'Taxes are the price you pay for civilisation.' -- Oliver Wendell Holmes, US Supreme Court of Justice, 1904

In most economies the tax system is the primary source of funding for a wide range of social and economic programmes.

How much revenue these economies need to raise through taxes depends on several factors, including the government's

capacity to raise revenue in other ways.

The recent global downturn has changed the economic scenario. Governments in economies of all sizes and at all stages of development are struggling with the tax policy choices available to them.

For companies, the challenge is dealing with the loss of public trust and increased scrutiny over how much tax they pay. Corporate income tax is only one of many taxes and is only part of the burden.

"Business has a key role to play and it is important for governments, business and civil society to foster a new collaborative approach to meet the common aims of a fair, stable and sustainable tax system," a study by the World Bank and International Finance Corporation on corporate tax rates the world over noted in their Paying Taxes - the global picture study.

While India does not figure either in the highest or the lowest bracket following is the tax rates in India:

India -- Total Tax Rate (TTR): 63.3%

Profit tax: 24.0%; Labour tax: 18.2%; Other taxes: 21.1%

Which countries have the world's highest coprporate tax rate, and which have the lowest?

...

Profit tax: Corporate Income Tax, etc; Other taxes: Sales Tax, Value Added Tax, etc.

Congo Democratic Republic -- TTR: 339.7%

Profit tax: 58.9%; Labour tax: 7.9%; Other taxes: 272.9%

The Democratic Republic of the Congo is the third largest country in Africa by area after Sudan and Algeria and has a corporate tax of 339.7 per cent!

Capital: Kinshasa

GDP (PPP) 2010 estimate:

- Total $22.718 billion

- Per capita $340

GDP (nominal) 2010 estimate:

- Total $12.600 billion

- Per capita $188

Currency: Congolese franc

Economy:

The economy of Congo relies heavily on mining.

The Congo is the world's largest producer of cobalt ore, and a major producer of copper and industrial diamonds.

NOTE: Profit tax: Corporate Income Tax, etc; Other taxes: Sales Tax, Value Added Tax, etc

...

Gambia -- TTR: 292.3%

Profit tax: 41.4%; Labour tax: 12.9%; Other taxes: 238.0%

The Republic of the Gambia is the smallest country on mainland Africa.

Capital: Banjul

GDP (PPP) 2009 estimate

- Total $2.406 billion

- Per capita $1,438

GDP (nominal) 2009 estimate

- Total $736 million

- Per capita $440

Currency: Dalasi

Economy:

The Gambia has a liberal, market-based economy characterized by traditional subsistence agriculture.

It accounts for roughly 30 per cent of gross domestic product (GDP) and employs about 70 per cent of the labour force.

The limited amount of manufacturing is primarily agricultural-based -- peanut processing, bakeries, a brewery, and a tannery).

Other manufacturing activities include soap, soft drinks, and clothing.

NOTE: Profit tax: Corporate Income Tax, etc; Other taxes: Sales Tax, Value Added Tax, etc

...

Sierra Leone -- TTR: 235.6%

Profit tax: 0.0%; Labour tax: 11.3%; Other taxes: 224.3%

Sierra Leone is rich in mineral resources, possessing some of the rarest and most valuable mineral types in the world, many of which are found in significant quantities.

Capital: Freetown

GDP (PPP) 2009 estimate

- Total $4.585 billion

- Per capita $759

GDP (nominal) 2009 estimate

- Total $1.877 billion

- Per capita $311

Currency: Leone

Economy:

The country is among the top 10 diamond producing nations in the world. Mineral exports remain the main foreign currency earner.

Sierra Leone is perhaps best known for its blood diamonds that were mined and sold to De Beers and other diamond conglomerates during the civil war.

Besides, it's economy depends on agriculture, trade and tourism, manufacturing and handicrafts, construction, and electricity and water.

NOTE: Profit tax: Corporate Income Tax, etc; Other taxes: Sales Tax, Value Added Tax, etc

...

Comoros -- TTR: 217.9%

Profit tax: 31.4%; Labour tax: 0.0%; Other taxes: 186.5%

The Union of the Comoros is an archipelago island nation in the Indian Ocean.

Capital: Moroni

GDP (PPP) 2009 estimate

- Total $772 million

- Per capita $1,159

GDP (nominal) 2009 estimate

- Total $532 million

- Per capita $798

Currency: Comorian franc

Economy:

Comoros is one of the world's poorest countries.

Agriculture contributes 40 per cent to GDP, employs 80 per cent of the labour force, and provides most of the exports.

Comoros is the world's largest producer of ylang-ylang, and a large producer of vanilla.

NOTE: Profit tax: Corporate Income Tax, etc; Other taxes: Sales Tax, Value Added Tax, etc

...

Central African Republic -- TTR: 203.8%

Profit tax: 176.8%; Labour tax: 8.1%; Other taxes: 18.9%

The Central African Republic covers a land area of about 240,000 square miles (623,000 km ), and has an estimated population of about 4.4 million as per 2008.

Capital: Bangui

GDP (PPP) 2009 estimate

- Total $3.309 billion

- Per capita $745

GDP (nominal) 2009 estimate

- Total $1.986 billion

- Per capita $447

Currency: Central African franc

Economy:

The economy of the CAR is dominated by the cultivation and sale of food crops such as cassava, peanuts, maize, sorghum, millet, sesame, and plantain.

The CAR's largest import partner is South Korea (20.2 per cent), followed by France (13.6 per cent) and Cameroon (7.7 per cent), while its largest export partner is Japan (40.4 per cent), followed by Belgium (9.8 per cent) and China (8.2 per cent).

Diamonds constitute the most important export of the CAR, accounting for 40-55 per cent of export revenues.

NOTE: Profit tax: Corporate Income Tax, etc; Other taxes: Sales Tax, Value Added Tax, etc

...

Burundi -- TTR: 153.4%

Profit tax: 19.4%; Labour tax: 7.8%; Other taxes: 126.2%

Republic of Burundi, is a landlocked country in the Great Lakes region of Eastern Africa.

Cobalt and copper are among Burundi's natural resources. Some of Burundi's main exports include coffee and sugar.

Capital: Bujumbura

GDP (PPP) 2009 estimate

- Total $3.245 billion

- Per capita $400

GDP (nominal) 2009 estimate

- Total $1.321 billion

- Per capita $162

Currency: Burundi franc

Economy:

Burundi is one of the world's poorest countries.

Its largest industry is agriculture and its largest source of revenue is coffee, which makes up 93 per cent of Burundi's exports.

Besides agriculture, other industries include: assembly of imported components; public works construction; food processing, and light consumer goods such as blankets, shoes, and soap.

NOTE: Profit tax: Corporate Income Tax, etc; Other taxes: Sales Tax, Value Added Tax, etc

...

Argentina -- TTR: 108.2%

Profit tax: 2.8%; Labour tax: 29.4%; Other taxes: 76.0%

Argentina is the second largest country in South America, after Brazil.

Capital: Buenos Aires

GDP (PPP) 2010 estimate

- Total $632.223 billion

- Per capita $15,603

GDP (nominal) 2010 estimate

- Total $351.015 billion

- Per capita $8,663

Currency: Peso

Economy:

Argentina has a market-oriented economy with abundant natural resources.

The nation's services sector accounts for around 59 per cent of the economy and 72 per cent of employment, manufacturing is 21 per cent of GDP and 13 per cent of employment, and agriculture is 9 per cent of GDP, with 7 per cent of employment; constructon, mining, and public utilities divide the rest.

NOTE: Profit tax: Corporate Income Tax, etc; Other taxes: Sales Tax, Value Added Tax, etc

...

Uzbekistan -- TTR: 95.6%

Profit tax: 1.6%; Labour tax: 27.1%; Other taxes: 66.9%

Republic of Uzbekistan shares borders with Kazakhstan to the west and to the north, Kyrgyzstan and Tajikistan to the east, and Afghanistan and Turkmenistan to the south.

Capital: Tashkent

GDP (PPP) 2010 estimate

- Total $85.188 billion

- Per capita $3,015

GDP (nominal) 2010 estimate

- Total $37.290 billion

- Per capita $1,320

Currency: Uzbekistan som

Economy:

Uzbekistan's economy relies mainly on commodity production, including cotton, gold, uranium, potassium, and natural gas.

NOTE: Profit tax: Corporate Income Tax, etc; Other taxes: Sales Tax, Value Added Tax, etc

...

Tajikistan -- TTR: 86.0%

Profit tax: 17.7%; Labour tax: 28.5%; Other taxes: 39.8%

Republic of Tajikistan is a mountainous landlocked country in Central Asia.

Capital: Dushanbe

GDP (PPP) 2009 estimate

- Total $13.666 billion

- Per capita $2,103

GDP (nominal) 2009 estimate

- Total $4.982 billion

- Per capita $767

Currency: Somoni

Economy:

Tajikistan was the poorest republic of the Soviet Union and is the poorest country in Central Asia.

The current economic situation remains fragile, largely owing to corruption, uneven economic reforms, and economic mismanagement.

The primary sources of income in Tajikistan are aluminium production, cotton growing and remittances from migrant workers.

Aluminium industry is represented by the state-owned Talco - the biggest aluminium plant in Central Asia and one of the biggest in the world.

In 2010, remittances from Tajik labour migrants totaled an estimated $2.1 billion.

NOTE: Profit tax: Corporate Income Tax, etc; Other taxes: Sales Tax, Value Added Tax, etc

...

Eritrea -- TTR: 84.5%

Profit tax: 8.8%; Labour tax: 0.0%; Other taxes: 75.7%

State of Eritrea is a country in the Horn of Africa bordered by Sudan in the west, Ethiopia in the south, and Djibouti in the southeast.

Eritrea's size is approximately 117,600 km2 (45,406 sq mi) with an estimated population of 5 million.

Capital: Asmara

GDP (PPP) 2010 estimate

- Total $3.598 billion

- Per capita $676

GDP (nominal) 2010 estimate

- Total $2.254 billion

- Per capita $424

Currency: Nakfa

Economy:

Like the economies of many other African nations, Eritrean economy is largely based on subsistence agriculture, with 80 per cent of the population involved in farming and herding.

Drought has often created trouble in the farming areas.

NOTE: Profit tax: Corporate Income Tax, etc; Other taxes: Sales Tax, Value Added Tax, etc

Click on NEXT to know about nations with the lowest corporate tax rate...

Following are the nations with lowest corporate tax rates...

Timor-Leste -- TTR: 0.2%

Profit tax: 0%; Labour tax: 0%; Other taxes: 0.2%

Timor-Leste, the small country of 15,410 km (5,400 sq mi) is located about 640 km (400 mi) northwest of Darwin, Australia.

Capital: Dili

GDP (PPP) 2009 estimate

- Total $2.741 billion

- Per capita $2,521

GDP (nominal) 2009 estimate

- Total $590 million

- Per capita $542

Currency: US dollar

Economy:

Prior to and during colonisation, Timor was best known for its sandalwood.

Timor-Leste has a large and potentially lucrative coffee industry.

Currently three foreign banks have a branch in Dili: Australia's ANZ, Portugal's Banco Nacional Ultramarino, and Indonesia's Bank Mandiri.

NOTE: Profit tax: Corporate Income Tax, etc; Other taxes: Sales Tax, Value Added Tax, etc

...

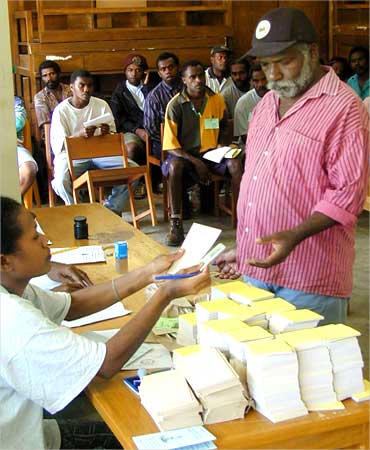

Vanuatu -- TTR: 8.4%

Profit tax: 0%; Labour tax: 4.5%; Other taxes: 3.9%

Republic of Vanuatu is an island nation located in the South Pacific Ocean.

Capital: Port Vila

GDP (PPP) 2009 estimate

- Total $1.141 billion

- Per capita $4,737

GDP (nominal) 2009 estimate

- Total $635 million

- Per capita $2,635

Currency: Vanuatu vatu

Economy:

The four mainstays of the economy are agriculture, tourism, offshore financial services, and cattle raising.

Tax revenues come mainly from import duties and a 12.5 per cent VAT on goods and services.

Agriculture is used primarily for consumption as well as for export. It provides a livelihood for 65 per cent of the population.

Tourism brings in much-needed foreign exchange. Financial services are an important part of the economy.

NOTE: Profit tax: Corporate Income Tax, etc; Other taxes: Sales Tax, Value Added Tax, etc

...

Maldives -- TTR: 9.3%

Profit tax: 0%; Labour tax: 0%; Other taxes: 9.3%

Republic of Maldives is an island nation in the Indian Ocean.

Capital: Male

GDP (PPP) 2009 estimate

- Total $1.688 billion

- Per capita $4,894

GDP (nominal) 2009 estimate

- Total $1.357 billion

- Per capita $3,932

Currency: Maldivian rufiyaa

Economy:

Maldives' largest industry is tourism, accounting for 28 per cent of GDP and more than 60 per cent of the nation's foreign exchange receipts.

Fishing is the second leading sector.

NOTE: Profit tax: Corporate Income Tax, etc; Other taxes: Sales Tax, Value Added Tax, etc

...

Namibia -- TTR: 9.6%

Profit tax: 4%; Labour tax: 1%; Other taxes: 4.6%

The Republic of Namibia s the second least densely populated country in the world, after Mongolia.

Capital: Windhoek

GDP (PPP) 2009 estimate

- Total $13.771 billion

- Per capita $6,614

GDP (nominal) 2009 estimate

- Total $9.459 billion

- Per capita $4,543

Currency: Namibian dollar

Economy:

Agriculture, herding, tourism and the mining industry - including mining for gem diamonds, uranium, gold, silver, and base metals form the backbone of Namibia's economy.

NOTE: Profit tax: Corporate Income Tax, etc; Other taxes: Sales Tax, Value Added Tax, etc

...

Macedonia -- TTR: 10.6%

Profit tax: 6.2%; Labour tax: 0.6%; Other taxes: 3.8%

Republic of Macedonia is a country located in the central Balkan peninsula in Southeastern Europe.

Capital: Skopje

GDP (PPP) 2010 estimate

- Total $19.330 billion

- Per capita $9,350

GDP (nominal) 2010 estimate

- Total $9.580 billion

- Per capita $4,634

Currency: Macedonian dinar

Economy:

Recently ranked as the fourth 'best reformatory state' out of 178 countries ranked by the World Bank, Macedonia has undergone considerable economic reform since independence.

The current government introduced a flat tax system with the intention of making the country more attractive to foreign investment.

Textiles represent the most significant sector for trade, accounting for more than half of total exports.Other important exports include iron, steel, wine and vegetables.

NOTE: Profit tax: Corporate Income Tax, etc; Other taxes: Sales Tax, Value Added Tax, etc

...

Qatar -- TTR: 11.3%

Profit tax: 0%; Labour tax: 11.3%; Other taxes: 0%

The State of Qatar is an oil- and gas-rich nation, with the third largest gas reserves, and the highest GDP per capita in the world.

Capital: Doha

GDP (PPP) 2010 estimate

- Total $102.147 billion

- Per capita $90,149

GDP (nominal) 2010 estimate

- Total $110.844 billion

- Per capita $81,963

Currency: Riyal

Economy:

Qatar's national income primarily derives from oil and natural gas exports.

NOTE: Profit tax: Corporate Income Tax, etc; Other taxes: Sales Tax, Value Added Tax, etc

...

United Arab Emirates -- TTR: 14.1%

Profit tax: 0%; Labour tax: 14.1%; Other taxes: 0%

The United Arab Emirates consists of seven states -- Abu Dhabi, Ajman, Dubai, Fujairah, Ras al-Khaimah, Sharjah and Umm al-Quwain.

Capital: Abu Dhabi

GDP (PPP) 2010 estimate

- Total $182.876 billion

- Per capita $40,175

GDP (nominal) 2010 estimate

- Total $252.736 billion

- Per capita $36,175.966

Currency: UAE dirham

Economy:

The UAE has an open economy with one of the highest per capita incomes in the world.

Petroleum and natural gas exports play an important role in the economy, especially in Abu Dhabi.

A massive construction boom, an expanding manufacturing base, and a thriving services sector are helping the UAE diversify its economy.

Aluminum, steel, iron and other forms of metal exports along with textile produce a significant amount of income.

Major increases in imports occurred in manufactured goods, machinery, and transportation equipment.

NOTE: Profit tax: Corporate Income Tax, etc; Other taxes: Sales Tax, Value Added Tax, etc

...

Saudi Arabia -- TTR: 14.5%

Profit tax: 2.1%; Labour tax: 12.4%; Other taxes: 0%

The Kingdom of Saudi Arabia is the third largest Arab country and the largest country in East Asia.

Capital: Riyadh

GDP (PPP) 2010 estimate

- Total $618.744 billion

- Per capita $23,701.260

GDP (nominal) 2010 estimate

- Total $438.009 billion

- Per capita $16,778.112

Currency: Saudi riyal

Economy:

Saudi Arabia's command economy is petroleum-based; roughly 75 per cent of budget revenues and 90 per cent of export earnings come from the oil industry.

NOTE: Profit tax: Corporate Income Tax, etc; Other taxes: Sales Tax, Value Added Tax, etc

...

Bahrain -- TTR: 15.0%

Profit tax: 0%; Labour tax: 14.6%; Other taxes: 0.4%

The Kingdom of Bahrain is a small island country with 1,234,596 inhabitants (2010), located near the western shores of the Persian Gulf.

Capital: Manama

GDP (PPP) 2009 estimate

- Total $28.275 billion

- Per capita $27,214

GDP (nominal) 2009 estimate

- Total $20.590 billion

- Per capita $19,817

Currency: Bahraini dinar

Economy:

Bahrain has the fastest growing economy in the Arab world.

A large share of exports consists of petroleum products made from imported crude oil.

Unemployment, especially among the young, and the depletion of both oil and underground water resources are major long-term economic problems.

NOTE: Profit tax: Corporate Income Tax, etc; Other taxes: Sales Tax, Value Added Tax, etc

...

Georgia -- TTR: 15.3%

Profit tax: 13.3%; Labour tax: 0%; Other taxes: 2.0%

Georgia is a sovereign state in the Caucasus region of Eurasia.

Capital: Tbilisi

GDP (PPP) 2010 estimate

- Total $22.194 billion

- Per capita $5,075

GDP (nominal) 2010 estimate

- Total $11.234 billion

- Per capita $2,559

Currency: Lari

Economy:

Throughout Georgia's modern history agriculture and tourism have been principal economic sectors, because of the country's climate and topography.

Tourism is an increasingly significant part of the Georgian economy.

NOTE: Profit tax: Corporate Income Tax, etc; Other taxes: Sales Tax, Value Added Tax, etc