Investors turn their attention to export-driven sectors, experts tell Krishna Kant.

Illustration: Uttam Ghosh

After betting on the domestic consumption story for over three years, equity investors could now turn their attention to export-driven sectors.

In the last month, the S&P BSE Sensex is down six per cent, while the Nifty IT (information technology) index is down only 1.5 per cent during this period.

Other export-focused companies in pharmaceutical, automobile and agrochemicals sectors have also seen share prices rise.

Investors are now betting on recovery in global economic growth to lift these companies' fortunes.

According to the International Monetary Fund's latest World Economic Outlook, global growth at constant prices is expected to accelerate to an eight-year high of 3.71 per cent in 2018, up from 3.21 per cent in 2016.

This is expected to result in faster revenue and profit growth for companies such as Tata Consultancy Services, Infosys, Tata Motors, Motherson Sumi, Bharat Forge, Bajaj Auto, Sun Pharmaceutical, Cadila Healthcare, and United Phosphorus Limited among others.

"The global economy is on an upswing and this should provide tailwinds to companies with significant global exposure. Investors have already begun to tweak their portfolio by raising exposure to IT companies," says Dhananjay Sinha, head of research, Emkay Global Financial Services.

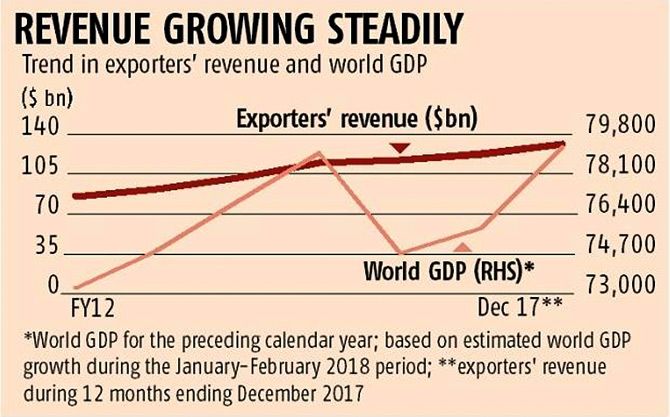

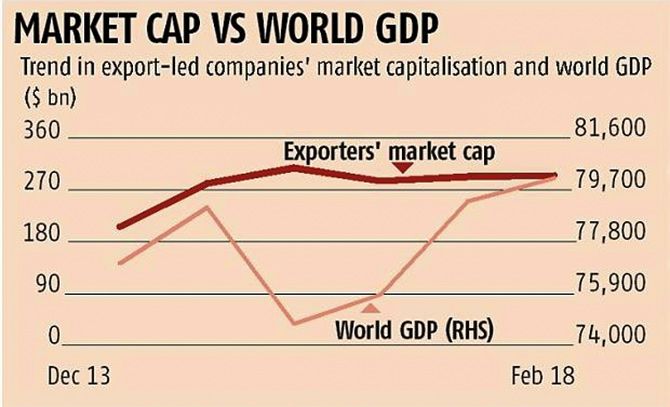

Historically, there is positive correlation between exporters' revenue and global GDP growth, though the link has weakened a bit in recent years.

The analysis is based on revenues and market capitalisation of 26 companies across sectors with large global exposure. This excludes metal and energy companies (please see chart below).

While global growth and trade have been accelerating for two years, India has witnessed a deceleration in GDP and export growth.

India's merchandise exports have been nearly stagnant in dollar terms over three years and many of corporate India's top exporters in IT, pharma, automobiles and textiles among others are facing growth headwinds.

"This time the correlation between global growth and exports growth could be weak. It could be due to transient factors such as disruption caused by demonetisation and the Goods and Services Tax or structural issues, which may take a while to sort out," says G Chokkalingam, managing director, Equinomics Research & Advisory.

So, unlike in the past, investors will have to be selective about global stocks. Here are some companies though, which might stand out in the crowd.

***

Company write-ups by Ram Prasad Sahu and Ujjval Jauhari

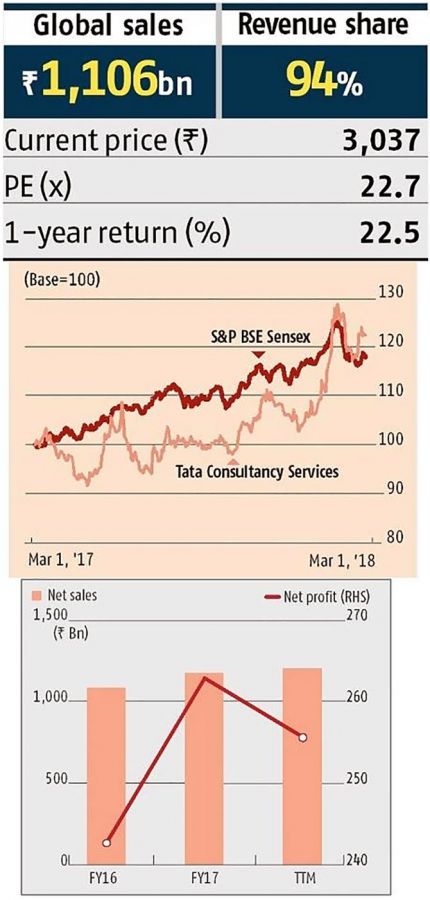

Tata Consultancy Services

- Recovery in the US economy and increasing outsourcing in Europe (80 per cent of revenues) should lead to an improvement in deal volumes for TCS

- Growth in retail vertical (12.5 per cent of revenues), with TCS clocking six per cent sequential increase in Q3 and estimating double-digit growth in FY19, is a positive

- Further traction in the banking, financial services and insurance or BFSI vertical is critical, even as TCS increases its share in digital contracts, as well as deal sizes

- Demand revival, increasing business visibility and healthy dividend yield could lead to more gains

***

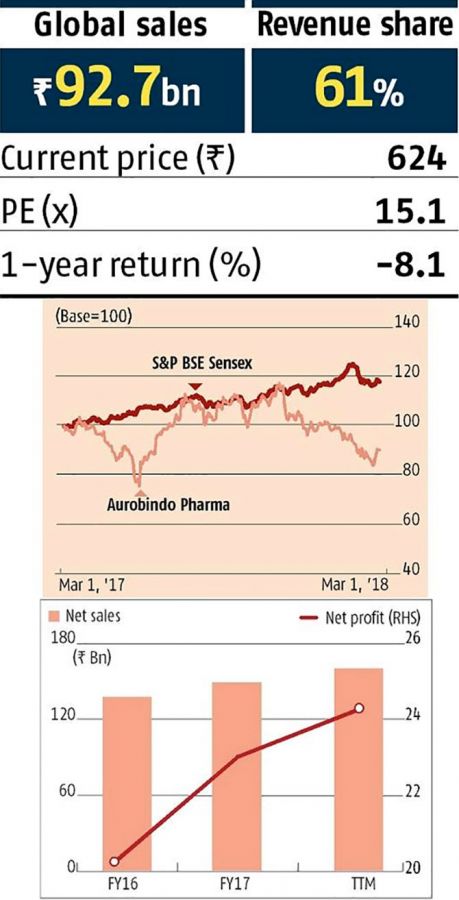

Aurobindo Pharma

- Aurobindo, with its niche and large product portfolio for the US market, which accounts for over 40 per cent of its sales, is well placed to grow at a healthy pace

- Low dependence on any single product to drive US sales and cushion it from any potential impact of pricing pressures

- European sales, which account for over a third of revenue, are also growing well, led by acquisitions

- As the manufacture of more products shifts from Europe to India, profitability will improve

***

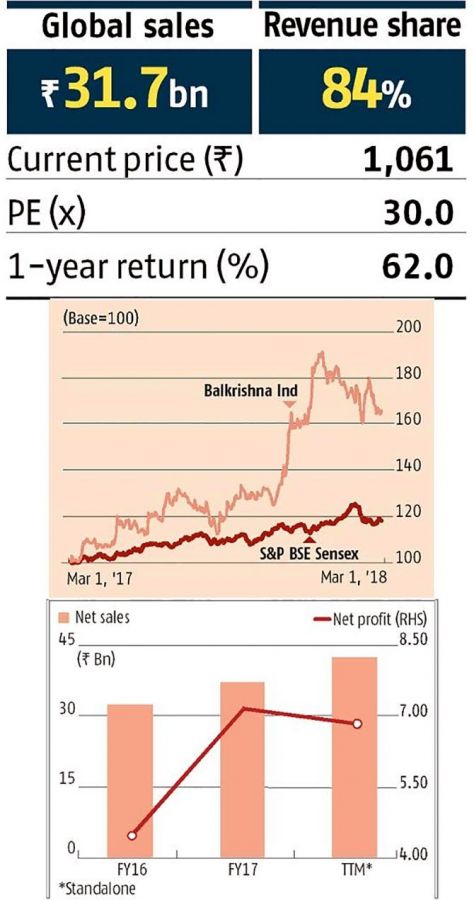

Balkrishna Industries

- Balkrishna Industries is a niche play in off-highway tyres (OHT) with global market share of four per cent

- Having doubled its capacity to 300,000 tonnes per annum, the company plans to increase its global market share to 7-8 per cent over the next three years

- The company primarily caters to replacement market and has a network of 200 distributors across 120 countries

- As volume growth remains strong, lower natural rubber prices will drive profits

- Aiming to grow India share from 16 per cent of its top line, to 25 per cent

- Margins over 20 per cent for past five years

***

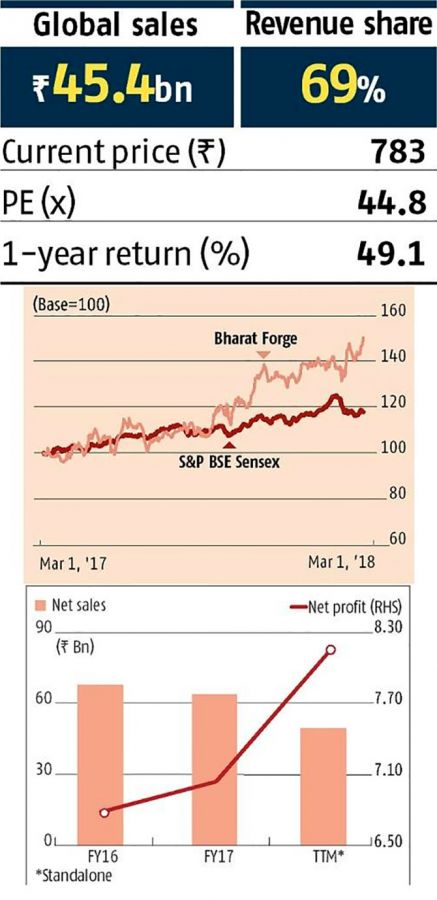

Bharat Forge

- US exports at record high led by sharp rebound in class-8 trucks, while strong Europe sales were due to good traction in medium and heavy commercial vehicles

- Strong order wins to expand its presence in industrial and passenger vehicle segments

- Growth in industrial segment was led by recovery in oil and gas demand and good momentum in the infrastructure, mining, construction and power generation segments

- Domestic business doing well, with healthy uptick in automobile volumes

- Improving product mix and operating leverage will lead to higher margins for Bharat Forge

***

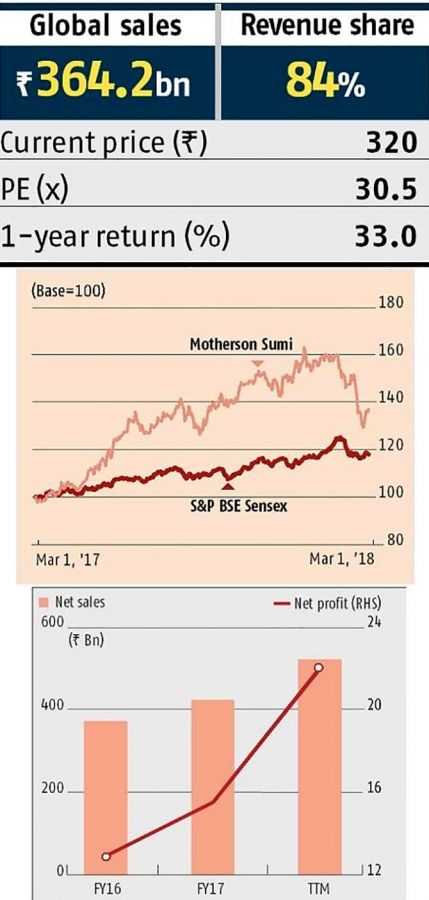

Motherson Sumi

- Motherson Sumi’s growth outlook is positive given its large order book and increasing content per car

- Ability to turn around acquisitions such as PKC, Finland will be a trigger

- Earnings growth for key overseas subsidiaries pegged at 30 per cent over FY17-20

- Strong domestic business should further benefit from the recovery in the passenger vehicle market

- Value accretive acquisitions could help achieve its FY20 revenue target of $18 billion from half that number now

- With US and Europe growing well, Motherson's earnings momentum should sustain moving forward

***

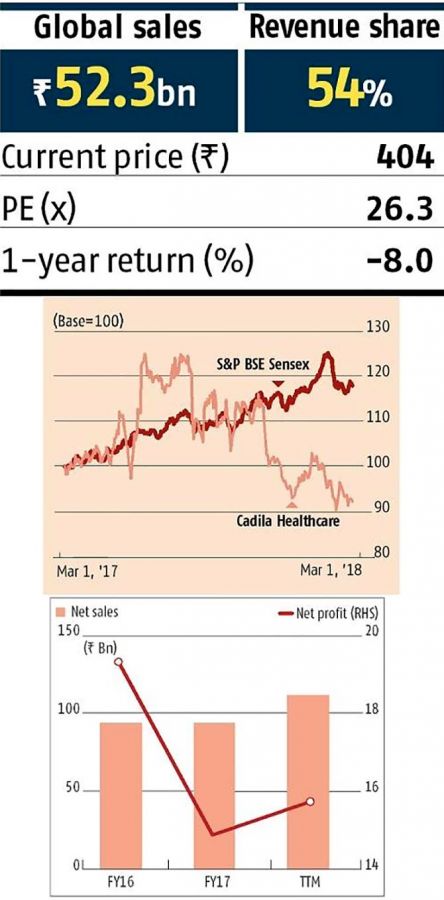

Cadila Healthcare

- Post resolution of US FDA issues pertaining to its Moraiya plant, Cadila is well placed to monetise its strong product pipeline for the US, which contributes half to its sales

- Having already received about 80 approvals for product launches since April, the highest amongst peers, it has 157 more filings; these will drive growth going ahead

- With early initiatives in its complex products pipeline playing out, outlook for FY19 is positive, say analysts

- Analysts expect a 20-23 per cent growth in US sales over FY17-20

- Domestic growth too, is expected to be strong

***

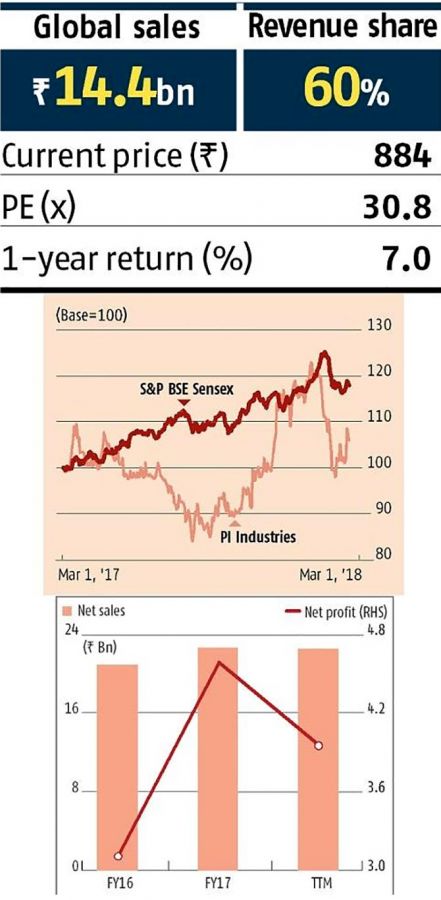

PI Industries

- PI Industries, a preferred partner for global agrochemicals companies for custom synthesis and manufacturing (CSM), expects the segment to drive its growth in coming years

- CSM, which contributes 70 per cent to its top line, has a strong order book of $1.15 billion

- The global scenario is improving with inventories falling, say analysts, who see further gains from second half of 2018

- Declining raw material dependence on China (less than 20 per cent now) post supply disruptions and rising prices will boost margins

- Domestic revenues, too, will be driven by new launches in FY19

***

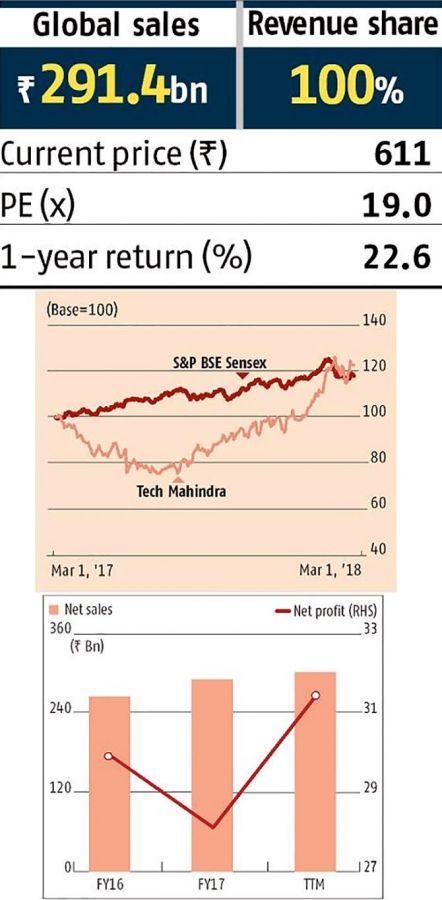

Tech Mahindra

- There is good momentum in its enterprise segment and its key vertical of telecom

- Large 5G rollouts in developed markets will improve scope for network services and boost telecom vertical growth, which accounts for 42 per cent of revenue

- Profit margins, which jumped by 180 basis points year-on-year in Q3, are expected to expand further in FY19, as well as in FY20

- Given the strong operating profit outlook for FY18-20, stock valuations at 15 times its FY19 estimates are reasonable, despite the recent outperformance

Financial data are consolidated unless mentioned as standalone; current price is rounded off as on March 1, 2018; PE is price-earnings ratio based on trailing 12 months ended December 2017 (TTM); Global sales is based on FY17 geographical segment-wise data reported by companies; Source: Capitaline; Compiled by BS Research Bureau