Underpinning this interest from PEs is the government backing for the sector, starting from the grant of infrastructure status to the logistics and warehousing industry in 2017 and the drafting of an independent national policy framework for the states to ensure uniformity in rules across the country, reports T E Narasimhan.

For logistics companies in India, though still freighted with inefficiencies, many things have started to go right.

Investment flow into the sector in the first half of the year has surpassed last year's full-year investment, kicking the industry into high gear.

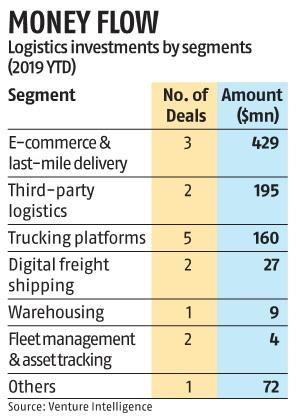

According to Venture Intelligence data, nearly $896 million was invested by PEs during the first half of 2019 across 16 deals, as against $682 million across 18 deals a year ago.

A slew of factors from the implementation of the Goods and Services Tax, emergence of a set of technology-backed start-ups improving efficiency of logistics companies and existing players expanding operation buoyed by the government's massive spending plan for infrastructure has brought the sector into the limelight, making it more attractive than ever to private equity investors.

Underpinning this interest from PEs is the government backing for the sector, starting from the grant of infrastructure status to the logistics and warehousing industry in 2017 and the drafting of an independent national policy framework for the states to ensure uniformity in rules across the country.

The final policy is expected to be notified soon and the National Act will serve as a policy guideline in terms of laying down a common national outlook for states when they draft their respective policies.

Some of the big-ticket fund raising, according to Venture Intelligence Data, are by Delhivery ($429 milllion) -- which also achieved unicorn status this year-- Kribhco Infrastructure ($195 million), Blackbuck ($160 million), and Locus ($26 million).

The choice of companies is a testimony to how investors are bullish on start-ups that help bring efficiency, thereby improving asset utilisation, and, in turn, putting more money into the truckers pocket while reducing logistics cost.

The industry is ripe for such a surge in interest, with its size projected to increase to $215 billion in the next three years from around $160 billion currently.

To a large extent, the need for efficiency is being driven by competition among e-commerce companies to deliver goods ever more quickly.

Tied to this is the focus on bringing down logistics costs for manufacturers.

Currently, logistics costs account for 13-17 per cent of the GDP in India, which is nearly double (6-9 per cent) the logistics costs in developed countries such as France and the US, according to a Knight Frank report.

Much of the higher cost could be attributed to the absence of efficient inter-modal and multi-modal transport systems.

But things are changing.

One thing that has been completely streamlined for the industry with the implementation of GST is taxation.

"Today, with organised players expanding and new technologies coming in, logistics industry is becoming more efficient and GST was an enabler to it," says Rajesh Jaggi, managing partner - real estate, The Everstone Group, a PE and real estate investment firm.

A logical next step the industry is working on is to bring in operational efficiencies.

Several companies have started to expand last-mile delivery, for instance.

Everstone Group's IndoSpace, an industrial real estate developer, has recently raised $580 million, of which around $250 million will be deployed in India in expanding operations.

Over the next five years, IndoSpace plans to increase its warehousing capacity to 80-100 million sq. ft. from 30-31 million sq. ft. as demand for warehousing is increasing, Jaggi added.

Traditionally, the port sector received the most attention from investors but now e-commerce, last-mile delivery, third-party logistics, trucking platforms, digital freight shipping, fleet management and asset tracking, besides warehousing are gaining favour. (see table)

The focus on last-mile delivery is more than just a cost-saving or profit enhancing strategy for companies.

For e-commerce, for instance, this is a matter of life and death as customers are quick to form their opinion about a company based on their delivery experience.

Several start-ups have come up focusing on bringing the offline business of truckers online.

"We believe technology is transforming logistics in India and across the world.

"We are excited to partner with BlackBuck, which is India's largest technology enabled logistics system.

"It's full-stack model is able to add value for both shippers and carriers," said Kabir Narang, general partner and co-head of Asia at B Capital, which serves as a launchpad for entrepreneurs by funding their business.

The fund is backing BlackBuck, a B2B inter-city full truckload marketplace, which raised nearly $203 million from investors, including B Capital Group, Wellington Management, Accel USA, IFC, Goldman Sachs and others.

Ramasubramaniam B, co-founder and chief operating office-strategic initiatives, BlackBuck, said increasing the utilisation of trucks is the main goal of the company.

As things stand today, out of 30 days in a month, trucks in India are idle for 12, compared to 5-6 days in the US, due to a lack of return load and inefficiencies in operations.

The platform addresses the issues of truckers to book a load and enables shipper to have access to the right truck, at the right time for the right price.

"More a truck is on the road, more money the owners make," said Ramasubramaniam.

BlackBuck claims trucks that are on the company's platform are running for nearly 22 days in a month and clocking in 30 to 40 per cent more kilometres than other trucks.

BlackBuck has over 3,00,000 partner trucks on its platform and the company has over 10,000 plus clients including Asian Paints, Coca Cola, ITC, Tata Steel and Hindustan Unilever.

A similar start-up, Rivigo, has nearly 100,000 trucks on its platform.

Gazal Kalra, co-founder of Rivigo, said her company's platform increased the utilisation of trucks by 40-50 per cent.

Three major things which the company addresses are price discovery, demand generation and asset maintenance.

Another area where PE money is flowing in is warehousing.

According to Anarock Research, nearly $1.1 billion was invested in logistics and warehousing sectors between Q1 2017 and Q1 2019 compared to no investments at all during 2015 and 2016.

Knight Frank report said 2018 saw a total area of 4.3 million sq ft transacted in the top eight warehousing markets in the country, a 77 per cent growth over 2017.

Total warehousing space is estimated to grow at a CAGR of five per cent in the next five years to 922 million sq ft by 2024.

All this new space being created by the industry and the tech-enabled platforms creating swifter delivery of goods are certain to shake-up the industry and take the headache out of logistics for manufacturers.