Global oil prices have slumped and India has access to larger amounts of discounted Russian crude oil, yet refiners are not passing on their savings to consumers.

Minister of Petroleum and Natural Gas Hardeep Singh Puri extolled the virtues of affordable fuels to Indian consumers in a speech he gave at a CII event titled 'Powering Amrit Kaal Through Energy Transition'.

'India has successfully been able to modulate the effective price to consumers, thus insulating the common man from price rise and volatility in international prices,' the minister said.

Agreed, Indian consumers were insulated when fuel prices touched near records in the early part of 2022. But motorists are now overpaying for fuels after international rates of petrol and diesel crashed 40 to 50 per cent from last year's record levels.

The question that arises is whether Indian State-run oil companies led by IOC, which holds the biggest share of India's $200 billion oil products market, are making fuels affordable for Indian households.

High fuel prices feed into India's inflation, sticky interest rates, and crimp households' disposable income.

Ramesh Rajan's family of four, comprising three working professionals and a student, have been paying over Rs 100 for over a year for a litre of petrol in the south Indian temple town of Madurai.

Rajan, a consulting engineer with a two-wheeler manufacturer, questioned why he still continues to pay the same amount at the pump despite a decline in international prices, and with cheap Russian crude flowing into Indian refineries.

IOC and BPCL were also profitable for the whole of FY23 despite facing headwinds in the early part of the financial year after Russia's invasion of Ukraine roiled commodity markets.

When IOC, HPCL and BPCL were asked why consumers like Ramesh are not benefiting from the low global rates of both crude and transport fuels, HPCL and BPCL said they cannot comment on this issue. IOC chose not to reply.

On paper, Indian refiners are obligated to adjust pump prices every day, or, at least every fortnight, in line with international product prices. In practice, they have given rate adjustments a quiet burial.

One of the biggest achievements of the Modi government's nine-year reign was lifting price controls on oil product prices in 2014.

New Delhi gave IOC, BPCL and HPCL the power to charge market prices for fuels.

Price reforms also sent a signal to the world that India, arguably the world's fastest growing market for fuels, welcomes investments in refining and marketing.

But since April 2022, prices of transport fuels have remained unchanged, barring an adjustment in federal taxes.

During this period, the price of the Indian crude basket oscillated between $116 a barrel in June 2022 and $75 a barrel in May 2023.

This price does not take into account the $10-$15 a barrel discounts Indian refiners enjoyed by importing Russian crude -- Moscow supplied 44 per cent of India's fuel needs in May, data from market analytics firm Kpler show.

Indian State refiners have saved billions of dollars from importing cheap Russian grades, which is reflected in record refining margins.

IOC was the biggest buyer of Russian crude in May at 22 million barrels, accounting for 36 per cent of India's imports from Russia and around half of the company's overall May crude imports, Kpler data on loadings show.

Assuming a discount of even $10 a barrel on landed Russian barrels, IOC may have saved around $220 million this month.

The company's average gross refining margins, a function of crude costs, rose 73 per cent last financial year to $19.5 per barrel.

IOC, on a standalone basis, ended the financial year with a net profit of Rs 8,242 crore (Rs 82.42 billion), despite a net loss of around Rs 1,993 crores (Rs 19.93 billion) in the first quarter.

State refiners bought 154 million barrels of Russian crude in calendar 2022 and 167 million barrels so far this year, according to Kpler, which, at prevailing discounts, may have resulted in $3.2 billion in savings.

State refiners said domestic product prices are pegged to international petrol and diesel rates. They do not track crude movements.

Agreed, but the price of petrol oscillated between $149 a barrel last June and $85 a barrel in both December 2022 and in May 2023; the price of diesel, India's most consumed fuel and a contributor to inflation, shifted between $171 a barrel last June and $85 a barrel this May.

The reference rates of diesel and petrol used by Indian refiners to price fuels locally involve processing of fully priced crudes, not discounted Russian oil.

So pump prices in India are also fully priced, and do not reflect the discounts that refiners enjoy from processing cheaper Russian grades.

The average crude price flirted with an average $100 a barrel levels in the first five months of 2022, a period when refiners posted losses; petrol averaged $127 a barrel during the period, and diesel averaged $148 a barrel.

These prices have substantially dropped to around $85 a barrel in May.

"The GRMs [gross refining margins] are very strong for Indian refiners but on the marketing side profitability for diesel has been a recent phenomenon," said Prashant Vashisht, vice president, Icra.

Overall, he added, "it's a function of margins at refining and marketing levels."

Vasisht said marketing margins on diesel have turned positive only in the last quarter, explaining that HPCL is the most affected because its refineries do not provide adequate fuels for its own pumps, forcing it to source diesel and petrol from the market.

But State refiners have also gained from subsidies New Delhi offered to offset some of their losses.

State refiners were offered over Rs 20,000 crore (Rs 200 billion) to compensate from a loss of LPG sales.

The government has also earmarked Rs 30,000 crore (Rs 300 billion) this financial year towards capital expenditure for state refiners.

In addition, IOC, BPCL, and HPCL are making 'supernormal' margins on fuel marketing.

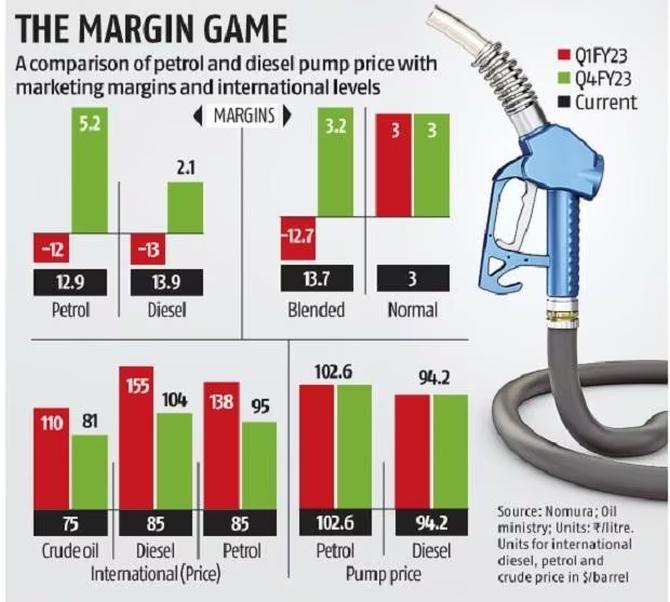

Blended margins rose to Rs 12.5 a litre in the week ended May 21, 2023, sharply above normative levels of Rs 3 a litre, said Nomura analyst Hemang Khanna in a May 24 report.

Margins were Rs 3.2 a litre in January-March 2023, and (-)Rs 12.7 a litre in April-June 2022.

Based on current crude and product prices, blended marketing margins for fuels remain at super-normal levels of Rs 10.3 a litre, driven by a significant decline in international prices, while Indian retail prices remain unchanged, Khanna said in the note.

Marketing margins for diesel are at Rs 10.8 a litre and petrol margins are at Rs 8.6 a litre.

Besides consumers like Rajan, frozen pump prices also end up hurting private sector retailers Reliance and Nayara Energy, which struggle to comprehend India's fuel pricing policy.

They were burned once in the past, in early 2000, when price reforms were scrapped.

It makes little sense to repeat history in the name of affordability, because inconsistent policies sow doubts in the minds of oil investing heavyweights like Exxon, Total, Saudi Aramco, or Adno -- on the government's commitment to energy sector reforms.

Feature Presentation: Rajesh Alva/Rediff.com