| « Back to article | Print this article |

Diversification and asset allocation can reduce uncertainty and improve portfolio outcomes, says Chandresh Nigam

The market has been volatile in the past three months, with the volatility index, India VIX, fluctuating between 13 and 22. The gauge is a measure of investors’ perception about the risk of sharp swings based on options prices.

The market has been volatile in the past three months, with the volatility index, India VIX, fluctuating between 13 and 22. The gauge is a measure of investors’ perception about the risk of sharp swings based on options prices.

Volatility can play on the minds of investors. In addition, the so-called experts sometimes add to the confusion by providing conflicting recommendations about what they think is the best idea over the next three to six months or even longer.

Uncertainty can cause real harm to the portfolio. Keeping the money idle to stay away from volatility can translate into lower portfolio returns.

Most investors may end up maintaining a much lo wer allocation to volatile asset classes like equity compared to what may be appropriate for their needs.

wer allocation to volatile asset classes like equity compared to what may be appropriate for their needs.

Even when allocation is made to riskier assets, sudden ups and downs can create fear or unnecessary panic.

It might seem the only way out of this situation is to invest in good market cycles or in times of a secular bull run. High returns in a bull market can make an investor over-confident.

So much so, that investors might end up increasing their equity allocation even further. Unfortunately, this strategy has ended up being a recipe for disaster for many as the allocation tends to get more and more lopsided as the asset class runs higher and higher.

When the inevitable correction comes, losses can be much greater than the returns made earlier in the cycle.

So, what should investors do?

Improving portfolio outcome and reducing uncertainty

Diversification has been called the only “free lunch” in financial markets. What makes diversification so powerful? How can it protect the investor from getting hurt by the uncertainty or risk of investing in any asset? By mixing a number of different asset classes with different properties and ensuring that all the eggs are not in one basket.

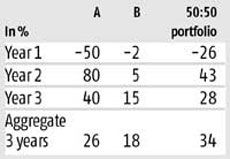

Let us look at an illustration. Assume a “high potential return” asset A, and a “medium potential return” asset B. Assume A can give a 3-year return of 20 per cent compared to B which can give 17 per cent. However A is more volatile – that is its price fluctuates much more – compared to B. Here are the numbers (see table):

Let us look at an illustration. Assume a “high potential return” asset A, and a “medium potential return” asset B. Assume A can give a 3-year return of 20 per cent compared to B which can give 17 per cent. However A is more volatile – that is its price fluctuates much more – compared to B. Here are the numbers (see table):

As can be seen from the table, for the patient buy and hold investor, A delivers a higher return in the end. However the ride is really bumpy – with maximum losses of 50 per cent of the initial investment.

For asset B, the total return is lower but with a reduced volatility. However, the real story is what happens when we create a mixed portfolio that invests half in each of the two assets – by adding a 26 per cent returning asset to an 18 per cent returning asset we have got a portfolio return of 34 per cent.

The outcome seems unreal. How did this happen? Is there really a “free lunch”? How diversification helps

How diversification helps

1.Reduced loss – The addition of a lower risk instrument reduced the loss at the end of year 1. While portfolio A was down 50 per cent at that stage, C (the 50:50 portfolio) was down only 26 per cent. The larger the loss, the more difficult it is for the portfolio to come back.

2.Lower correlations – While A and B seem to be moving in the same direction, the extent of change is different. For example, A has a better return in year 2, while B has a better return in year 3.

3.Rebalancing – Portfolio C at the end of every year has rebalanced its allocation to 50:50. That is at the end of year 1, when A under-performed relative to B, it sold B and bought A. This helped the portfolio participate in the good returns given by A in the subsequent years.

Asset allocation in practice

The three ingredients described above ensure successful diversification benefits over the long term – but has it worked in practice with real market data? The answer is an unequivocal yes. Let us see the following two examples using real long-term market data.

The three ingredients described above ensure successful diversification benefits over the long term – but has it worked in practice with real market data? The answer is an unequivocal yes. Let us see the following two examples using real long-term market data.

1.Multi-asset funds investing in domestic asset classes – A triple asset portfolio that invests in equity, debt and gold will diversify the risk from a single portfolio that invests only in equities. History has shown that such a portfolio has a lower risk and yet can potentially give higher returns as compared to investing only in equities.

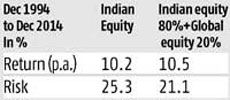

2. Use of offshore funds – Combining a global diversified equity fund to an Indian equity portfolio.

Once again, while Indian equities have outperformed global equities in this period, a 20 per cent allocation to global equity actually improved the risk and return profile of the portfolio.

These are just two examples of how asset allocation can be used by investors. In reality, asset allocation can add value to all long-term investors, irrespective of their risk profile or portfolio objectives.

Asset allocation also inculcates discipline and protects us from getting swayed by short-term market movements. Rather than worrying about what any investment or asset class may do in the next 6-12 months, all investors will be well advised to focus on what their appropriate long-term asset allocation should be and then work to get their portfolio aligned to that target.

Chandresh Nigam is chief executive officer, Axis MF