.

The fear of slowdown in China seems to be more certain now. All this may result in some sovereign defaults and corporate death globally and locally.

. . .

The TOP 5 stock picks for the year 2012

Photographs: Reuters

This has dampened the business and market sentiments, the current valuation of Indian stock and indices reflect that. The question is, will this continue and worsen or will the economy show signs of improvement in 2012.

While it is very difficult to make a guess given the uncertainty in many quarters, the equity markets seems to have substantially priced in the worst.

It is trading at a PE of 12 times financial year 2013 estimates.

Many of the large-cap and mid-cap stocks are trading at 52-week lows and some of them below book value. Thus, the down side seems limited to not more than 10 per cent fall from here though it is possible due to technical factors, markets may for shorter periods of time, trade lower.

. . .

The TOP 5 stock picks for the year 2012

Photographs: Reuters

The positive part is with depreciation in currency Indian manufacturing, service and software sector has become more competitive globally.

The RBI is likely to pause and start reducing interest rates. With the China and rest of the globe slowing, oil and other commodity prices are likely to soften. All this will be a good base for Indian companies to show signs of improvement and grow.

Post the state elections hopefully Central government will push reforms more decisively. With no major accidents globally and locally, one can expect around 15 per cent return from Indian Equities in 2012.

But one can expect high volatility and pain before things settle down by end of next year."

the top 5 stock picks for 2012. . .

The TOP 5 stock picks for the year 2012

Photographs: Reuters

Top 5 picks for the year 2012

HDFC Bank

Consistency in its earning growth (grown around 30 per cent YoY in past 38 quarters).

It has consistently delivered one of the highest CASA mix in the industry. Its CASA mix remained healthy at 47.3 per cent at the end of Q2FY12, despite the rise in FD rates in last few quarters.

Valuations: P/ABV - 3.1x FY13.

. . .

The TOP 5 stock picks for the year 2012

Photographs: Reuters

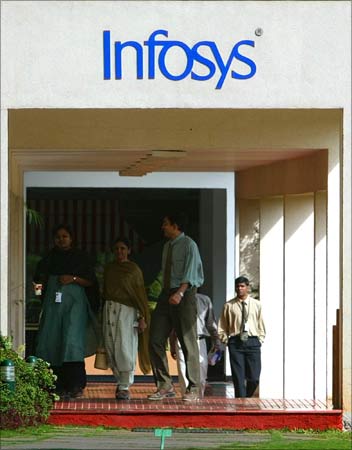

Infosys

We remain positive on the medium- to long-term strategy of the company.

Management has reiterated its long term commitment to increase the proportion of non-linear revenues.

We concur with the management's view that this is necessary to ensure profitable growth, while providing more value to customers.

Valuations: PE - 16.8x FY13.

. . .

The TOP 5 stock picks for the year 2012

Photographs: Reuters

ITC

ITC has a long track record of high market share in the cigarette business.

Coupled with pricing power, this creates an improving profit profile, and high visibility in revenue and earnings growth for the segment.

Large opportunity size in other FMCG businesses, positive market share trends.

Tobacco constitutes only 15 per cent of India's consumption pie; which explains ITC's entry in the space.

ITC's products show encouraging trends in market share, creating portents for profitability toward the end of FY-13.

Other businesses top-of-the-class, are self-sustaining: Over a cycle all other businesses of ITC are self-sustaining, and gel strategically with growth objectives of the company.

Valuations: PE - 21.8x FY13E.

. . .

The TOP 5 stock picks for the year 2012

Photographs: Reuters

IRB Infra

Experienced player in road BOT segment and likely to benefit from upcoming project awards in road segment.

Strong order book of Rs 9,600 crore (Rs 96 billion) to drive growth in revenues at a CAGR of 36 per cent between FY11-FY13.

Valuations: PE of 9.4x FY13.

. . .

The TOP 5 stock picks for the year 2012

Photographs: Reuters

Cummins

Company is well poised to benefit from recovery in the infrastructure spending in the country.

Commencement of mega production site at Phaltan is likely to ease out capacity constraints and would add to cash flow generation

Valuations: PE 14x FY13E.

We would recommend accumulating these stocks.

The author is head of fundamental research, Kotak Securities.

Analyst's holding: Nil. The views provided herein are general in nature and do not consider risk appetite or investment objective of particular investor. Readers are requested to take independent professional advice before investing. This should not be construed as invitation or solicitation to do business with Kotak Securities Ltd.

article