| « Back to article | Print this article |

If the new governor can think out of the box even as he signals that he can bat for the RBI cadre and respect its institutional memory, that will go a long way in getting out of the current impasse.

Raghu Mohan and Abhijit Lele report.

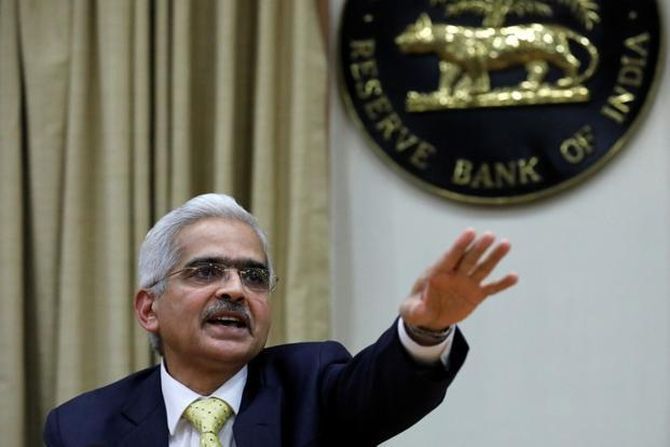

It's not known what a new governor at Mint Road does in his first few hours after taking over office, but if as economist Alice Rivlin said, 'the job of the central bank is to worry', Shaktikanta Das the 25th governor of the Reserve Bank of India, will have plenty of it.

Ask Duvvuri Subbarao, former RBI governor, to suggest a way out of the current impasse, and he says: "The way forward is to take corrective actions because the credibility of the central bank is important."

First of all, the RBI's stated positions on a raft of contentious issues -- its economic capital framework, the quarantine of a dozen banks under its prompt corrective action (PCA), and the adequacy or otherwise of liquidity in the system to irrigate India Inc -- will be up for review.

Then you have the clean-up of bank books and the February 12, 2018, circular which does not allow banks to delay dud-loan recognition, something which has caused much heartburn in India Inc.

And then there is a jittery financial market.

Says Suyash Choudhary, head, fixed income, at IDFC Asset Management Company: "Urjit Patel's (resignation) expands India's risk premium, at least, in the short term. Whether this widened risk premium remains or not will depend upon the way forward."

He feels the common perception today is that there is an intent to compromise the RBI's independence in a variety of ways.

"The most important from a bond market perspective is the notion that the government wants large portions of RBI's capital to step up fiscal spending. This notion and these perceptions need to be controlled," he adds.

If the new governor can think out of the box even as he signals that he can bat for the RBI cadre and respect its institutional memory, that will go a long way in getting out of the current impasse.

Of course, it will help if North Block also takes a few steps towards effecting a detente between itself and the RBI.

Let's take a closer look at the events immediately preceding Dr Patel's resignation to get a sense of what his successor will have to contend with once he takes over.

While Dr Patel cited 'personal reasons' for his resignation the fact that it was with 'immediate effect' and that he did not thank the government of the day, is indicative that there was a flashpoint after the so-called 'truce' at the RBI board meeting on November 19.

Dr Patel chaired two meetings after that -- of the Monetary Policy Committee and the Board for Financial Supervision.

The outcome of the former was on expected lines.

However, it is believed that the trigger for Dr Patel walking off in a huff was the demand that the BFS be broad-based.

It would have had a direct bearing on the call to cut some slack to banks under PCA and the February 12 circular.

This will be the number one hurdle that Das will have to overcome.

What's in the pile?

Set up in 1994, the BFS, chaired by the governor, has four directors from the RBI's central board as members.

The four deputy governors are ex-officio members, and usually the one in charge of banking regulation and supervision is nominated as its vice-chairman.

The BFS meets monthly to weigh inspection reports and supervisory issues placed before it by the supervisory departments and oversees the functioning of the department of banking supervision, department of non-banking supervision, and financial institutions division.

It also gives direction on regulatory and supervisory issues.

Its audit sub-committee includes a deputy governor as the chairman and two directors of the RBI central board as members.

"If you broad-base the composition of the BFS, and get to have a seat on it, you not only get access to some of the most sensitive information on banks and their borrowers, but also get to influence decision-making," said the chief executive of a bank.

"Even in my bank, very few get to see the inspection report. Access to it is highly restricted," he added.

It's understandable if Dr Patel put his foot down on this demand.

Needless to say, Das will have to figure out a way to parry the demands to broad-base the BFS.

In this context, a senior central bank official pointed to the 2017 Financial Sector Assessment Programme -- a comprehensive and in-depth analysis of a country's financial sector, jointly done by the International Monetary Fund and World Bank in developing economies and emerging markets.

The 2017 FSAP (the second such assessment conducted for India) noted that more work needed to be done on the resolution tools and arrangements to deal with a crisis.

On the assessment of the Basel Core Principles, non-compliance was found in two areas: Independence, accountability, resourcing and legal protection for supervisors; and on corporate governance in banks.

In the first case, it was mainly on account of the fact that the regulator does not have full discretion to take supervisory actions against state-run banks.

In the latter, it was due to the RBI's very limited authority to hold the boards of these banks accountable and to replace weak and non-performing senior management and government-appointed board members.

This is the issue that Dr Patel had flagged when the RBI was criticised for not having been agile enough when it came to the oversight of State-run banks.

In fact, BFS, PCA and the 12th February circular are all inter-linked.

Says Srikanth Vadlamani, vice-president (financial institutions group) at Moody's Investors Service, "Banks can no longer resort to various loan restructuring schemes to delay the recognition of bad loans."

"This initiative follows the review conducted by the RBI in December 2015, and the promulgation of the Insolvency and Bankruptcy Code 2016 provides a clearer framework for its resolution," Vadlamani adds.

"The haircuts that banks agree to in upcoming resolutions will be a driver for their financial profiles."

While banks have recognised the bulk of legacy problem loans and will start making recoveries from large resolved bad loans, which will help shore up asset quality, the degree of success in resolution of large accounts will determine the extent of asset quality improvements.

State-run banks will continue to grapple with weak capitalisation and depend on government capital infusions.

It's also to borne in mind that a positive fallout of demonetisation was a significant increase in low-cost deposits and a concomitant increase in liquidity, which reduced their borrowing.

And in the face of low credit off-take, banks deployed resources in money market instruments.

What was worrisome is that despite the positive tail winds in the form of low-cost funds made available post-demonetisation, the financial performance of banks, especially the state-run PSBs, was weighed down by high provisioning on account of bad-loans.

Yet another contentious issue is the desire on the part of North Block to convert the RBI board into an active one from a purely advisory role.

Says Dr Subbarao: "It has to be conveyed to the board that it is an important forum, but there are limits to what it can do. The new governor also has to establish constructive relationship with board members."

Alice Rivlin was right after all.