| « Back to article | Print this article |

Bengaluru-based InMobi and Microsoft combine their powers to break the stranglehold of Google and Facebook in the digital advertising space.

Illustration: Uttam Ghosh/Rediff.com.

When Ravi Krishnaswamy quit India’s largest e-commerce company Flipkart last October to join ad-tech firm InMobi as its chief technology officer, he already had an inkling into an important business development brewing there.

The Bengaluru-based company was in talks with Microsoft to combine their powers to break the duopoly of Google and Facebook in the digital advertising space.

Krishnaswamy, himself a Microsoft veteran, who had spent 17 years building tools for developers and the framework for its cloud computing platform Azure, managed to close the deal within six months.

In June this year, the two companies announced their strategic partnership, one in which InMobi would utilise Microsoft’s cloud infrastructure while giving the Redmond-headquartered company a play in the mobile domain where it has failed to make a mark.

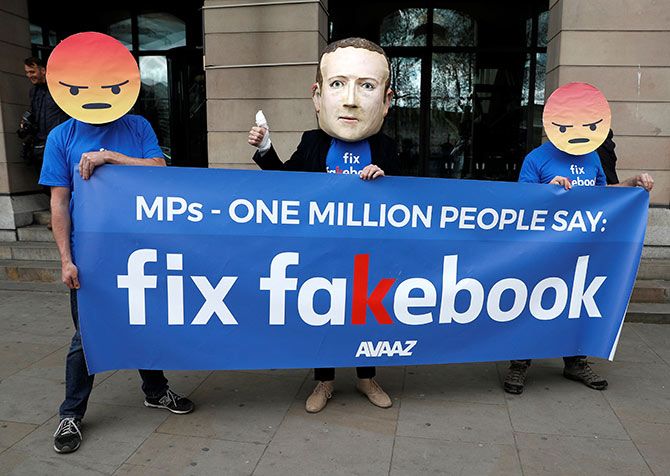

The deal could not have come at a more opportune time. While European regulators are scrutinising Facebook and Google’s ‘walled-garden’ approach (where all operations in the closed ecosystem are controlled by the ecosystem operator), governments globally are becoming increasingly uncomfortable with the power of these tech giants to sway public opinion, as was revealed in the Cambridge Analytica data breach.

“The industry is a little battered right now. But this affects the walled garden ecosystems more than us,” says Krishnaswamy. He has now been tasked with pivoting InMobi from being a mere network where advertisers bid for display slots on mobile devices to a cloud-based platform where marketers can manage entire campaigns across digital mediums.

Apart from building its technology on the back of Microsoft Azure, InMobi will also be able to leverage the US tech giant’s deep partnerships with enterprises across the globe. The two will build end-to-end digital advertising solutions, leveraging specific parts of each other’s portfolios. These include Microsoft’s search engine Bing and InMobi’s data from the 1.6 billion mobile devices on which its partners’ apps are installed.

“Together, we can disrupt the ad-tech industry and also disrupt the duopoly which is Google and Facebook, a move that is symbiotic for both Microsoft and InMobi. We get to ride on their deep tech and R&D and they get to ride on our industry know-how,” explains Krishnaswamy.

Google and Facebook together controlled about 61 per cent of all online advertising revenues in 2017 and cornered a 25 per cent share of all media advertising revenues -- both online and offline. While Google earns around 85 per cent of its revenues through ads, for Facebook that figure is close to 98 per cent.

The ads pay for all the other businesses Google and Facebook are vying to get into such as self-driving cars, internet services and even their futuristic moonshot projects. Any disruption in their ability to collect customer data and serve up targeted ads would hurt the two significantly.

Experts feel that regulatory pressure to give consumers control over their data will push the digital advertising industry to become more secular, leading to standards being set in the ad-tech space. Krishnaswamy wants InMobi to be in a dominant position when this happens so that it can dictate the standards rather than just follow them.

“We don’t have a garden wall of captive audience like Google or Facebook to say that if you want this free service, you shall submit your data to me,” he adds. “Secularism will level the playing field and in the long-run, this will take away from Google and Facebook’s ability to have a proprietary lock on data.”

Krishnaswamy believes that favourable regulatory conditions along with the backing of a giant like Microsoft will allow InMobi to rapidly expand its service. Today, the company handles 15 billion transactions (number of ad slots within various apps and websites filled using InMobi’s platform) on any given day. The company wants to grow that number four times within the next one year.

One of the biggest advantages of its tie-up with Microsoft is that InMobi does not have to worry about whether its infrastructure would be able to handle such a big increase in load. Moreover, it frees up InMobi’s resources and allows it to focus on building the best and most lucrative ad-tech solutions since “disruption and innovation are no longer at the infrastructure level,” says Krishnaswamy.

“Whether it’s an ad on a mobile screen or a screen in a connected car, or even a billboard, our strength lies in being able to tell when someone saw an ad and actually went to a store and transacted,” says Krishnaswamy. This, along with strong capabilities in AI, will help InMobi’s customers gain insights into where each of their advertising dollar is best spent.

The company has already begun verticalising certain large sectors such as retail and telecom and is building solutions specific to them. Krishnaswamy says that the idea is to get to a point where the chief marketing officer of any company can get insights into how well every dollar they spend is working.

What they wouldn’t be seeing, of course, is the highly specialised AI algorithms co-built by InMobi and Microsoft operating in the background to extract that intelligence.