Photographs: Reuters Manojit Saha in Mumbai

NPAs impair a bank’s capacity to earn. Rising NPAs are associated the world over with reckless credit expansion and inadequate risk assessment, notes Manojit Saha

In March 2009, when the global financial crisis was winding down, public sector banks accounted for 64.5 per cent of the Indian banking sector’s total non-performing assets, or NPAs, while their share in total bank credit was 75.2.

In September 2013, their share of NPAs had risen sharply to 86.1 per cent even as their loan share remained almost at the same level.

This shows that private and foreign banks have brought down their non-performing assets from over a third to less than a seventh in the last four-and-a-half years.

. . .

How RBI is helping banks to realign their finances

Photographs: Reuters

There’s more: stressed loans (gross NPAs and restructured advances put together) have gone up sharply for public sector banks from 7.7 per cent (of gross advances) in 2008-09 to 11 per cent now, while for new private banks, they have fallen from 5.5 per cent to 3.1 per cent.

NPAs impair a bank’s capacity to earn. Rising NPAs are associated the world over with reckless credit expansion and inadequate risk assessment.

What went wrong with public-sector banks?

Talk to any chief executive of such a bank and he is likely to tell you that higher interest rates and the slowing economy are the culprits.

. . .

How RBI is helping banks to realign their finances

Photographs: Uttam Ghosh/Rediff

If that is true, the asset quality of all banks -- public sector, private and foreign -- would have been impacted; but that is not the case.

Actually, a combination of lax credit appraisal processes coupled with lack of accountability of top management has resulted in a disproportionate rise in the NPAs of public sector banks in the last few years.

Even the Reserve Bank of India has admitted this at several forums.

“This divergent trend clearly indicates that the ability to manage asset quality across banks varies markedly and, in the post crisis years in particular, the concerns on asset quality are largely confined to the public sector banks,” RBI Deputy Governor KC Chakrabarty recently said while addressing bankers.

. . .

How RBI is helping banks to realign their finances

Photographs: Danish Siddiqui/Reuters

Differing trend

This was evident in Pune-based Bank of Maharashtra clocking 36 per cent loan growth in 2012-13, while the industry’s growth rate during the year was around 16 per cent.

In its annual financial inspection, RBI asked the lender to adopt a cautious stance on loan disbursements.

The bank’s net profit for the July-September quarter dipped to Rs 47 crore (Rs 470 million) from Rs 166 crore (Rs 1.66 billion) in the same period the previous year; its gross NPAs almost doubled to Rs 2,450 crore (Rs 24.5 billion).

Mumbai-based Central Bank of India was asked by the regulator to furnish financial data till a few months ago on a monthly basis.

The bank, which seems to have deferred NPA classification for a few quarters, posted a net loss of Rs 1,500 crore (Rs 15 billion) in the second quarter due to higher provisioning for bad loans.

. . .

How RBI is helping banks to realign their finances

Photographs: Reuters

Two Kolkata-based lenders -- United Bank of India and Allahabad Bank -- are facing forensic audit.

RBI has directed UBI not to sanction loans of more than Rs 10 crore (Rs 100 million) till the audit has been completed.

The bank had posted a net loss of Rs 490 crore (Rs 4.9 billion) in the second quarter, compared with a profit of Rs 145 core (Rs 1.45 billion) in the same period the previous year.

Allahabad Bank, on the other hand, is facing forensic audit because its system-driven NPA identification process was not found to be robust.

RBI has now decided to take a fresh approach to tackle the menace.

. . .

How RBI is helping banks to realign their finances

Image: RBI Governor Raghuram Rajan.Photographs: Adnan Abidi/Reuters

Earlier this week, it floated a discussion paper, seeking feedback from all stakeholders on how to identify stress early and steps that could be taken for resolution.

The discussion paper has proposed banks should identify signs of stress even before the loan turns into an NPA by classifying the loan in special mention accounts if repayment is overdue for one month, though no additional provisioning will be required.

The paper also emphasises on information sharing among banks as it has proposed to form a central repository of information on large credits.

Borrowers have always taken advantage of the lack of information sharing among banks to take multiple loans even if they had failed to service loans from some banks.

. . .

How RBI is helping banks to realign their finances

Image: Autorickshaws wait in front of the head office of State Bank of India in New Delhi.Photographs: Anindito Mukherjee/Files/Reuters

A case in point is a large publishing house in South India which has taken loans from seven public sector banks and the lenders have no clue about the status of the loans from the various banks.

“There is no formal method of information sharing, particularly in multiple lending models.

“At best, banks ask for a credit report from the borrower which is sketchy most of the times,” says a top official of a public sector bank.

In this backdrop, the recent proposals of the regulator could bring more transparency in loan sanctioning and resolution of stressed loans.

. . .

How RBI is helping banks to realign their finances

Image: An employee poses with the bundles of Indian rupee notes inside a bank in Agartala.Photographs: Jayanta Dey/Reuters

Effective measures

“RBI, in its discussion paper, proposes formidable measures to combat asset quality issues in the Indian banking system.

“If these measures are implemented in true spirit, overall asset quality of Indian banks in medium to long term should improve, in our view,” JM Financial said in a recent note to its clients.

One key feature of the proposals is the penalty banks will face if they fail to resolve an account which has been identified as stressed within a specified time frame.

Provision requirement will be accelerated (double in some cases) and asset classification benefit for work-in-progress restructured loans will be removed if banks fail to recognise and resolve stress early.

According to experts, if the new proposals see the light of the day then it will speed up decision making of the corporate debt restructuring mechanism.

. . .

How RBI is helping banks to realign their finances

At present, the CDR cell approves restructuring of loans between 90 and 180 days -- the paper proposes to bring this down to within 30 days.

RBI Governor Raghuram Rajan is keen to implement the proposals.

He has indicated, after the feedback received by the end of this month, final guidelines will be issued early next year.

Bankers welcome the move, but say it could take more than a year for banks and borrowers to get more disciplined and adhere to the new conditions.

And there are fears that NPA may rise in the short term.

. . .

How RBI is helping banks to realign their finances

Photographs: Reuters

Breaking the bank-businessman nexus

“We cannot have an affluent promoter and a sick company,” Finance Minister P Chidambaram famously said earlier this year in New Delhi.

Asked by reporters if he was referring to Kingfisher Airlines and its once-flamboyant promoter, Vijay Mallya, Chidambaram said he wouldn't name any one company.

But the finance minister's message was clear.

He was referring to the banker-businessman nexus which often took the advantage of debt restructuring mechanism to defer what is inevitable, that is, the formation of NPA. Kingfisher’s loan was restructured and banks took a haircut.

. . .

How RBI is helping banks to realign their finances

Image: SBI headquarters, Mumbai.Photographs: Manjulkumar/Wikimedia Commons

Still, the airline could not service its dues though the debt was recast and eventually became an NPA.

Three years since the restructuring, lenders are still struggling to recover their money. The finance minister's word of caution along with RBI’s vigil on a regular basis has made banks think twice before going ahead with any further restructuring.

There are other signs too that things could be changing: Winsome Jewellery — earlier known as Su-raj Diamonds -- which burnt a Rs 3,800-crore (Rs 38-billion) hole in banks' books was declared an NPA even while discussions were on whether to restructure the asset.

. . .

How RBI is helping banks to realign their finances

Photographs: Reuters

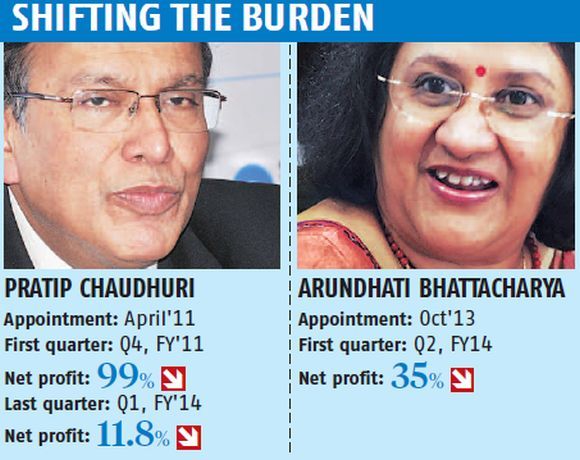

The curious case of SBI

It happens with such regularity that most observers are no longer ready to put it down to coincidence.

Whenever a new State Bank of India chairman announces his (or her) first quarterly result, there is a sharp decline in net profit.

Under OP Bhatt, it fell 35 per cent.

Pratip Chaudhuri, his successor, reported a plunge of 99 per cent.

Its latest victim is Arundhati Bhattacharya, the incumbent.

In November, when she announced the bank’s earnings for the quarter ended September 30, the profit was down 35 per cent from the same quarter a year earlier.

The investor community had probably expected it.

The SBI share price gained 2 per cent on the day of the results.

While the drop in profitability may vary, the reason behind the fall remains more or less the same: higher provisions on account of non-performing assets.

“The chairman normally decides the way accounts are prepared.

When a chairman retires, he often leaves the task of cleaning the books to his successor. Everyone wants to leave on a high note and tries to show higher profitability in the last few quarters of one's term.

This trend is visible in most government banks,” a former executive of a Mumbai-based bank recently told Business Standard.

Arundhati Bhattacharya,

Chairman, SBI

article