| « Back to article | Print this article |

Why are FIIs in love with India?

Currently, little about India looks promising. From rating agencies to heads of state, everybody's commented on the policy paralysis and the anemic growth.

Corporate India's growth in the quarter ended June was the slowest in years and profitability has never been under more stress.

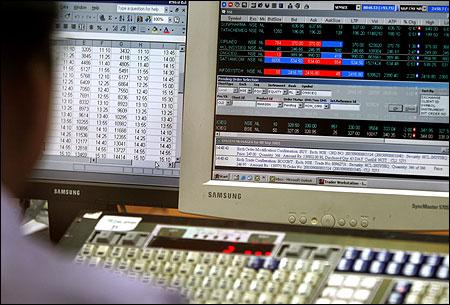

Despite this, foreign institutional investors (FIIs) have invested $11.26 billion in Indian equities since January. Even as they sell in other Asian markets, large global funds are continuing to invest in Indian equities.

Click NEXT to read more...

Why are FIIs in love with India?

The theory doing the rounds is disguised as FII inflow, this is actually Indian money being routed back into the country through Mauritius. However, data suggests a new breed of foreign investors is bullish on India.

Manishi Raychaudhuri of BNP Paribas says more than 50 per cent of the flows have come from Asia ex-Japan funds and global emerging market funds.

"On a year-to-date basis, exchange-traded funds have contributed little (three per cent), while India-dedicated FII funds have been sellers. Almost half the flows seem to have come from 'other', that is, unexplained sources comprising sovereign wealth funds, sector funds, hedge funds, etc.

Click NEXT to read more...

Why are FIIs in love with India?

This could lend credence to the oft-repeated conspiracy theory that a lot of FII flow into India is, in reality, Indian money disguised as FII money."

Even if this is true for half the funds, the remaining half is from global funds that are overweight on India by 0.5-1 per cent.

Historically, when FIIs sold equities in other Asian markets, they sold in India, too.

Click NEXT to read more...

Why are FIIs in love with India?

However, data suggests during April and May, when FIIs were selling across Asia, net selling in India was not significant.

Of the $8.5 billion FIIs invested in India till July, $2.62 billion has come from Asia ex-Japan funds, while $1.7 billion was from global emerging market funds.

So, why are FIIs investing in India, despite all the talk of slowing growth and faltering profits?

Click NEXT to read more...

Why are FIIs in love with India?

Analysts say despite all the inertia, corporate profitability has held on. Raychaudhuri of BNP Paribas says while earnings forecast for the rest of the region declined over the past few quarters, the worst of the pressure on earnings seemed to be behind India.

And, unlike previous phases, when FII buying was strong, this time, they are focused on the top 15-20 stocks that have better revenue and earnings visibility.

So, even if there's selling, the pressure would be on specific stocks, not the broader market.