| « Back to article | Print this article |

Starting this month, we will bring to you incisive reports on the state of real estate in India compiled by Knight Frank (India). Through these reports to be published every fortnight, the global real estate company will delve into the growth dynamics of several locations in India that are experiencing a paradigm shift in their economic and real estate scenarios and will also comment on various interesting aspects of real estate sector.

The real estate action is no longer limited to the large metropolises of India but has now permeated to the burgeoning smaller towns and cities. These emerging centres of growth are lending sparkle to India's booming economy. What is leading this transformation?

The upswing of the Indian real estate sector has been an outcome of a number of positive micro and macro factors.

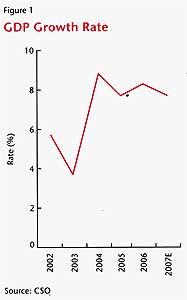

Consistent and sustaining GDP growth, expanding service sector, rising purchasing power and affluence, proactive and changing government policies have all lent momentum to this rapidly growing sector.

Accounting for almost 80 per cent of the total office space absorption, the Indian IT/ITES sector has been the primary demand driver. India's low cost-high quality and productivity model has given it a leadership position in the outsourcing arena.

In a bid to scale up their operations and to remain globally competitive, the Indian IT/ITES companies are exploring the smaller towns and cities. Rising manpower and real estate costs, plaguing attrition levels and very often risk mitigation have been the key reasons for this movement.

Positive economic growth has also translated in rising disposable incomes and growing aspiration levels across India. Rising consumerism has created a demand for new retailing and entertainment avenues. Realising that consumers across cities have similar needs, albeit the scale may vary, new age retailers are vying to cash in on the first mover advantage and are expanding into hitherto unexplored smaller cities.

Advent of organised retailing has also translated into real estate growth in these emerging locations. Growth of the Indian 'Rich' (annual income>$4,700) and 'Consuming' (annual income $1,000-4,700) class coupled with falling interest rates and other fiscal incentives on home loans has increased the affordability and the risk appetite of the average Indian consumer thereby leading to a substantial rise in demand for housing.

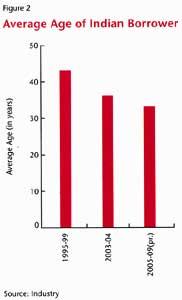

This has been further fueled by the increase in the size of 25-55 age group of earning population and the emergence of double income, nuclear families.

Over the last decade the average age of Indian home loan borrower has reduced by 10 years.

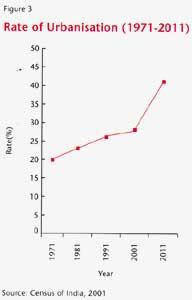

Another variable facilitating real estate growth in India is the growing urbanisation. According to United Nations Population Division, the urban population in India will continue to grow at a rate of 2.5 per cent per annum for the next two and a half decade.

As per the Census of India 2001, 41 per cent of the total population of India will be living in urban areas by 2011. The number of cities with a population of one million or more is also is expected to double from 35 recorded in 2001 to 70 by 2005. This increase in population will generate incremental demand for housing and other real estate components.

All these factors together with increased liquidity in the real estate sector through the international real estate funds and private equity funds will result in radically transforming the real estate landscape over the next 3-5 years.

India's investment scenario is already undergoing a sea change and has been seen to be making roads in rural India with telecom, rural retailing, agricultural supply chain and logistics facilities, micro-credit, etc. All these factors foretell that the real estate growth will soon spread out of the established boundaries.

However, to support this growth and to make it more expansive, a lot needs to be done. Foremost is thethrust on infrastructure.

According to a World Bank estimate, India needs to invest an additional 3-4 per cent of its GDP on infrastructure to sustain its current levels of growth and to spread the benefits of growth more widely. Some positive steps have already been taken in this direction.  Huge investments in infrastructure to the tune of $350 billion have been envisaged over the next five years.

Huge investments in infrastructure to the tune of $350 billion have been envisaged over the next five years.

Connectivity may get a boost with the completion of 13,000 kms of roads under the Golden Quadrilateral, North-South-East-West corridor and with 4-laning of all the major national highways. This will further facilitate the economic development of smaller towns and cities in the country.

Major real estate destinations of the country and some other emerging towns can be classified into three broad categories depending upon the stage of real estate development that each one of them is undergoing.

As the Indian real estate sector moves higher on the growth curve, a number of state capitals and smaller cities which have relatively better infrastructure and are able to support higher economic growth have come into limelight.

These emerging growth centres are characterised by low real estate costs, availability of land for development, untapped manpower pool and rising quality of life. Many of these towns have industrial and tourism driven economic base that can be leveraged for growth.

Anticipating the latent demand in these markets, a number of real estate developers and retailers have chalked out expansive plans to harness the opportunity.

|

Category |

Cities |

Characteristics |

|

|

|

*Demand drivers quite pronounced |

|

Tier II |

Hyderabad, Pune, Chennai and Kolkata |

*Growing real estate markets |

|

Tier III |

|

|

Summing up

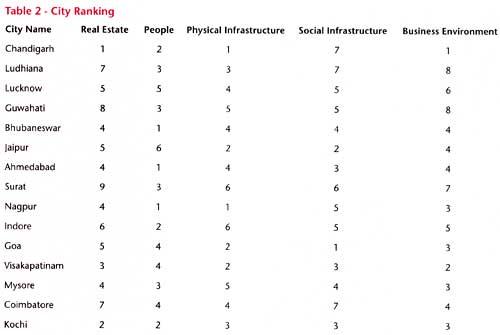

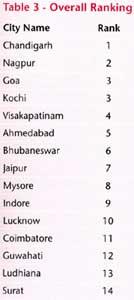

The study and analysis of the emerging growth centres of India has brought in to light several interesting facts. For arriving at the most attractive destination from among the 15 cities presented in this report, an analysis of five key parameters was undertaken.

These parameters, as presented below, were selected on the basis of key decision making factors that are taken into consideration while choosing a location over another. Each of these parameters were further divided into sub-parameters and weights were assigned to each of them. The weights assigned were in accordance to the relative importance of these variables in determining the future attractiveness of a location.

Real estate -- In today's scenario, real estate is a major determinant of the general attractiveness of a city. Sub-parameters like real estate cost, availability and outlook were the variables considered here. These variables are decisive factors behind a corporate as well as an investor's plan to enter a city. Cost advantages have been seen to tilt the scales in favour of a Tier II or Tier III city, away from the established Tier I cities of the country.

While high real estate cost in a city may bring down the attractiveness, good availability of real estate and positive outlook may push up the rating of that particular city.

People -- People form the foundation of a city's strengths. Market potential of a city depend upon several people factors like decadal growth, purchasing power of the population as well as the literacy rate. These sub-parameters depict whether a city has the requisite catchment for retail success, as a city with high decadal growth and purchasing power would also denote a strong consumer base.

Besides, a city with high literacy rate would score well as literacy is a reflection of general awareness level of the city populace.

Social infrastructure -- The social infrastructure of a city is also acknowledged as one of the key decisive factors in a city selection exercise. Many corporates are driven by cost constraints and prefer to locate to cities with lower cost of living.

Therefore, the sub-parameter of cost of living could take up or bring down the overall attractiveness of a city. Presence of quality educational institutes is another important sub-parameter and implies a qualified workforce in the region. Besides, it also provides employees with an incentive for relocating their families when a transfer to that particular location is proposed.

Other social sub-parameters like hotels and entertainment avenues act as business support facilities.