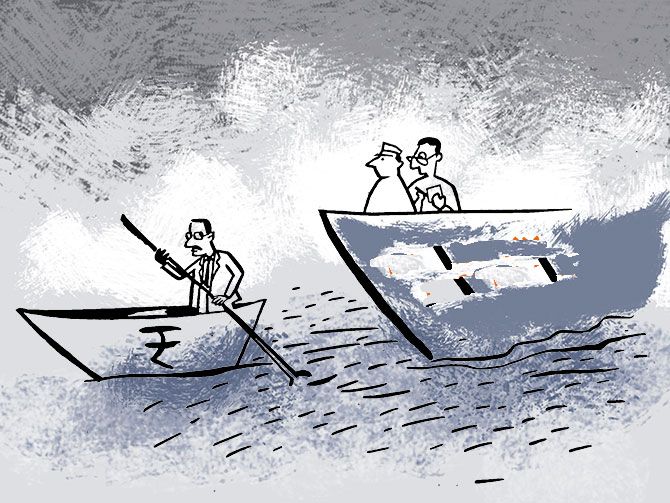

The trend in corporate earnings suggests that index earnings could fall to the levels last seen in early 2014.

The COVID-19 crisis is threatening to wipe out most of the gains in corporate earnings accrued from the September 2019 cut in corporation income tax.

The underlying earnings per share (EPS) of the benchmark Nifty 50 index are now down to Rs 428 per unit of the index from the January high of Rs 453 and inching towards the level prior to the tax cut.

The tax cut in September last year had resulted in a 10 per cent increase in the post-tax profits of index companies, and Nifty EPS shot up from around Rs 410 in the middle of September 2019 to Rs 450 after the tax cut.

Analysts expect a further decline in the index earning as more Nifty companies declare fourth quarter results over the next two weeks.

“Both Nifty and Motilal Oswal universe companies have so far missed on the pre-tax and post-tax profit front.

"FY21 earnings revision is significantly tilted in favour of downgrades and management commentaries suggest more volatility and disruption in earnings ahead with several Nifty companies seeing fresh double-digit EPS cuts for FY21,” write Gautam Duggad and Deven Mistry of Motilal Oswal Financial Services in Q4 interim earnings review.

The trend in corporate earnings suggests that index earnings could fall to the levels last seen in early 2014.

At current level, the Nifty EPS is the same as it was in the September 2014 quarter and a further 5 per cent decline will wipe out the entire earnings growth since early 2014.

The Nifty EPS was around Rs 400 during the January-March 2014 quarter.

“The collapse in India’s manufacturing and services Purchasing Managers’ Index (PMIs) and weakness in goods export data has been quite extreme when compared to other Asian countries.

"UBS India-Financial Conditions Index tightened sharply in March and April.

"We do not see any respite in May, dampening any hopes of a near-term recovery,” said Gautam Chhaochharia, head of India research at UBS Securities India.

In all, 28 Nifty firms have declared Q4 results, of which 20 reported either losses or decline in their profit before tax (PBT) on a year-on-year (YoY) basis.

The combined PBT of these 28 index firms was down 29.2 per cent YoY during Q4 while their net profit was down 18.6 per cent.

In comparison, the combined PBT of these 28 index companies was up 4 per cent during the October-December 2019 quarter (Q3FY20) while their net profit was up 12.4 per cent.

On a trailing 12-months basis, index firms’ PBT was down 9.1 per cent YoY while net profit was down 4.1 per cent during Q4 based on the results declared so far.

Analysts say the full impact of the pandemic will be visible in the corporate earnings for June and September quarters.

“I foresee a sharp decline in the Nifty EPS in the first half of FY21 as the economy will be in lockdown during most of April-June.

"This could wipe out years of growth in corporate earnings,” said G Chokkalingam, founder & MD, Equinomics Research & Advisory Services.

A contraction in Nifty EPS is pushing up the valuation of Nifty, which could make the index expensive with just a small rise in the index level.

This, analysts say, could cap the upside in the market during the current calendar year.