NSE Nifty sank 127.80 points, or 1.03 per cent, to 12,224.55. According to traders, besides stock-specific action, domestic investors were also seen booking profits at record peaks.

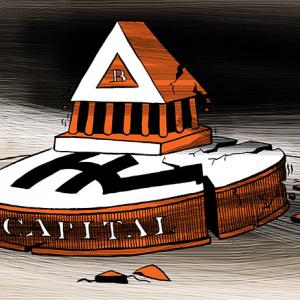

Retreating from its record peak, market benchmark Sensex closed 416 points lower on Monday, tracking an intense sell-off in index heavyweights Reliance Industries, Kotak Bank, HDFC Bank and TCS following their quarterly results.

After hitting a record intra-day high of 42,273.87, the 30-share BSE Sensex gave up all gains to settle 416.46 points, or 0.99 per cent, lower at 41,528.91.

Likewise, the broader NSE Nifty sank 127.80 points, or 1.03 per cent, to 12,224.55.

It hit a record intra-day high of 12,430.50 in early session.

Kotak Mahindra Bank was the biggest laggard in the Sensex pack, dropping 4.70 per cent, after the lender reported a rise in non-performing assets in Q3.

Reliance Industries, HDFC Bank and TCS fell up to 3.08 per cent after the companies reported their quarterly earnings over the weekend.

On the other hand, PowerGrid was the top gainer, rising 3.75 per cent, followed by Bharti Airtel, ITC, Asian Paints, ICICI Bank and L&T.

According to traders, besides stock-specific action, domestic investors were also seen booking profits at record peaks.

Bourses in Shanghai, Tokyo and Seoul ended higher, while Hong Kong closed in the red.

Brent crude oil futures rose 0.66 per cent to $65.28 per barrel on supply concerns after exports from Libya were blocked after a pipeline was shut down by armed forces and a strike at a key oil field in Iraq hit output.

Photograph: Danish Siddiqui/Reuters