This is the new addition to the tax data, which had identified over 600,000 people for scrutiny over huge inconsistencies in the cash deposits.

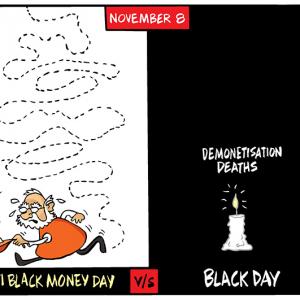

Ilustration: Dominic Xavier/Rediff.com

A year since demonetisation of high-value currency notes, the income-tax (I-T) department has identified 80,000 “actionable cases” (people) who deposited cash of over Rs 10 lakh each in bank accounts but have no tax profile.

This is the new addition to the tax data, which had identified over 600,000 people for scrutiny over huge inconsistencies in the cash deposits made during the period under the two phases of Operation Clean Money - an exercise to identify black money stashed in the form of cash deposits in banks.

According to sources, the I-T department has sought explanations from these 80,000 people who have no record of income-tax filing in the system.

Some of them deposited cash of more than Rs 20 lakh in the bank account but have never filed returns.

The findings are part of a status report on demonetisation which was prepared by the I-T department under the supervision of the Central Board of Direct Taxes (CBDT).

Sources said the report will be tabled in the Prime Minister’s Office (PMO) along with the action plan on what could be done further on the actionable cases.

Interestingly, after examining some of the profiles of these people, their official income had no match with their cash deposits.

“We are currently collaborating the minute details of each person identified.

The issue seems complex as the person’s testimonial and submission look financially weak.

However, we are not concluding here and are trying to dig out the nuances of such deposits,” said a senior tax official privy to the development.

“The department does not want to pursue the cases impulsively and hence no harsh action against these people is planned as of now.

Also, we could see some tax returns by March 2018,” the official added.

The status report also compiled the actions taken under the newly enforced Benami Transactions Act.

Till now, the benami unit of the tax department has attached 475 properties, as against 1,000 properties identified post demonetisation.

The worth of these attached properties is pegged at over Rs 1,000 crore.

Soon after demonetisation, the I-T department had launched the first phase of Operation Clean Money, which began on January 31 and ended on February 15.

It targeted deposits of Rs 500,ooo and above in cash. The second phase of the operation was launched in April and targeted deposits of Rs 10 lakh and above.

Mumbai and Chennai regions saw the highest number of cases where benami properties were attached provisionally accounting for nearly half of such cases.

According to official data, 1.77 million suspicious cases involving Rs 3.68 lakh crore were identified by the taxman in 2.3 million bank accounts post demonetisation.

So far, I-T has received online responses from 1.18 million persons for 1.7 million bank accounts.

About 900 searches have been conducted by the department after the note ban, leading to seizures of assets worth Rs 900 crore, including Rs 636 crore in cash.

So far, disclosures of Rs 7,961 crore undisclosed income have been made during searches.