| « Back to article | Print this article |

2011 second worst for investors in 14 years

For stock market investors in India, 2011 is set to be the second worst calendar year in at least the last 14 years.

It is second only to the disastrous 2008.

Investors' wealth, as measured in terms of market capitalisation of all the companies listed on the Bombay Stock Exchange, has been eroded by Rs 19,11,122 crore (Rs 19111.22 billion) in 2011 till December 28, data available with BS Research Bureau for the last 14 years show.

Click NEXT to read further. . .

2011 second worst for investors in 14 years

Considering there are 19.7 million dematerialised, or demat, account holders in India, the average loss per stock market investor in 2011 is about Rs 9.70 lakh (Rs 9,70,000).

In percentage terms, the total market capitalisation of all BSE-listed companies has slumped 26.2 per cent to Rs 53,88,118 crore (Rs 53881.18 billion) this year till on Wednesday.

Click NEXT to read further. . .

2011 second worst for investors in 14 years

The list of companies that have seen the highest wealth erosion in 2011 includes Reliance Industries, SBI, MMTC, L&T, ONGC, BHEL and ICICI Bank.

Shareholders of each of these companies have lost more than Rs 50,000 crore (Rs 500 billion) in this year so far.

The total wealth erosion in 2008 was Rs 40,75,321 crore (Rs 40,753.21 billion).

Click NEXT to read further. . .

2011 second worst for investors in 14 years

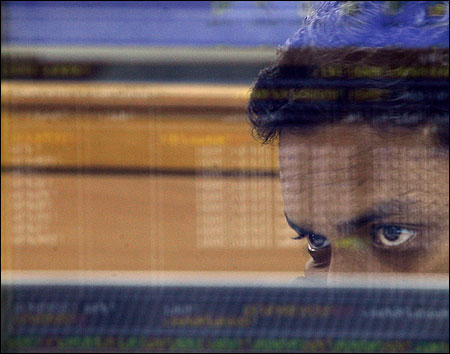

Not just in India, investors across the world have suffered in 2011 due to global risk aversion on account of the euro zone debt crisis and fears of double-dip recession in the US.

Globally, stock market investors lost $6.04 trillion in 2011 till Tuesday, according to Bloomberg data.

Click NEXT to read further. . .

2011 second worst for investors in 14 years

Back home, high inflation and interest rates, a growth slowdown, corruption scandals, a lack of economic reforms and a sharp depreciation in the rupee have contributed to investors' losses.

The BSE benchmark, the Sensex, has declined 23 per cent this year so far, making India one of the worst performing markets in the world.

Click NEXT to read further. . .

2011 second worst for investors in 14 years

Experts believe some of these concerns will continue to weigh on Indian markets in the next few months.

They expect shares to recover in the second half of 2012 as the central banks starts easing its monetary policy.

"In the near term, India clearly faces global and domestic challenges, but the silver lining is the rupee depreciation should help boost exports.

Click NEXT to read further. . .

2011 second worst for investors in 14 years

Also, cooling inflation should provide scope for interest rates to come down in FY13," said Dinesh Thakkar, chairman and managing director, Angel Broking.

"The downgrade in earnings will continue through the next six months at least.

"Hence, the market will continue to remain under pressure, notwithstanding strong bear market rallies," said Anish Damania, Business Head-Institutional Equity, Emkay Global Financial Services.

Damania expects the market to bottom out close to a Nifty level of 4,200 in the first half of next year.