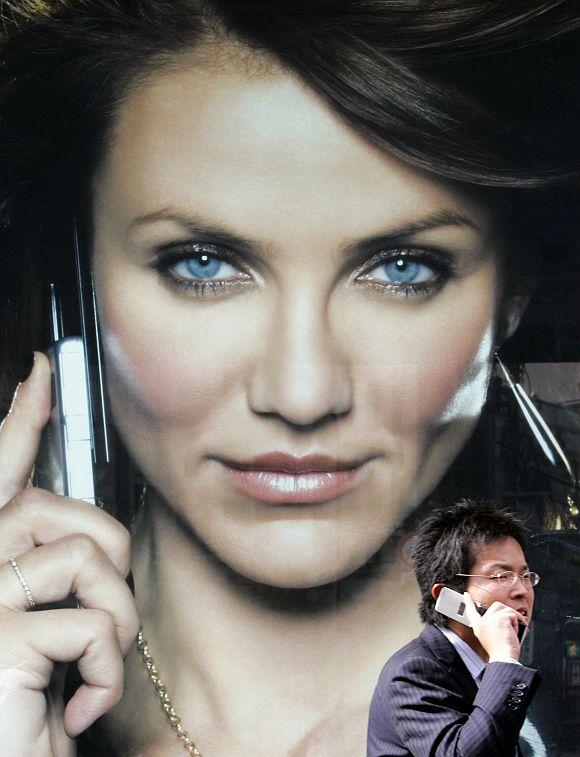

Photographs: Kim Kyung-Hoon/Reuters Sayantani Kar and Urvi Malvania in Mumbai

As Aereo makes waves in the US and awaits its Supreme Court’s judgement, media companies in India are trying their hand at capturing the demand for TV on handheld devices.

From broadcasters, aggregators to direct-to-home players, all have been raising their mobile TV pitch.

Aereo, the service that lets users in the US access free-to-air channels through the Internet with the help of its small antennae, is revolutionary in terms of hardware but the channels are not the encrypted ones.

The US audience has been steadily moving on to the Internet for its TV content.

. . .

How mobile television brands are trying to strike it big

Image: A man watches television on his mobile phone while commuting on a train in Tokyo, Japan.Photographs: Yuriko Nakao/Reuters

As Aereo makes waves in the US and awaits its Supreme Court’s judgement, media companies in India are trying their hand at capturing the demand for TV on handheld devices.

From broadcasters, aggregators to direct-to-home players, all have been raising their mobile TV pitch.

Aereo, the service that lets users in the US access free-to-air channels through the Internet with the help of its small antennae, is revolutionary in terms of hardware but the channels are not the encrypted ones.

The US audience has been steadily moving on to the Internet for its TV content.

. . .

How mobile television brands are trying to strike it big

Image: A mobile 'myMobileTV' by Sagem is displayed during the Mobile World Congress in Barcelona, Spain.Photographs: Albert Gea/Reuters

But in India, the lack of telecom bandwidth is an inhibitor for mobile TV.

Jehil Thakkar, head of media and entertainment, KPMG, says viewers number a few thousands. Mobile TV is yet to gain scale since the days Zenga had launched its pre-loaded TV-viewing app in 2009.

But that has not stopped media players from entering.

The Zee group had launched Ditto TV and Tata Sky, a DTH JV of Tata Sons and STAR, the television unit of News Corp, has launched Everywhere TV.

Broadcasters like Star Sports and Sony have put up websites such as starsports.com and Sony Liv.

While Zenga is pre-loaded on phones, Ditto is an over-the-top service that requires subscription and the user to pay her telecom operator data charges.

. . .

How mobile television brands are trying to strike it big

Image: An employee of Samsung Electronics walks past a large-scale replica of one of its mobile phones displayed for visitors at the company's headquarters in Seoul, South Korea.Photographs: Jo Yong-Hak/Reuters

Then there are telecom operators who offer TV content as VAS. Thakkar says that those who offer a bouquet of channels, replicating the TV environment, are most likely to succeed: “Broadband TV content should not be limited to a broadcaster because users want the same choices on their handheld devices too”.

The latest entrant, Tata Sky, is banking on it. Vikram Mehra, chief commercial officer, Tata Sky, says, “We have tried to keep it simple.

“As part of the same billing process for a Tata Sky connection at home, one can view the same set of channels (over 65 on it) and movies on demand.

“The product taps another screen for catch-up TV and linear channels.”

. . .

How mobile television brands are trying to strike it big

Image: Ernst & Young Partner Devendra Parulekar says sports and news are genres that would take off the fastest. Everywhere TV is on a free trial (till June 1) fuelled by live IPL matches, and all news channels in the same app, this elections.Photographs: Reuters

It would be leveraging its content agreements with broadcasters while charging users Rs 60 for the service streamed over the Internet or on Wi-Fi through the app.

Ernst & Young Partner Devendra Parulekar says sports and news are genres that would take off the fastest. Everywhere TV is on a free trial (till June 1) fuelled by live IPL matches, and all news channels in the same app, this elections.

OTT player Vuclip has made its service available on both feature-phones and smartphones.

“Apart from providing linear TV content, we have tied up Vodafone.

“Vodafone users can access real-time and archival content,” says Nikhil Naik, head, strategic accounts, Vuclip. Airtel Digital TV also has Pocket TV, with over 150 live channels for Rs 60 per month.

Telecom operators can ride on the payment process of their existing voice services to make payments easier.

. . .

How mobile television brands are trying to strike it big

Image: Mobile TV has witnessed a growth of 400 per cent in viewership.Photographs: Courtesy, Nokia

Other mobile TV players are now turning their attention to it too. Ditto TV has tied up with mobile payment provider Fortumo so that subscribers can make payments directly through their mobile operator.

As per Airtel Mobitude 2013, rural customers too are using such services.

Mobile TV has witnessed a growth of 400 per cent in viewership. Entertainment channels were viewed for catching up, while sports and news fired up live content demand (growth of over 800 per cent and 200 per cent, respectively)

Broadcasters too are trying to overcome their single-network content challenge.

. . .

How mobile television brands are trying to strike it big

Image: Broadcasters can offer such content for free as there is little acquisition costs but they lack the variety of the OTT players.Photographs: Courtesy, Nokia

As Nitesh Kriplani, executive VP, new media, business development and digital/syndication at Sony Entertainment Network says, “Video has existed since YouTube was launched. So, we decided to make our digital platform more interactive.

"On Sony Liv, users can play games and interact with our properties across the network.”

For the next season of Kaun Banega Crorepati, Sony Liv will run a contest to let users participate on the show.

Broadcasters can offer such content for free as there is little acquisition costs but they lack the variety of the OTT players.

. . .

article