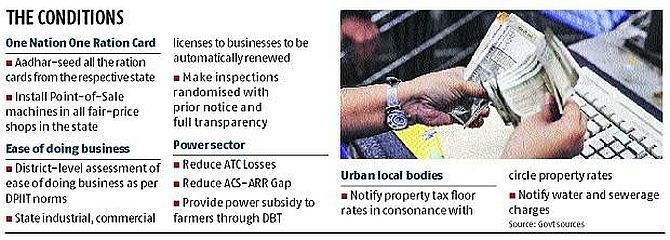

These conditions are implementation of the ‘One Nation, One Ration Card’ scheme, ease of doing business, power sector reforms, and urban local body reforms.

The finance ministry has sent a memorandum to the states listing out 10 specific targets that they have to meet to avail extra borrowing from the markets.

These conditions are implementation of the ‘One Nation, One Ration Card’ scheme, ease of doing business, power sector reforms, and urban local body reforms.

Finance Minister Nirmala Sitharaman had spoken of the conditions during her media briefing on Sunday.

Immediately after her address on Sunday afternoon, the ministry sent the missive to all the state governments explaining what that will entail.

According to senior government sources, under the ‘One Nation One Ration Card’, states should seed all ration cards with Aadhaar and install point-of-sale machines at all fair price shops.

Second, states should carry out district-level assessments, automatically renew state industrial and commercial licenses to businesses and make inspections randomised with prior notice and full transparency as part of ‘ease of doing business’.

Third, states should provide power subsidy to farmers through direct benefits transfer, reduce aggregate technical & commercial (ATC) losses and reduce the gap between average cost of supply and average realisable revenue, as part of power sector reforms.

Finally, under ‘urban local body reforms’, states have to notify property tax floor rates in consonance with circle property rates and notify water and sewerage charges.

“When you take debt, the debt market will also want to look at its sustainability.

"The lender would want to know if it is sustainable or not. Sustainability comes from two sides.

"First is that gross state domestic product (GSDP) growth should increase, the second is that deficit comes down through revenue increase or subsidy decrease,” said a top central government official.

The official said the targets were aimed at plugging leakages, maximising revenues and ensuring investment.

With the ‘One Nation One Ration Card’ targets, states’ aim should be to ensure migrants can collect ration anywhere in India, the official said, adding that seeding with Aadhaar will reduce leakages as nobody will be able to double-claim rations.

On ‘ease of doing business’, “Each state should do a district-level assessment in accordance with a standard protocol given by Department of Promotion of Industrial and Internal Trade (DPIIT).”

“There is a list of state industrial and commercial licences that businesses are expected to get.

"The renewal for these should be automatic if the businesses are abiding by the laws.

"It should not require discretionary decision by an officer,” said the official.

The official clarified that the power of inspection and fee collection by states was not being taken away.

“In specified laws, inspections must be made randomised. The same inspector will not be assigned to a firm again and again.

"Every inspection should be preceded by prior notice to the establishment. After each inspection, the report must be uploaded online.

"Such things will ensure investors don’t have bad view about our business environment,” the person said.

The power sector reforms (see table) will only have to be implemented in one district for the states to be eligible for increased borrowing, the official added.

For urban local bodies, the official said, “The floor rates of property taxes need to be in consonance with the circle rates of property. In some states, it has not been revised for 30 years, while property rates have doubled or tripled in that time.”

Acceding to states’ demand to let them borrow more in light of the resource crunch and expenditure commitments triggered by COVID-19, Sitharaman had said the Centre had increased their borrowing limit to 5 per cent of their respective GSDP, from the existing 3 per cent, for the current financial year.

Sitharaman said beyond the 3 per cent of GSDP borrowing limit, there will be an unconditional increase of 0.50 per cent. Beyond the limit of 3.5 per cent of GSDP, an increase to 4.5 per cent of GSDP will be allowed in in four tranches of 0.25 per cent, with each tranche linked to clearly specified, measurable and feasible reform action.

“Further 0.5 per cent, which will take the borrowing limit to 5 per cent of GSDP, will be allowed if milestones are achieved in at least three out of four reform areas,” she said.