Masoom Gupte in Mumbai

While select private insurers like ICICI Lombard, Tata AIG and IFFCO Tokio provide specialised insurance covers for 'art' items, the minimum value they look at is in excess of Rs 1 crore (Rs 10 million).

And, the accompanying guidelines are tough.

For instance, ICICI Lombard looks at a minimum sum assured value of Rs 1-2 crore (Rs 10-20 million).

The premium could be 1.5-2 per cent of this amount. Tata AIG charges similar premiums but is more flexible.

However, they would "evaluate the overall net worth of the client, rather than the sum assured before granting an insurance cover".

The product offers an all-risk cover - loss reimbursement, repair and restoration, and preservation and storage assistance.

...

Want to insure art? Be ready for tough norms

Image: Policy will cover the assets while in transit.Most important, the policy will cover the assets while in transit and if you lend the object to an exhibition, they would be covered there as well.

Insurers will evaluate the location used for storing your assets, as well as the security measures to protect them.

Past loss history will also be studied prior to fixing the premium payable.

...

Want to insure art? Be ready for tough norms

Image: In the case of art insurance, valuation of the 'goods' insured is key.Besides paintings, the policy can be used to cover sculptures, antiques, artefacts and even note or coin collections.

But insurers said due to lack of knowledge, people do not get a sculpture or artefacts covered under the policies.

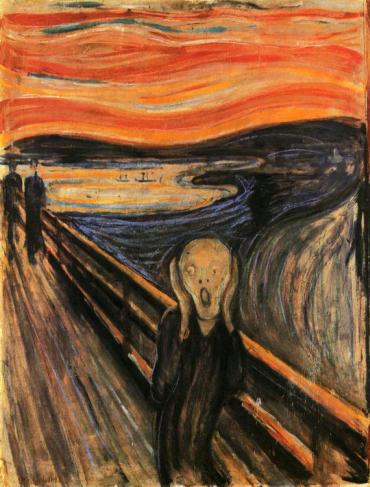

In the case of art insurance, valuation of the 'goods' insured is key.

According to Rajive Kumaraswami, head - risk and reinsurance, ICICI Lombard, this poses a challenge as they do not have sufficient expertise to value assets like notes and coins, as there are no clear benchmarks.

...

Want to insure art? Be ready for tough norms

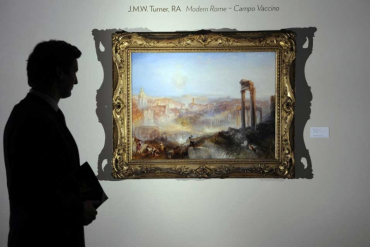

Image: Valuation is not difficult in the case of art sold through premier art galleries.However, in case of inheritances or assets bought without an intermediary, services of professional valuers are enlisted and the sum assured decided accordingly.

The valuations are revised annually. However, if there was a sudden spike in art prices and the value of your asset exceeds the sum assured, you can claim only up to the pre-decided sum assured and will lose out on the appreciation in the asset price.

To avoid this, you must get the valuation and the sum assured revised mid-term or whenever there is a significant increase in value.

...

Want to insure art? Be ready for tough norms

Image: There is insurance cover for small investors, too.For small collectors who cannot afford a Rs 1-2 crore (Rs 10-20 million) binge on a painting and own Rs 5,000, Rs 5,001-25,000, Rs 25,000-1,00,000, you can use home insurance products or householders' policies to get insurance cover.

"Typically, if the value of art holdings is lesser than the others contents being insured, it can be covered under home insurance as well," said the VP, retail - health and home, of a general insurance company.

The cover would cost you about Rs 300 per lakh of coverage amount, covering the contents against burglary and theft.

article