Overall forex market sentiment suffered a sudden reversal of fortune contrary to expectation largely moving in line with local equities, reversing all early strong gains.

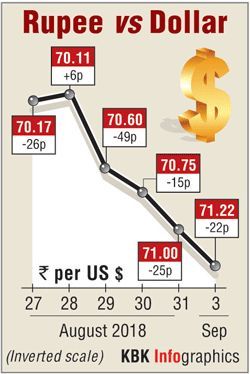

The Indian rupee on Monday crashed to yet another historic low of 71.21, losing 21 paise at the close against the US dollar as nagging concerns over rising crude oil prices and trade war tensions continued to hurt forex market sentiment.

It was a virtual collapse for the Indian unit during the late afternoon session despite a strong start as investors hit the panic button and even government's efforts to calm investor nerves failed to yield any result.

A sharp rally in global crude prices further dampened the overall trading mood.

Benchmark Brent crude oil was trading at $78 a barrel.

The domestic currency opened with strong gains largely helped by weekend robust macro numbers also some technical bounces after recent record fall.

The domestic currency opened with strong gains largely helped by weekend robust macro numbers also some technical bounces after recent record fall.

However, overall forex market sentiment suffered a sudden reversal of fortune contrary to expectation largely moving in line with local equities, reversing all early strong gains.

India's economy grew at a delightful 8.2 per cent rate in April-June this year after the twin shocks of cash ban in 2016 and the chaotic introduction the GST last year, reclaiming its position as the fastest growing major global economy this year.

The central bank has recently pulled several moves to support its currency including its foreign cash reserves along with raising its interest rate twice with the last in August to pre-empt any fresh bout of currency rout as the global trade war escalates.

Heightened risk associated with the swelling current account deficit against the grim backdrop of surging global crude prices and global turmoil have all contributed to excess volatility on the trading front.

Escalating global trade tensions could prompt further weakening the domestic currency along with exodus of capital from a nation also added excess volatility.

The bond yield curve also jumped substantially to hit multi-year high of 8 per cent.

With year-to-data, the rupee has fallen by 11 per cent - making it the worst-performing currency in Asia.

Crude prices supported by concerns that falling Iranian output will tighten markets once US sanctions bite from November but gains were limited by higher supply from OPEC and the United States.

Meanwhile, petrol and diesel prices climbed new highs across the country driven by combination of surging global crude prices and falling rupee value, stoking inflationary pressure in the economy.

In the meantime, foreign investors infused over Rs 5,100 crore into the country's capital market in August on improvement on the macro front, better corporate earnings.

The latest inflow comes following a net infusion of over Rs 2,300 crore in the capital market -- both equity and debt -- in July.

Country's foreign exchange reserves jumped $445.4 million to $401.293 billion in the week to August 24, on an increase in currency assets, RBI data showed.

In early trade, the rupee resumed on a firm foot at 70.80 against weekend close of 71.00 at the inter-bank foreign exchange (forex) market.

It later strengthened to hit a high of 70.71 following bouts of dollar selling by banks before taking a sudden U-turn in late afternoon deals.

The home currency witnessed heavy downside selling pressure with unexplained fatigue and exhaustion towards the fag-end trade and finally ended at the historic level of 71.21, showing a steep loss of 21 paise, or 0.30 per cent.

The Financial Benchmarks India private limited (FBIL) meanwhile fixed the reference rate for the dollar at 70.7695 and for the euro at 82.1445.

In the cross currency trade, the rupee remained under pressure against the euro to finish at 82.72 from 82.69 and also weakened against the Japanese yen to settle at 64.10 per 100 yens from 64.07 last Friday.

However, the local unit recovered against the British pound to close at 91.65 per pound from 92.12 earlier.

On the global front, the Dollar was broadly higher largely, benefitting from perceived haven status, apparent impasse in trade talks between Canada and the US.

Hardening worries about US tensions with China were also kept alive by a report last week that Trump had told aides he was ready to impose tariffs on an additional $200 billion worth of imports from China as soon as a public comment period on the plan ends on Thursday.

Against a basket of other currencies, the dollar index is up at 95.09.

In forward market on Monday, premium for dollar showed a mixed trading owing to lack of market moving factors.

Photograph: Francis Mascarenhas/Reuters