With three key subscription drivers -- F1, IPL and HBO -- gone, can Disney+Hotstar depend only on its chart-topping originals like Criminal Justice and Rudra: Edge of Darkness to hit both scale and profitability?

SonyLIV, Amazon Prime Video, Netflix or Jio Cinema, where will you see shows like Succession, Game of Thrones or The Last of Us after March 31?

That is the first big question analysts were asking after an announcement that HBO content will no longer be available on Disney+Hotstar from March 31.

The other big question is what will Disney+Hotstar do? It has lost F1, the Indian Premier League (IPL), 3.8 million subscribers and now HBO.

Disney India and HBO's parent Warner Bros Discovery declined to comment.

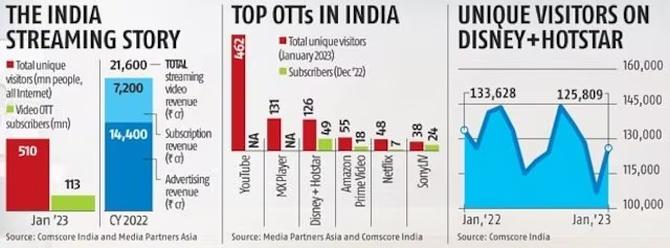

"The bulk of the subscription revenue is with the top few players: Disney+Hotstar, Zee-Sony, Netflix and Amazon Prime Video," says Mihir Shah, vice-president, Media Partners Asia.

"Disney+Hotstar is in cost-cutting mode. The Zee-Sony merger is yet to go through so they are in transition. As things stand, it will be down to Amazon Prime Video or Jio Cinema," reckons Shah.

Why not Netflix? Because the HBO rights come with geographical boundaries and Netflix usually buys global rights, says another analyst. Netflix declined to comment.

The analyst reckons that from a brand fit, SonyLIV or Netflix would be the best home for HBO content.

The five-year Disney-HBO deal was up for renewal in March this year.

The $34 billion (FY 2022 revenue) Warner Bros Discovery had been talking about launching the Indian version of HBO Max, its global streaming service.

It had hired a whole team back in 2021. The idea was to have Indian originals in different languages.

That sort of dulled the $82.7 billion (FY 2022 revenue) Disney's desire to promote HBO content on its service.

At 126 million unique visitors in January 2023, Disney+Hotstar is India's third largest OTT in reach after YouTube and MX Player.

The 3 million-3.5 million unique visitors that HBO brought to over the years was neither here nor there (See chart).

Where HBO matters is in its ability to get high-end subscribers to walk in, sample and stay with the service.

That is why, according to one insider, the contract between the two mandated that every time Disney+Hotstar's subscriber numbers rose by a certain number, HBO's share would rise too.

Warner's global merger with Discovery in the summer of 2022 changed priorities.

It is not planning to launch HBO Max anytime soon.

If anything it has been in talks with the who's who of the Indian OTT space -- especially the big subscription driven-video-on-demand (SVoD) players -- to park HBO content on them.

SonyLIV or Amazon Prime Video could use it to drive subscriptions at the top end of the market. But HBO's asking price, a reported $50 million (Rs 410 crore/Rs 4.1 billion) for 30-36 months, has them baulking.

The insider reckons that only at a price of $10 million-12 million (Rs 82 crore-Rs 98 crore/Rs 820 million-Rs 980 million) a year can any of the big SVoD players make money on HBO content.

The price is clearly a big reason Disney let go of the HBO deal, too. But for a company that was willing to spend a crazy amount of money (Rs 16,347 crore/Rs 163.47 billion for TV plus digital) on IPL just a few years ago, the about turn has been sharp.

Clearly, Disney+Hotstar is feeling the heat from the American markets, which have long been sceptical of the low average revenue, short-term subscribers that IPL attracts.

The brand made an unprofitable Rs 3,220 crore (Rs 32.20 billion) in revenues in the financial year ending 2022.

It has announced a loss of 3.8 million subscribers in the last earnings call.

'In Q1 and Q2 (of CY 2023) major renewals are due on Hotstar. That will be a true test of what the loss of IPL has meant for the brand,' says Shah.

With three key subscription drivers -- F1, IPL and HBO -- gone, can Disney+Hotstar depend only on its chart-topping originals such as Criminal Justice and Rudra: Edge of Darkness to hit both scale and profitability?

Feature Presentation: Rajesh Alva/Rediff.com