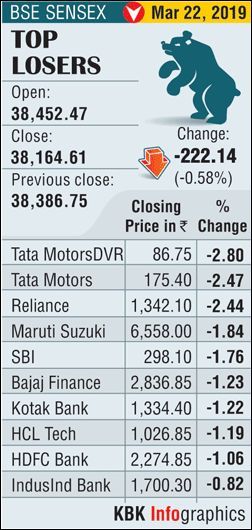

Tata Motors was the biggest loser in the Sensex pack, tumbling 2.47 per cent, followed by Reliance Industries (2.44 per cent), Maruti (1.84 per cent), SBI (1.76 per cent) and Bajaj Finance (1.23 per cent).

Illustration: Uttam Ghosh/Rediff.com

Snapping its eight-day winning streak, the BSE benchmark Sensex tumbled over 222 points on Friday as investors scrambled to book profits after the recent rally while ratings agency Fitch slashed India's growth forecast.

Lacklustre global cues and a depreciating rupee also weighed on the markets, analysts said.

The 30-share index opened on a positive note at 38,452.47, but soon succumbed to heavy selling pressure, touching an intra-day low of 38,089.36. It finally closed at 38,164.61, down by 222.14 points, or 0.58 per cent.

On similar lines, the NSE Nifty shed 64.15 points, or 0.56 per cent, to finish at 11,456.90.

On a weekly basis, the Sensex added over 140 points, while the wider Nifty gained 30 points.

On a weekly basis, the Sensex added over 140 points, while the wider Nifty gained 30 points.

Fitch Ratings on Friday cut India's GDP growth forecast for the next fiscal to 6.8 per cent from 7 per cent estimated earlier on weaker than expected economic momentum.

In its latest Global Economic Outlook, Fitch also slashed GDP growth forecast for current fiscal ending March 2019 to 6.9 per cent from 7.2 per cent projected in the December edition.

Tata Motors was the biggest loser in the Sensex pack, tumbling 2.47 per cent, followed by Reliance Industries (2.44 per cent), Maruti (1.84 per cent), SBI (1.76 per cent) and Bajaj Finance (1.23 per cent).

NTPC emerged as the biggest gainer in the index, spurting 3.67 per cent. Other winners included L&T, Asian Paints, Tata Steel and PowerGrid, rising up to 1.54 per cent.

"Domestic market ended on a weak note as investors turned to profit booking given the sharp rally in last two weeks and weak global cues. US Fed has indicted that there will be no rate hike this year and ended its ongoing QE tightening program due to concern over economic growth.

"On the other hand, uncertainties over Brexit deal and delay in trade deal between US-China continued to impact global markets. Global bond yields were on decline as global central banks were tweaking their monetary policy to support growth, this is likely to benefit emerging markets like India in the medium term," said Vinod Nair, Head of Research, Geojit Financial Services.

Foreign institutional investors (FIIs) remained net buyers in the capital markets, putting in Rs 1,771.61 crore on a net basis Wednesday, as per provisional data.