| « Back to article | Print this article |

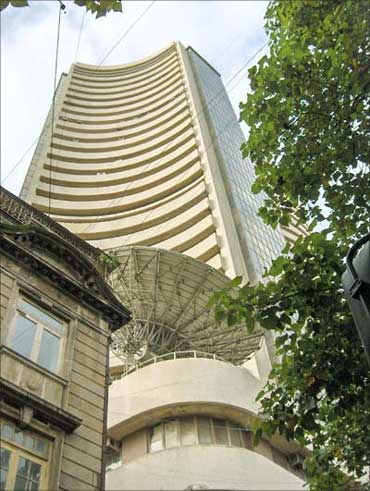

2/3 of the cos listed this year trading in red: BSE survey

In contrast to handsome gains made in the primary market, nearly two-third of the 69 companies listed on bourses during 2010 are trading below their issue prices, resulting into negative returns for investors.

An analysis of the BSE-listed companies shows that as many as 44 out of the 69 stocks are trading below their issue prices fixed after their initial public offers.

Seventy firms, comprising 59 private sector firms and 11 PSUs, came up with an public offer this year, raising Rs 71,114 crore (Rs 711.14 billion) in the process.Click NEXT to read further. . .

2/3 of the cos listed this year trading in red: BSE survey

Of the 11 PSUs issues, the Punjab & Sind bank is the latest entrant: it got listed today and, therefore, has not been taken into account.

Meanwhile, a host of companies are rushing in to file their draft prospectus' with market regulator Sebi for launching their IPOs.

Analysts believe that this is the right time for firms to raise funds through primary market because of a revival in the market after a lackluster 2009.

"After getting listed on the bourses many of the companies are unable to sustain their issue price levels, because of aggressive pricing.

Click NEXT to read further. . .

2/3 of the cos listed this year trading in red: BSE survey

"Besides, investors are still cautious and do not want to keep their funds invested in one place for a long-time and thus shuffle their portfolios after making some profits," Religare Securities executive vice president head research retail Rajesh Jain said.

The total funds raised by the private sector through the 59 issues were worth Rs 21,100 crore (Rs 211 billion).

The current mark-to- market value of these issues is now Rs 17,600 crore (Rs 176 billion).

So, the mark-to-market loss on these issues was about Rs 3,500 crore (Rs 35 billion), indicating a 16.82 per cent loss.

Click NEXT to read further. . .

2/3 of the cos listed this year trading in red: BSE survey

While in contrast, PSUs have given smart returns to investors.

The public sector firms have garnered a whopping Rs 49,500 crore (Rs 495 billion) in 2010 through 10 listed issues.

And, the current mark-to-market value of these issues is about Rs 54,000 crore (Rs 540 billion) and the mark-to-market profit on these issues was Rs 4,500 crore (Rs 45 billion), translating into a profit of 9.19 per cent.

"The year 2010 clearly reflects the difference in the listing gains by the private sector and the PSU public issues.

"PSUs have clearly offered better returns, may be because of their strong balance sheets, reliable revenue streams and tried-and-tested business models," SMC Global Securities Ltd strategist and head of research Jagannadham Thunuguntla said.

Click NEXT to read further. . .

2/3 of the cos listed this year trading in red: BSE survey

The 30-share Sensex gained about 14 per cent during the year and is at present hovering at 20,000 level, while the IPO index has shown poor performance since its launch in August 24, 2009 and is down nearly two per cent.

The BSE IPO index tracks the performance of those companies, which got listed on the bourse in the past two years.

Of the 59 issues by the private sector, about 40 issues are trading below their issue prices, whereas 19 issues are trading above their issue prices.

The prominent private sector issues that are trading above their issue prices include Jubilant Foodworks (322 per cent), Thangamayil Jewellery (125 per cent), Mandhana Industries (104 per cent), Talwalkars Better Value Fitness (103 per cent).

Click NEXT to read further. . .

2/3 of the cos listed this year trading in red: BSE survey

Therefore, it is the new-age lifestyle products such as pizza corners, jewellery and gyms that are delivering better returns.

In the PSU segment, six of the 10 firms that got listed this year, are trading above their issue prices while the rest are trading below their issue prices.

Major PSU issues trading above their issue prices are United Bank of India (43.64 per cent), REC (35.85 per cent), Coal India (23.82 per cent), MOIL (17.23 per cent) and Engineers India (+13.36 per cent).

The IPO pipeline is flush; some of the firms that have filed their draft prospectus and received Sebi approvals include Jindal Power, Reliance Infra Tel Ltd, Sterlite Energy, Lodha Developers and Lavasa Corporation among others.