Photographs: Reuters

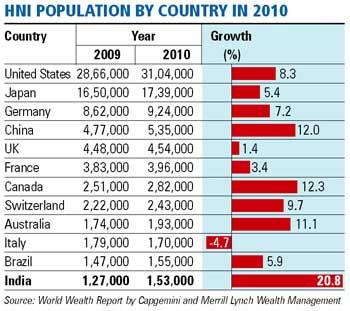

The number of dollar-millionaires in India surged to a record high of 1.53 lakh (153,000) in 2010, making the country's high net worth individual (HNI) population 12th largest across the globe, as per a global study.

The increase in India's HNI population has also helped Asia-Pacific overtake Europe as the region with the second-highest number of millionaires, as per the annual World Wealth Report of Merrill Lynch Wealth Management and Capgemini.

"India's HNI population became the world's 12th largest in 2010, entering the top 12 for the first time," the report said.

At the same time, Indian millionaires also showed growing interest in investments like luxury collectibles (luxury cars, boats and jets), as also in sports, the annual survey found.

. . .

India now has 153,000 millionaires; 12th highest in world

Photographs: Courtesy, Business Standard

At the end of 2010, India's HNI population stood at 153,000, up more than 20 per cent from 126,700 in 2009, when India was ranked 14th.

The HNIs have been identified as those with investible assets of $1 million or more, excluding their primary residence, collectibles, consumables and consumer durables.

The report named the US as the country with the largest HNI population (31,04,000), followed by Japan, Germany, China, UK, France, Canada, Switzerland, Australia, Italy, Brazil and India.

In Asia-Pacific, India has the highest number of millionaires after Japan, China and Australia. Among the top 12 countries globally, India's growth in HNI population was highest at 20.8 per cent.

. . .

India now has 153,000 millionaires; 12th highest in world

Photographs: Reuters

The annual report said that the world's HNIs expanded in both population and wealth in 2010, surpassing the 2007 pre-crisis levels in nearly every region.

The worldwide population of HNIs rose by 8.3 per cent to 10.9 million, while their financial wealth grew by 9.7 per cent to $42.7 trillion.

At the same time, the global population of Ultra-HNIs (those having assets of $30 million or more) grew by 10.2 per cent in 2010 and its wealth by 11.5 per cent.

The report attributed the growth in wealth to factors like appreciation in equity and other asset classes, as also in markets like commodities and real estate.

. . .

India now has 153,000 millionaires; 12th highest in world

Photographs: Reuters

"Higher interest rates in some developing economies attracted investor capital from lower-rated developed economies. The global HNI population remained highly concentrated in the US, Japan and Germany, which together account for 53 per cent of the world's HNIs.

The US is still home to the single-largest HNI segment in the world, with its 3.1 million HNIs accounting for 28.6 per cent of the global HNI population.

"While over half of the global HNI population still resides in the top three countries, the concentration of HNIs is fragmenting very gradually over time," Capgemini Global Financial Services' Global Head of Sales and Marketing Jean Lassignardie said.

"The concentration of HNIs among these areas will continue to erode if the HNI population of emerging and developing markets continues to grow faster than those of developed markets," he added.

. . .

India now has 153,000 millionaires; 12th highest in world

Photographs: Reuters

The report said that Asia-Pacific surpassed Europe for the first time in both HNI population and wealth with the strongest regional rate of HNI population growth in 2010 among the top three markets.

Asia-Pacific is now the second-largest region for both HNI wealth and population, second only to North America.

The report also said that HNIs assumed calculated risk in search for better returns in 2010 and "in an environment of relatively stable but uneven recovery, equities and commodities markets, as well as real-estate (specifically in Asia-Pacific), performed solidly throughout 2010."

"By the end of 2010, HNIs held 33 per cent of all their investments in equities, up from 29 per cent a year earlier. "Allocations to cash/deposits dropped to 14 per cent in 2010 from 17 per cent in 2009 and the share held in fixed-income investments dipped to 29 per cent from 31 per cent."

. . .

India now has 153,000 millionaires; 12th highest in world

Photographs: Reuters

Among alternative investments, many HNIs favoured commodities. The survey also found investments in emerging markets providing good opportunities for HNIs in search of profit.

"In the first 11 months, investors poured in record amounts into emerging market stocks and bond funds before selling to capture profits as the year ended and after the value of many emerging market investments topped pre-crisis highs," it said.

Looking forward, HNIs are expected to increase their equity and commodities allocations even more in 2012 while reducing their allocations to real estate and cash/deposits.

Regional preferences are less certain as the extent of emerging market opportunities will depend on whether those markets can push to new highs while economies are being weaned of the government stimulus, the report said.

article