Photographs: Ajay Verma/Reuters Jaimini Bhagwati

The United States and euro zone governments are contending with sceptical electorates as they grope for that elusive mix of policies to contain fiscal deficits, reduce sovereign debt-to-GDP ratios (on average about 110 per cent for advanced economies) and address banking sector weakness -- even as they try to bolster employment and maintain social welfare benefits.

Political opponents can be expected to misrepresent government initiatives and engage in competitive posturing domestically.

. . .

Why financial TSUNAMIS are expected soon

Image: Labourers work at the construction site of a flyover on the outskirts of Ahmedabad.Photographs: Amit Dave/Reuters

However, independent observers too have sharply divergent views about the policies being pursued in the US, Euro area and Japan -- advocating either more or less emphasis on austerity, another round of quantitative easing and/or Keynesian pump priming.

Amid all this uncertainty, it is worth reviewing the import of key pronouncements at the International Monetary Fund-World Bank annual meetings held in Tokyo from October 9 to 14, 2012.

For instance, the US acknowledged the need to reduce its fiscal deficit and indicated its support for the fledgling moves towards a banking union within the euro zone.

. . .

Why financial TSUNAMIS are expected soon

Image: Mobile cranes prepare to stack containers at Thar Dry Port in Sanand in Gujarat.Photographs: Amit Dave/Reuters

The UK was explicit about challenges faced by the euro area and that presented by the 'US fiscal cliff' (current political impasse between Democrats and Republicans could result in spending cuts and re-imposition of taxes from early 2013 equivalent to fiscal tightening of about five per cent of GDP).

The UK does not favour regulatory forbearance for European banks that are lagging on Basel III norms for capital and liquidity.

Japan was explicit about its fiscal consolidation efforts aimed at halving the primary budget deficits of its national and local governments over the next three years.

. . .

Why financial TSUNAMIS are expected soon

Image: A worker fills a car with diesel at a fuel station in Ahmedabad.Photographs: Amit Dave/Reuters

Japan also expressed concern about the US fiscal cliff and Europe's debt and financial sector problems.

According to Japan, the additional $450 billion pledged to the International Monetary Fund by its members and the doubling of funds available under the Chiang Mai Initiative, promoted by the Asean Plus Three, to $240 billion should enhance the international financial system's ability to withstand future shocks.

The underlying sentiment in China's statement was that the fiscal consolidation plans of the US and Japan lack credibility and that considerable uncertainty persists about the euro area.

. . .

Why financial TSUNAMIS are expected soon

Japan also expressed concern about the US fiscal cliff and Europe's debt and financial sector problems.

According to Japan, the additional $450 billion pledged to the International Monetary Fund by its members and the doubling of funds available under the Chiang Mai Initiative, promoted by the Asean Plus Three, to $240 billion should enhance the international financial system's ability to withstand future shocks.

The underlying sentiment in China's statement was that the fiscal consolidation plans of the US and Japan lack credibility and that considerable uncertainty persists about the euro area.

. . .

Why financial TSUNAMIS are expected soon

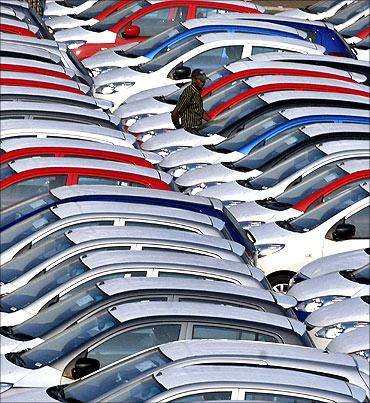

Photographs: Reuters

The official communique of the International Financial and Monetary Committee suggested that there should be 'timely implementation of an effective banking and stronger fiscal union' in the euro area.

The communique also flagged the risks stemming from volatile cross-border capital flows.

In the light of the IMF's latest less optimistic updates on its World Economic Outlook numbers and what was stated at last week's IMF-World Bank meetings, India should assume that the international financial-economic environment could deteriorate further.

. . .

Why financial TSUNAMIS are expected soon

Image: Robots work at Ford plant.Photographs: Reuters

The bottom line is that India remains vulnerable to the risk of a reduction in capital inflows and, clearly, we should not depend on multilateral financial institutions to provide bridge financing.

It follows that we need urgent and persistent action to: a) eliminate primary (revenue) deficits at central and state government levels; b) improve current account balances including through exchange rate management, but not additional capital controls; c) boost private sector investment by recalibrating rupee interest rates; d) raise foreign exchange reserves since these have shrunk in terms of import cover from around 12 months at end-March 2008 to about six months at end-March 2012.

. . .

Why financial TSUNAMIS are expected soon

Photographs: Reuters

For now we need not be distracted by issues such as how and when to increase capital account convertibility, or pay excessive attention to sovereign credit ratings assigned to India.

Turning back to global factors that affect India, despite the flood of liquidity unleashed in dollars and euros, banks in large developed economies remain focused on reducing their debt exposure.

In fact, it is only this month that funding costs for European banks have fallen below those of investment-grade companies.

One of the several unintended consequences of this greater liquidity for India is that we again see a rise in the volume of 'carry' trades (borrow in low interest rate currencies such as the dollar, euro and yen to invest in higher interest rate currencies like the rupee).

. . .

Why financial TSUNAMIS are expected soon

Image: India's Finance Minister P Chisambaram.Photographs: Reuters

A build-up of such transactions gets unwound in ways that can be unpredictably disruptive.

One of the difficulties of monitoring and regulating too-big-to-fail financial institutions has been correctly characterised by Andrew Haldane, executive director for financial stability at the Bank of England, as their 'too complex to price' transactions.

In India, we should be thinking about how best to track the transactions of banks, non-bank finance companies and companies with deliberately complicated holding company structures.

Additionally, we need to tighten audit norms and oversight of firm-specific audit committees.

. . .

Why financial TSUNAMIS are expected soon

Photographs: Reuters

This needs relentless effort and this is evident, at an international level, from the tardy progress made till now in harmonising the regulations of the International Accounting Standards Board and the US Financial Accounting Standards Board.

Hans Hoogervorst, chairman of the IASB, is reported to have stated on October 14 that this convergence of norms process has become 'dysfunctional' as there has been little progress, even though efforts have been on for the last 10 years.

In the US and the UK, there has been some talk about how to wean talent back from the overcompensated financial sector to the real sectors.

. . .

Why financial TSUNAMIS are expected soon

Photographs: Reuters

As of now, there is very little resonance with this in India. Our trend still seems to be for those with quantitative abilities and degrees in physical sciences or engineering to move to financial institutions after some training in finance.

To sum up, at the risk of sounding alarmist we should anticipate the financial-economic tsunamis that may be brewing in local and distant locations.

Foreign and domestic investors could be expected to take market, credit and operational risks in their stride to invest in India.

It is too much to expect that they would put up indefinitely with legal and accounting uncertainty on top of a stop-go type of policy environment.

The author is the High Commissioner for India in the UK. These views are his own.

article